Tax Receipt Form Cradles to Crayons

What is the Tax Receipt Form Cradles To Crayons

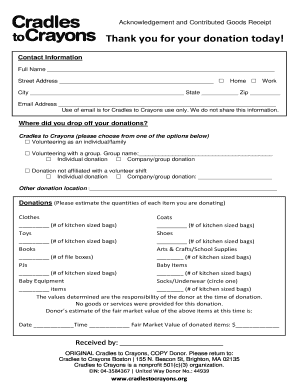

The Tax Receipt Form Cradles To Crayons is a document used by the organization Cradles To Crayons to provide donors with a formal acknowledgment of their contributions. This form serves as a tax receipt, enabling donors to claim their charitable contributions on their tax returns. It includes essential information such as the donor's name, the date of the donation, the amount contributed, and a statement confirming that no goods or services were provided in exchange for the donation. This form is crucial for individuals seeking to maximize their tax deductions while supporting a charitable cause.

How to use the Tax Receipt Form Cradles To Crayons

Using the Tax Receipt Form Cradles To Crayons is straightforward. Donors should first ensure they have made a qualifying donation to the organization. Afterward, they can request the receipt from Cradles To Crayons, typically through their website or by contacting their office directly. Once received, donors should keep the form with their tax records. When filing taxes, they can use the information on the receipt to claim their charitable contribution, ensuring they adhere to IRS guidelines regarding documentation for tax deductions.

Steps to complete the Tax Receipt Form Cradles To Crayons

Completing the Tax Receipt Form Cradles To Crayons involves several key steps:

- Confirm the donation amount and date.

- Fill in the donor's full name and address as it appears on tax documents.

- Include a statement indicating that no goods or services were received in exchange for the donation.

- Sign and date the form if required.

- Retain a copy for personal records and submit it with your tax return.

Legal use of the Tax Receipt Form Cradles To Crayons

The Tax Receipt Form Cradles To Crayons is legally recognized as a valid document for tax purposes. It complies with IRS regulations, which require charitable organizations to provide written acknowledgment for contributions over a certain amount. Donors must ensure that the form includes all necessary details to substantiate their claims during tax filing. This legal acknowledgment protects both the donor and the organization, ensuring transparency and compliance with tax laws.

Key elements of the Tax Receipt Form Cradles To Crayons

Several key elements are essential for the Tax Receipt Form Cradles To Crayons to be valid:

- Donor Information: Name and address of the donor.

- Donation Details: Date and amount of the contribution.

- Organization Information: Name and address of Cradles To Crayons.

- Statement of No Goods or Services: Confirmation that the donation was not exchanged for any goods or services.

- Signature: A signature from an authorized representative of the organization, if applicable.

IRS Guidelines

The IRS has specific guidelines regarding the documentation of charitable contributions. For donations over a certain threshold, donors must obtain a written acknowledgment from the charity. The Tax Receipt Form Cradles To Crayons meets these guidelines by providing all necessary information. Donors should familiarize themselves with IRS Publication 526, which outlines the requirements for deducting charitable contributions, including the need for proper documentation to support their claims during tax filing.

Quick guide on how to complete tax receipt form cradles to crayons

Complete Tax Receipt Form Cradles To Crayons effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without interruptions. Manage Tax Receipt Form Cradles To Crayons on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Tax Receipt Form Cradles To Crayons with ease

- Find Tax Receipt Form Cradles To Crayons and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically available through airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text (SMS), or invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Tax Receipt Form Cradles To Crayons and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax receipt form cradles to crayons

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Receipt Form Cradles To Crayons?

The Tax Receipt Form Cradles To Crayons is a document designed for donors to easily track and verify their contributions. This form helps organizations acknowledge donations and provides the necessary information for donors to claim tax deductions. Utilizing this form ensures compliance with IRS regulations, making it easier for both the organization and the donor.

-

How can I access the Tax Receipt Form Cradles To Crayons?

You can access the Tax Receipt Form Cradles To Crayons through the airSlate SignNow platform. Simply create an account, and you can find the template available for use. This makes it easy to customize and send out the forms directly to your donors.

-

Is the Tax Receipt Form Cradles To Crayons customizable?

Yes, the Tax Receipt Form Cradles To Crayons is fully customizable. You can add your organization's logo, personalize the content, and adjust any fields to suit your specific requirements. This flexibility allows you to maintain your branding while efficiently managing donations.

-

What features does airSlate SignNow offer for the Tax Receipt Form Cradles To Crayons?

airSlate SignNow offers various features for the Tax Receipt Form Cradles To Crayons, including e-signature capabilities, secure document storage, and automated workflows. These features streamline the donation acknowledgment process, making it easier and faster to get forms signed and sent. Additionally, you can track the status of each document for peace of mind.

-

Are there any fees associated with the Tax Receipt Form Cradles To Crayons?

While the Tax Receipt Form Cradles To Crayons is part of the airSlate SignNow platform, users may incur subscription fees depending on the plan they choose. airSlate offers various pricing tiers, ensuring that nonprofits and businesses can find a solution that fits their budget. Always check the pricing page for the latest information on subscription options.

-

What are the benefits of using airSlate SignNow for tax receipt processing?

Using airSlate SignNow for processing the Tax Receipt Form Cradles To Crayons provides signNow benefits, including time savings and enhanced accuracy. The automated workflows eliminate the hassle of manual paperwork, while e-signatures ensure that documents are legally binding. This efficiency allows your organization to focus more on its mission rather than administrative tasks.

-

Can I integrate the Tax Receipt Form Cradles To Crayons with other tools?

Yes, airSlate SignNow supports integrations with a variety of tools and platforms. You can connect your Tax Receipt Form Cradles To Crayons with CRM systems, payment processors, and other software to streamline your workflow. This capability allows for seamless data transfer and enhanced operational efficiency.

Get more for Tax Receipt Form Cradles To Crayons

- Application for employment clement industries form

- Dodea volunteer application form

- Uniform residential loan application deal mortgage dealmortgage

- New york state loan request and enrollment certificate form

- Pif version 6 template download form

- Schedule b interest dividends and certain capital gains and form

- Form m 8453 individual income tax declaration for

- Fchp health insurance tax forms

Find out other Tax Receipt Form Cradles To Crayons

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document