Files PDF K Ben990 2018-2026

What is the K Ben990 Form?

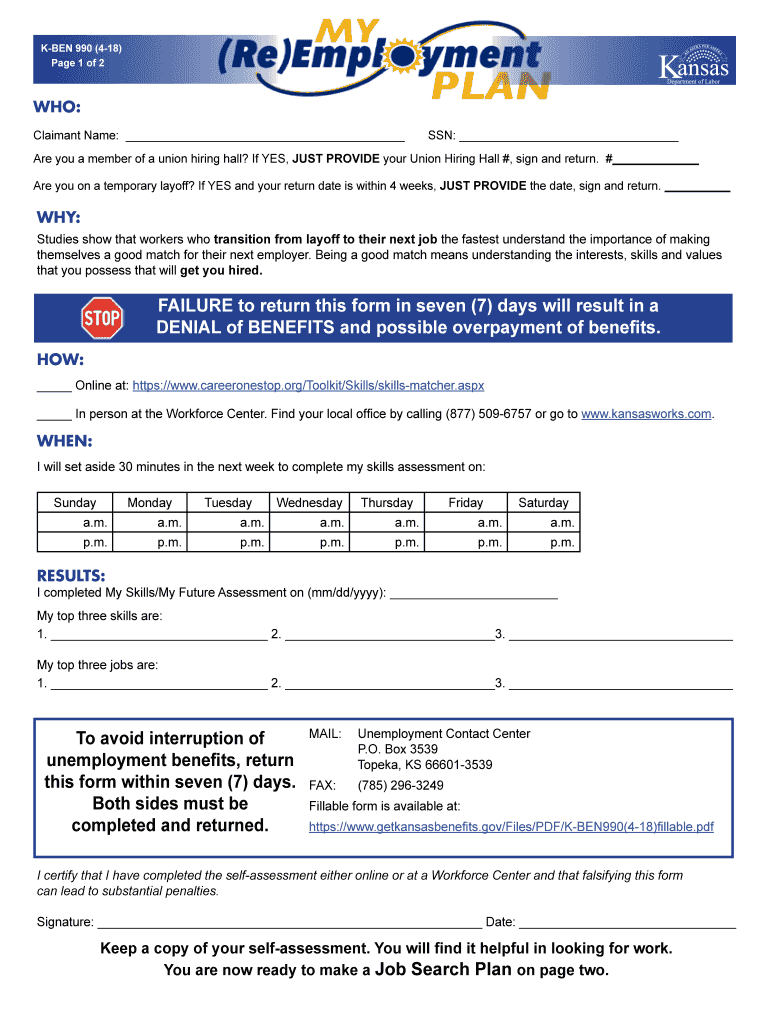

The K Ben990 form is a crucial document used in the Kansas unemployment system. It serves as a reemployment plan that outlines the steps an individual must take to secure employment while receiving unemployment benefits. This form is essential for both claimants and the Kansas Department of Labor, as it establishes the claimant's commitment to actively seek work and outlines the specific actions they will undertake to achieve this goal.

Steps to Complete the K Ben990 Form

Completing the K Ben990 form involves several key steps to ensure accuracy and compliance with state requirements. Follow these guidelines:

- Gather necessary personal information, including your Social Security number and contact details.

- Outline your employment history, focusing on relevant skills and experiences.

- Detail your job search activities, including the types of jobs you are applying for and the methods you are using to find employment.

- Include any training or education plans that may enhance your employability.

- Review the form for completeness and accuracy before submission.

Legal Use of the K Ben990 Form

The K Ben990 form must be filled out and submitted in accordance with Kansas state laws governing unemployment benefits. This legal framework ensures that the information provided is truthful and that claimants are actively engaged in their job search. Failing to adhere to these legal requirements may result in penalties, including the loss of benefits or legal action.

Eligibility Criteria for the K Ben990 Form

To be eligible for submitting the K Ben990 form, individuals must meet specific criteria set by the Kansas Department of Labor. These criteria typically include:

- Being a resident of Kansas.

- Having a valid unemployment claim.

- Demonstrating an active job search and willingness to accept suitable employment.

Form Submission Methods for the K Ben990

The K Ben990 form can be submitted through various methods to accommodate different preferences. Claimants may choose to:

- Submit the form online via the Kansas Department of Labor's website.

- Mail a printed copy of the form to the appropriate office.

- Deliver the form in person at designated unemployment offices across Kansas.

Key Elements of the K Ben990 Form

The K Ben990 form includes several key elements that are critical for its effectiveness and compliance. These elements typically consist of:

- Claimant's personal information and unemployment claim details.

- A comprehensive job search plan outlining specific actions and timelines.

- Signature and date to affirm the accuracy of the information provided.

Examples of Using the K Ben990 Form

Practical examples of how to utilize the K Ben990 form can enhance understanding and compliance. For instance, a claimant might outline their job search strategy by listing specific companies they plan to apply to, along with the dates they intend to submit applications. Additionally, including any scheduled interviews or networking events can demonstrate proactive engagement in the job market.

Quick guide on how to complete k ben 990 2018 2019 form

Enhance your HR processes with Files Pdf K Ben990 Template

Every HR specialist recognizes the importance of keeping employee information organized and orderly. With airSlate SignNow, you gain access to an extensive collection of state-specific employment forms that greatly facilitate the retrieval, management, and preservation of all job-related documents in one location. airSlate SignNow enables you to handle Files Pdf K Ben990 management from beginning to end, with powerful editing and eSignature tools available whenever you require them. Improve your precision, document security, and reduce minor manual errors in just a few clicks.

The optimal method to modify and eSign Files Pdf K Ben990:

- Select the appropriate state and search for the form you require.

- Access the form page and click on Get Form to start editing it.

- Allow Files Pdf K Ben990 to load in our editor and adhere to the prompts that indicate mandatory fields.

- Input your details or insert additional fillable fields to the form.

- Utilize our tools and features to customize your form as needed: annotate, obscure sensitive information, and create an eSignature.

- Review your form for errors before proceeding with its submission.

- Simply click Done to save changes and download your form.

- Alternatively, send your document directly to your recipients and collect signatures and information.

- Safely store completed forms in your airSlate SignNow account and retrieve them whenever you wish.

Employing a flexible eSignature solution is essential when handling Files Pdf K Ben990. Make even the most intricate workflow as seamless as possible with airSlate SignNow. Start your free trial today to discover what you can achieve with your department.

Create this form in 5 minutes or less

Find and fill out the correct k ben 990 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the k ben 990 2018 2019 form

How to make an electronic signature for your K Ben 990 2018 2019 Form in the online mode

How to generate an electronic signature for the K Ben 990 2018 2019 Form in Google Chrome

How to make an electronic signature for signing the K Ben 990 2018 2019 Form in Gmail

How to generate an electronic signature for the K Ben 990 2018 2019 Form right from your smart phone

How to make an electronic signature for the K Ben 990 2018 2019 Form on iOS

How to make an electronic signature for the K Ben 990 2018 2019 Form on Android

People also ask

-

What is airSlate SignNow's role in managing Kansas unemployment documentation?

airSlate SignNow streamlines the creation and signing of employment-related documents necessary for Kansas unemployment claims. With an easy-to-use interface, you can quickly prepare and eSign necessary forms, ensuring compliance with state regulations. This saves valuable time and minimizes paperwork hassle for both employers and applicants.

-

How does airSlate SignNow help with Kansas unemployment claims?

By utilizing airSlate SignNow, businesses can efficiently manage the documentation required for Kansas unemployment claims. The platform allows for quick eSigning and sharing of documents, which helps reduce delays in the claims process. This ensures that employees receive their benefits swiftly and without unnecessary complications.

-

What are the pricing options for airSlate SignNow related to Kansas unemployment services?

airSlate SignNow offers various pricing plans that cater to businesses handling Kansas unemployment processes. The plans are designed to be cost-effective, allowing businesses to choose options based on their specific needs and budget. Whether you are a small business or a larger organization, there's a plan that can accommodate your needs.

-

What features does airSlate SignNow offer to assist with managing Kansas unemployment documentation?

Key features of airSlate SignNow include document templates, secure eSigning, and real-time collaboration tools. These features simplify the process of creating and managing Kansas unemployment documents, ensuring everything is completed accurately and efficiently. Additionally, custom workflows can be set up to automate repetitive tasks.

-

What benefits does airSlate SignNow provide for Kansas businesses dealing with unemployment claims?

Using airSlate SignNow allows Kansas businesses to enhance their workflow efficiency when processing unemployment claims. The platform ensures that all documents are securely eSigned, reducing the risk of errors. Moreover, the ability to track document status in real-time provides transparency and peace of mind.

-

Can airSlate SignNow integrate with other tools for Kansas unemployment processes?

Yes, airSlate SignNow boasts integrations with various tools and software that can enhance your Kansas unemployment documentation process. These integrations allow for seamless data transfer between applications, ensuring that your workflows remain efficient. This flexibility makes it easier to adapt SignNow to your existing systems.

-

How secure is airSlate SignNow for Kansas unemployment documentation?

airSlate SignNow prioritizes the security of your documents, particularly when handling sensitive information related to Kansas unemployment. The platform uses encryption and complies with industry security standards to protect your data. This added layer of security ensures that your unemployment documentation is safe from unauthorized access.

Get more for Files Pdf K Ben990

- African unity claim form

- Electronic funds authorization american general life insurance company agl aig life insurance company aig life insurance form

- Needham montessori form

- Request for public records foia city of dearborn cityofdearborn form

- Hancock bank online sign on form

- Change form 5309144

- Cost sharing agreement template form

- Cottage agreement template form

Find out other Files Pdf K Ben990

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast