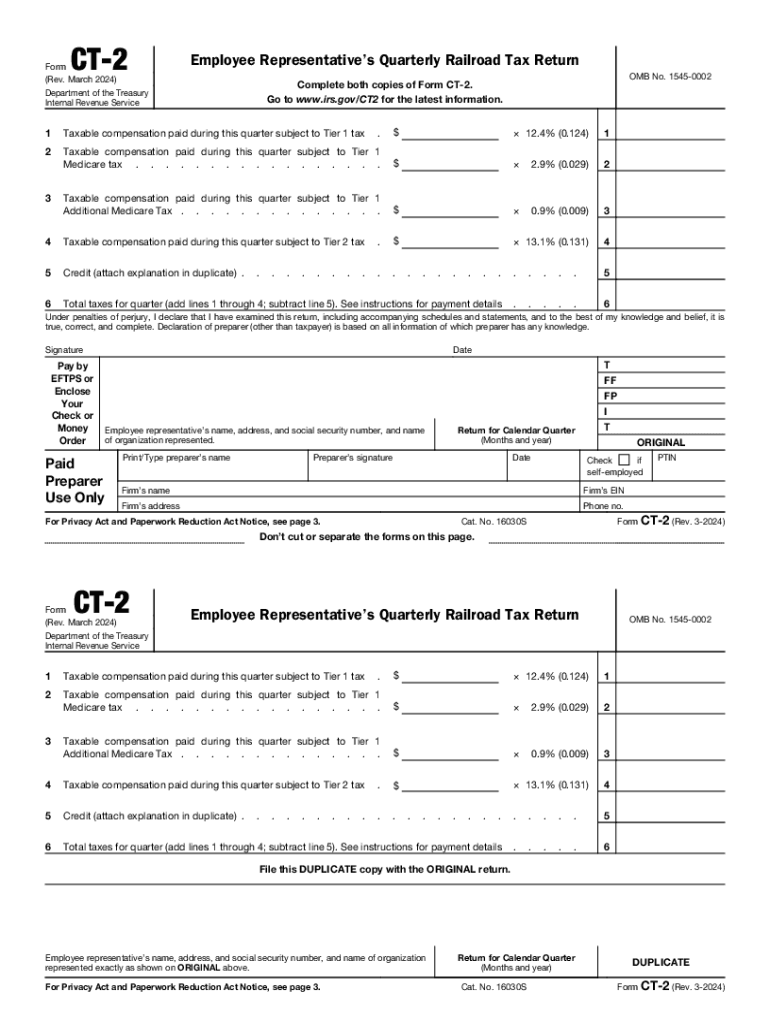

Form CT 2 Rev March 2024

What is the Form CT 2 Rev March

The Form CT 2 Rev March is a state-specific document used in Connecticut for reporting and remitting certain tax obligations. This form is primarily utilized by businesses to report specific tax liabilities, ensuring compliance with state tax laws. It is essential for maintaining accurate records and fulfilling legal requirements related to taxation in Connecticut.

How to use the Form CT 2 Rev March

Using the Form CT 2 Rev March involves several key steps. First, businesses must identify the tax obligations that require reporting on this form. After gathering the necessary financial information, users should accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, it can be submitted either electronically or via mail, depending on the specific instructions provided by the Connecticut Department of Revenue Services.

Steps to complete the Form CT 2 Rev March

Completing the Form CT 2 Rev March involves a systematic approach:

- Gather all relevant financial documents and records related to your tax obligations.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either online or by mail.

Legal use of the Form CT 2 Rev March

The legal use of the Form CT 2 Rev March is crucial for businesses operating in Connecticut. This form serves as an official record of tax reporting and compliance. Failing to use the form correctly or not submitting it on time can lead to penalties or legal repercussions. It is important for businesses to understand the legal implications of this form and to ensure that it is completed and submitted according to state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 2 Rev March are established by the Connecticut Department of Revenue Services. It is important for businesses to be aware of these deadlines to avoid late fees or penalties. Typically, the form must be submitted quarterly or annually, depending on the specific tax obligations being reported. Keeping track of these important dates is essential for maintaining compliance and avoiding unnecessary complications.

Required Documents

When completing the Form CT 2 Rev March, certain documents are required to ensure accurate reporting. These may include:

- Financial statements that reflect income and expenses.

- Previous tax returns for reference.

- Any supporting documentation related to deductions or credits claimed.

Having these documents on hand will facilitate the completion of the form and help ensure compliance with state tax laws.

Quick guide on how to complete form ct 2 rev march

Complete Form CT 2 Rev March seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Form CT 2 Rev March on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Form CT 2 Rev March effortlessly

- Obtain Form CT 2 Rev March and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form CT 2 Rev March and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 2 rev march

Create this form in 5 minutes!

How to create an eSignature for the form ct 2 rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CT 2 form and how does it work with airSlate SignNow?

The CT 2 form is a document used for various business transactions that require electronic signatures. With airSlate SignNow, you can easily create, send, and eSign CT 2 forms, streamlining your workflow and ensuring compliance. Our platform simplifies the process, making it accessible for users of all technical levels.

-

How much does it cost to use airSlate SignNow for CT 2 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently use CT 2 forms. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for managing CT 2 forms?

airSlate SignNow provides a range of features for managing CT 2 forms, including customizable templates, automated workflows, and secure cloud storage. You can also track the status of your documents in real-time, ensuring that you never miss a signature. These features enhance efficiency and improve document management.

-

Can I integrate airSlate SignNow with other applications for CT 2 forms?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage CT 2 forms alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our integrations help streamline your processes. This connectivity enhances productivity and collaboration.

-

What are the benefits of using airSlate SignNow for CT 2 forms?

Using airSlate SignNow for CT 2 forms provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are signed quickly and securely, minimizing delays in your business processes. Additionally, the user-friendly interface makes it easy for anyone to use.

-

Is airSlate SignNow compliant with legal standards for CT 2 forms?

Absolutely! airSlate SignNow is compliant with all relevant legal standards for electronic signatures, ensuring that your CT 2 forms are legally binding. We adhere to regulations such as ESIGN and UETA, providing peace of mind that your documents meet legal requirements. This compliance is crucial for businesses operating in regulated industries.

-

How can I get started with airSlate SignNow for CT 2 forms?

Getting started with airSlate SignNow for CT 2 forms is simple. You can sign up for a free trial on our website, allowing you to explore the features and functionalities. Once registered, you can easily create and send your CT 2 forms for eSignature, making the onboarding process quick and efficient.

Get more for Form CT 2 Rev March

- Trench inspection and entry authorization form ehs okstate

- Insight card form

- Farm job application form

- Common cations anions acids salts and hydrate nomenclature form

- Corporate sponsorship letter pink and green gala finaldocx epsilonomega form

- 9103 ministry funds request form 010522 cdr

- Vbs volunteer form st mary stmaryalexandria

- Conditional use permit application form

Find out other Form CT 2 Rev March

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document