Form CT 2 Employee Representative's Quarterly Railroad Tax 2023

What is the Form CT 2 Employee Representative's Quarterly Railroad Tax

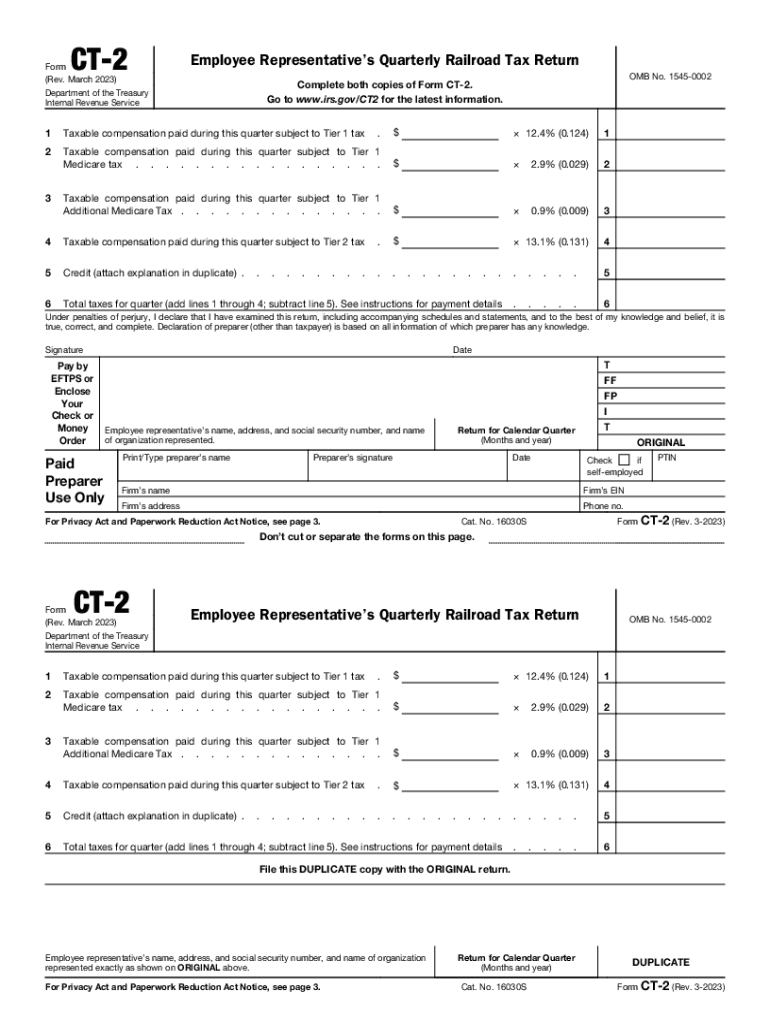

The Form CT 2 Employee Representative's Quarterly Railroad Tax is a tax form used by employee representatives in the railroad industry to report and pay taxes related to employee wages. This form is essential for ensuring compliance with federal tax regulations and helps maintain accurate records of tax liabilities. It is specifically designed for representatives who are responsible for collecting and remitting taxes on behalf of employees in the railroad sector.

How to use the Form CT 2 Employee Representative's Quarterly Railroad Tax

To use the Form CT 2, employee representatives must first gather the necessary information about the employees they represent. This includes total wages paid during the quarter, the applicable tax rates, and any deductions that may apply. Once the information is compiled, the representative can fill out the form accurately, ensuring all sections are completed. After completing the form, it should be submitted according to the specified filing methods, which may include online submission or mailing a paper copy to the appropriate tax authority.

Steps to complete the Form CT 2 Employee Representative's Quarterly Railroad Tax

Completing the Form CT 2 involves several important steps:

- Gather employee wage information for the reporting period.

- Determine the applicable tax rates based on current regulations.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the deadline, either online or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 2 are typically set on a quarterly basis. Employee representatives must be aware of these deadlines to avoid penalties. Generally, the form must be submitted within a specific timeframe after the end of each quarter, often within 30 days. It is important to check the current year's deadlines as they may vary, and timely submission is crucial for compliance.

Penalties for Non-Compliance

Failure to file the Form CT 2 by the deadline can result in significant penalties. These may include fines based on the amount of tax owed or additional charges for late submission. In some cases, repeated non-compliance can lead to more severe consequences, such as increased scrutiny from tax authorities. It is essential for employee representatives to adhere to filing requirements to avoid these penalties.

Who Issues the Form

The Form CT 2 is issued by the appropriate tax authority responsible for overseeing railroad taxes. In the United States, this typically falls under the jurisdiction of the Internal Revenue Service (IRS) or state tax agencies, depending on the specific regulations governing railroad employment. Employee representatives should ensure they are using the most current version of the form as issued by the relevant authority.

Quick guide on how to complete form ct 2 employee representatives quarterly railroad tax

Complete Form CT 2 Employee Representative's Quarterly Railroad Tax smoothly on any device

Web-based document management has become a popular choice among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hassles. Manage Form CT 2 Employee Representative's Quarterly Railroad Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Form CT 2 Employee Representative's Quarterly Railroad Tax effortlessly

- Obtain Form CT 2 Employee Representative's Quarterly Railroad Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: by email, text message (SMS), or an invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management needs with a few clicks from any device of your choice. Edit and eSign Form CT 2 Employee Representative's Quarterly Railroad Tax and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 2 employee representatives quarterly railroad tax

Create this form in 5 minutes!

How to create an eSignature for the form ct 2 employee representatives quarterly railroad tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 2 Employee Representative's Quarterly Railroad Tax?

Form CT 2 Employee Representative's Quarterly Railroad Tax is a tax form that railroad employers use to report quarterly withholding tax on compensation paid to employees. This form is essential for compliance within the railroad industry, ensuring accurate tax reporting.

-

How does airSlate SignNow assist with Form CT 2 Employee Representative's Quarterly Railroad Tax?

airSlate SignNow streamlines the process of completing and eSigning Form CT 2 Employee Representative's Quarterly Railroad Tax, allowing users to fill out and submit their forms digitally. This reduces errors and saves time, making tax compliance easier for railroad employers.

-

Is there a cost associated with using airSlate SignNow for Form CT 2 Employee Representative's Quarterly Railroad Tax?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our affordable solutions empower businesses to eSign and manage documents such as Form CT 2 Employee Representative's Quarterly Railroad Tax without breaking the bank.

-

Can I integrate airSlate SignNow with other platforms for managing Form CT 2 Employee Representative's Quarterly Railroad Tax?

Absolutely! airSlate SignNow integrates seamlessly with various platforms like Google Drive, Dropbox, and Salesforce. This enables businesses to manage their Form CT 2 Employee Representative's Quarterly Railroad Tax documents effectively within their existing workflows.

-

What are the benefits of using airSlate SignNow for Form CT 2 Employee Representative's Quarterly Railroad Tax?

Using airSlate SignNow for Form CT 2 Employee Representative's Quarterly Railroad Tax provides several benefits, including faster processing times and reduced paperwork. Our platform also enhances collaboration among team members, ensuring that all necessary signatures are obtained promptly.

-

Is it secure to use airSlate SignNow for eSigning Form CT 2 Employee Representative's Quarterly Railroad Tax?

Yes, security is a top priority at airSlate SignNow. We utilize bank-level encryption, secure servers, and compliance with industry standards to ensure that your Form CT 2 Employee Representative's Quarterly Railroad Tax and other sensitive documents are protected at all times.

-

How user-friendly is airSlate SignNow for completing Form CT 2 Employee Representative's Quarterly Railroad Tax?

airSlate SignNow is designed with user experience in mind, making it incredibly easy to complete Form CT 2 Employee Representative's Quarterly Railroad Tax. Our intuitive interface allows users of all skill levels to navigate through the form completion and signing process effortlessly.

Get more for Form CT 2 Employee Representative's Quarterly Railroad Tax

Find out other Form CT 2 Employee Representative's Quarterly Railroad Tax

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement