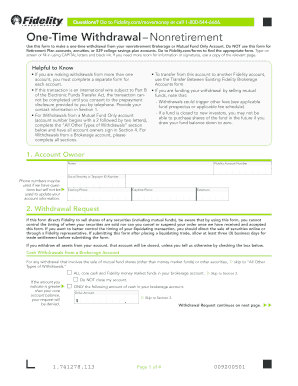

Fidelity 401k Withdrawal 2014

What is the Fidelity 401k Withdrawal?

The Fidelity 401k withdrawal refers to the process of taking money out of your Fidelity 401k retirement account. This type of withdrawal can occur under various circumstances, such as retirement, financial hardship, or reaching the age of fifty-nine and a half. Understanding the specific conditions and implications of withdrawing from your 401k is essential to ensure compliance with IRS regulations and to avoid unnecessary penalties.

Steps to Complete the Fidelity 401k Withdrawal

Completing a Fidelity 401k withdrawal involves several key steps. First, determine your eligibility based on your current employment status and the reason for withdrawal. Next, gather the necessary documentation, which may include identification and any supporting financial documents. After that, you can access the Fidelity 401k withdrawal form, which can typically be completed online or printed for manual submission. Finally, submit the completed form according to the specified instructions, ensuring you retain copies for your records.

Legal Use of the Fidelity 401k Withdrawal

When withdrawing from a Fidelity 401k, it is vital to understand the legal implications. The IRS has specific guidelines regarding withdrawals, including potential penalties for early withdrawal. Generally, if you withdraw funds before the age of fifty-nine and a half, you may incur a ten percent penalty in addition to regular income tax. Familiarizing yourself with these regulations helps ensure that your withdrawal complies with legal standards and minimizes financial repercussions.

Required Documents for Fidelity 401k Withdrawal

To successfully process a Fidelity 401k withdrawal, you will need to provide certain documents. These typically include:

- Government-issued identification, such as a driver's license or passport.

- Completed Fidelity 401k withdrawal form.

- Any supporting documentation relevant to your withdrawal reason, such as proof of financial hardship.

Having these documents prepared in advance can streamline the withdrawal process and help avoid delays.

IRS Guidelines for 401k Withdrawals

The IRS outlines specific guidelines regarding 401k withdrawals that account holders must follow. These guidelines include age restrictions, tax implications, and exceptions for hardship withdrawals. For instance, if you withdraw funds before reaching fifty-nine and a half, you may face a penalty unless you qualify for an exception, such as disability or medical expenses. It is crucial to consult the IRS guidelines to understand your obligations and rights when withdrawing from your Fidelity 401k.

Eligibility Criteria for Fidelity 401k Withdrawal

Eligibility for a Fidelity 401k withdrawal generally depends on several factors, including your age, employment status, and the reason for the withdrawal. Typically, you can withdraw funds if you are:

- At least fifty-nine and a half years old.

- Experiencing financial hardship, which meets specific criteria set by the IRS.

- Leaving your job or retiring.

Understanding these criteria is essential for ensuring a smooth withdrawal process.

Quick guide on how to complete fidelity 401k withdrawal

Complete Fidelity 401k Withdrawal effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Fidelity 401k Withdrawal on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Fidelity 401k Withdrawal with ease

- Locate Fidelity 401k Withdrawal and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you select. Edit and eSign Fidelity 401k Withdrawal and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fidelity 401k withdrawal

Create this form in 5 minutes!

How to create an eSignature for the fidelity 401k withdrawal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 401k withdrawal?

A 401k withdrawal refers to the process of taking money out of your 401k retirement account. This can occur under various circumstances, including hardship withdrawals, loans, or after signNowing retirement age. It's important to understand the implications of a 401k withdrawal, including potential taxes and penalties.

-

What are the common reasons for making a 401k withdrawal?

Common reasons for a 401k withdrawal include financial emergencies, purchasing a home, or funding education. Additionally, individuals may withdraw funds when they retire or leave their job. However, it's crucial to evaluate the long-term impact on your retirement savings before proceeding with a 401k withdrawal.

-

Are there any penalties for a 401k withdrawal?

Yes, taking a 401k withdrawal before the age of 59 and a half typically incurs a 10% early withdrawal penalty, along with applicable income taxes. However, there are exceptions, such as in cases of disability or signNow medical expenses. Always check the IRS guidelines to understand your situation better.

-

How does airSlate SignNow assist with 401k withdrawal documentation?

airSlate SignNow provides a seamless way to collect signatures for any documentation related to 401k withdrawals. Our e-signature solution ensures that your forms are signed electronically, making the process efficient and compliant. This feature simplifies administrative tasks and allows for quick access to necessary documents.

-

Can I use airSlate SignNow to manage multiple 401k withdrawal requests?

Absolutely! With airSlate SignNow, you can efficiently handle multiple 401k withdrawal requests through our user-friendly interface. The platform allows for bulk sending of documents, tracking progress, and managing signatures without hassle, ensuring a streamlined process for your organization.

-

What are the benefits of using airSlate SignNow for 401k withdrawal processes?

Using airSlate SignNow for 401k withdrawal processes offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform ensures compliance with legal standards while allowing users to access documents from anywhere, making it an ideal solution for managing withdrawals.

-

Does airSlate SignNow integrate with other financial services for 401k withdrawals?

Yes, airSlate SignNow integrates with various financial services and software, making it easy to coordinate 401k withdrawals. Our integrations allow for automatic data syncing and secure document management across platforms, facilitating a smooth withdrawal process. This connectivity enhances overall workflow and efficiency.

Get more for Fidelity 401k Withdrawal

- Cdl data form nebraska dmv

- And state id card data form nebraska dmv

- Name of person submitting documents to dmv for official use form

- Appendix a nevada department of transportation form

- Affirmation of repossession 2015 2019 form

- Aa 3 3 2016 2019 form

- Form bmv 4826 placard application ohio 2018 2019

- Bmv3303 2013 2019 form

Find out other Fidelity 401k Withdrawal

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy