BOE 266 CLAIM for HOMEOWNERS' PROPERTY TAX EXEMPTION BOE 266 CLAIM for HOMEOWNERS' PROPERTY TAX EXEMPTION Form

What is the BOE 266 Claim for Homeowners' Property Tax Exemption?

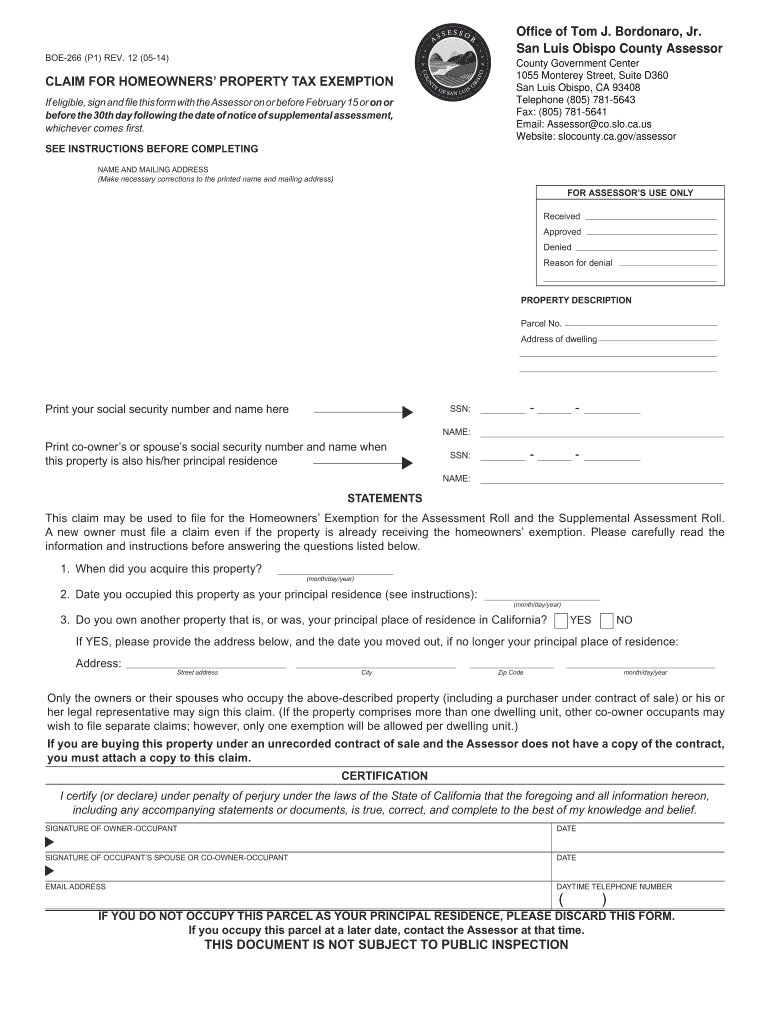

The BOE 266 form is a claim for the Homeowners' Property Tax Exemption in California. This exemption allows qualified homeowners to reduce their property tax liability by a specified amount. The form is primarily designed for individuals who own and occupy their primary residence. By filing this claim, homeowners can benefit from significant savings on their annual property taxes, making homeownership more affordable.

Eligibility Criteria for the BOE 266 Form

To qualify for the Homeowners' Property Tax Exemption using the BOE 266 form, applicants must meet certain criteria:

- The property must be the applicant's principal residence.

- The applicant must be the owner of the property as of January 1 of the tax year.

- The applicant must not have claimed the exemption on any other property.

- Income limitations may apply, depending on local regulations.

Steps to Complete the BOE 266 Form

Completing the BOE 266 form involves several straightforward steps:

- Obtain the BOE 266 form from the California State Board of Equalization website or your local county assessor's office.

- Fill out the required personal information, including your name, address, and property details.

- Indicate your eligibility by answering the questions regarding ownership and residency.

- Submit the completed form to your local county assessor's office by the specified deadline.

How to Submit the BOE 266 Form

The BOE 266 form can be submitted in various ways to ensure convenience:

- Online: Many counties offer online submission through their official websites.

- By Mail: You can send the completed form via postal service to your local county assessor's office.

- In-Person: Visit your local county assessor’s office to submit the form directly.

Required Documents for the BOE 266 Form

When filing the BOE 266 form, certain documents may be required to support your claim:

- Proof of ownership, such as a deed or title.

- Identification documents, like a driver’s license or state ID.

- Any additional documentation requested by the local assessor's office.

Common Mistakes to Avoid When Filing the BOE 266 Form

To ensure a smooth filing process, consider these common mistakes:

- Failing to meet the filing deadline, which can result in losing the exemption for the tax year.

- Not providing complete and accurate information on the form.

- Neglecting to include required supporting documents.

Quick guide on how to complete boe 266 claim for homeowners property tax exemption boe 266 claim for homeowners property tax exemption

Complete BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION effortlessly on any device

Online document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION effortlessly

- Locate BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION and click Get Form to begin.

- Utilize the tools provided to submit your document.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Edit and eSign BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the boe 266 claim for homeowners property tax exemption boe 266 claim for homeowners property tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the boe 266 form and how is it used?

The boe 266 form is a crucial document primarily used for tax purposes in certain jurisdictions. It serves as a declaration for business entities regarding their tax obligations and can streamline tax compliance when properly filled out and submitted.

-

How can airSlate SignNow facilitate the completion of the boe 266 form?

airSlate SignNow provides an intuitive platform that allows businesses to easily fill out, sign, and send the boe 266 form. With features like templates and automated workflows, it simplifies the process, ensuring accuracy and efficiency.

-

Is there a cost associated with using airSlate SignNow for the boe 266 form?

Yes, while airSlate SignNow offers various pricing plans, many features related to completing the boe 266 form are included at competitive rates. These plans cater to businesses of all sizes, ensuring a cost-effective solution for document management.

-

What are the key benefits of using airSlate SignNow for my boe 266 form?

Using airSlate SignNow for your boe 266 form offers multiple benefits, including easy e-signature capabilities, cloud storage for secure document management, and the ability to collaborate in real-time. This not only speeds up the signing process but also ensures compliance and reduces errors.

-

Can I integrate airSlate SignNow with other applications for managing the boe 266 form?

Absolutely! airSlate SignNow supports integration with popular applications such as Google Drive, Salesforce, and Dropbox, making it easier to manage your boe 266 form alongside other business documents. This enhances productivity and streamlines your workflow.

-

Is it secure to use airSlate SignNow for the boe 266 form?

Yes, airSlate SignNow employs top-notch security measures including encryption and secure data storage, ensuring that your boe 266 form and other sensitive documents are protected. This commitment to security helps build trust with your clients and stakeholders.

-

What types of businesses benefit from using the boe 266 form via airSlate SignNow?

Businesses across various industries that have tax obligations can benefit from using the boe 266 form through airSlate SignNow. This includes small businesses, freelancers, and corporate enterprises looking to simplify document management and compliance.

Get more for BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION

Find out other BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION BOE 266 CLAIM FOR HOMEOWNERS' PROPERTY TAX EXEMPTION

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document