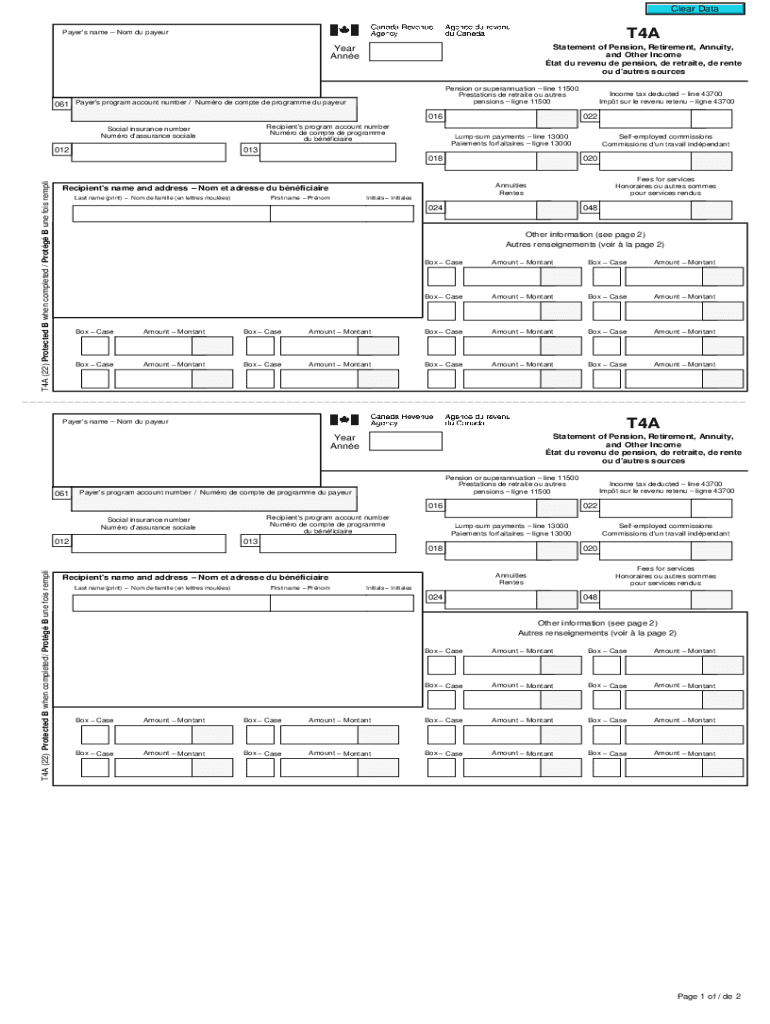

Statement of Pension, Retirement, Annuity, and Other Income Form

Understanding the Statement of Pension, Retirement, Annuity, and Other Income

The T4A form, officially known as the Statement of Pension, Retirement, Annuity, and Other Income, is a crucial document for individuals receiving various types of income in the United States. This form is typically issued by employers or financial institutions to report income such as pensions, annuities, and other retirement benefits. It serves as a record of the income received during the tax year and is essential for accurately filing tax returns.

How to Complete the T4A Form

Filling out the T4A form involves several key steps to ensure accuracy and compliance with tax regulations. Start by gathering all necessary information, including personal identification details, income amounts, and any relevant deductions. Each section of the form must be filled out carefully, paying close attention to the income types and amounts reported. It is important to double-check entries for accuracy, as errors can lead to complications with tax filings.

Obtaining the T4A Form

The T4A form can be obtained from various sources, including your employer, financial institution, or the official IRS website. Many organizations provide the form electronically, allowing for easy access and completion. If you are unable to obtain a copy directly, you can request one from the issuing entity or download a blank T4A form from the IRS resources.

Key Elements of the T4A Form

Several key elements must be included in the T4A form to ensure it meets reporting requirements. These include:

- Recipient Information: Name, address, and Social Security number of the income recipient.

- Income Details: Types of income received, such as pensions or annuities, along with the corresponding amounts.

- Tax Withholding: Any taxes withheld from the reported income must be clearly indicated.

- Issuer Information: The name and contact information of the entity issuing the form.

Legal Use of the T4A Form

The T4A form is legally required for reporting specific types of income to the IRS. Failure to provide accurate information can result in penalties or audits. It is essential for recipients to retain copies of their T4A forms for their records and to ensure compliance with tax laws. The information reported on this form is used to calculate tax liabilities and verify income during tax assessments.

Filing Deadlines for the T4A Form

It is important to be aware of the filing deadlines associated with the T4A form. Typically, the form must be submitted by the end of January following the tax year in which the income was received. Recipients should ensure that they receive their T4A forms in a timely manner to facilitate accurate and on-time tax filings. Missing the deadline can lead to penalties and interest on unpaid taxes.

Quick guide on how to complete statement of pension retirement annuity and other income

Complete Statement Of Pension, Retirement, Annuity, And Other Income effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage Statement Of Pension, Retirement, Annuity, And Other Income on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to adjust and eSign Statement Of Pension, Retirement, Annuity, And Other Income with ease

- Locate Statement Of Pension, Retirement, Annuity, And Other Income and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require new document printing. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Modify and eSign Statement Of Pension, Retirement, Annuity, And Other Income and ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the statement of pension retirement annuity and other income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a T4A form and why is it important?

The T4A form is a tax document used in Canada to report various types of income, including pensions and payments made to self-employed individuals. Understanding the T4A form is crucial for accurate tax reporting and compliance, ensuring you avoid penalties and maximize your deductions.

-

How can airSlate SignNow help with T4A forms?

airSlate SignNow simplifies the process of completing T4A forms by allowing you to fill out, sign, and send documents securely online. Its user-friendly interface enables you to manage your forms efficiently, reducing the risk of errors and ensuring timely submissions.

-

Is airSlate SignNow a cost-effective solution for managing T4A forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to handle T4A forms and other documents. With a range of pricing plans available, you can choose the plan that fits your budget while still accessing all necessary features to streamline your document workflow.

-

What features does airSlate SignNow offer for T4A form handling?

airSlate SignNow includes features such as customizable templates for T4A forms, real-time collaboration, and secure eSigning capabilities. These tools allow you to create, send, and receive signed forms effortlessly, enhancing your productivity and efficiency.

-

Can I integrate airSlate SignNow with other software for T4A form management?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enabling you to connect your T4A form workflow with accounting and CRM software. This integration helps automate processes, ensuring that your documents are managed effectively across platforms.

-

What are the benefits of using airSlate SignNow for T4A forms?

Using airSlate SignNow for T4A forms offers numerous benefits, including increased efficiency, improved accuracy, and reduced processing times. By automating the form handling process, you can focus more on your core business activities instead of paperwork.

-

Is it easy to track T4A forms sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all T4A forms that you send. You'll receive notifications when your documents are viewed and signed, allowing you to stay updated on the status of your form submissions.

Get more for Statement Of Pension, Retirement, Annuity, And Other Income

- Employment application education maxim staffing solutions form

- Complete the sentence using the verbs from above form

- Covenant hospice massage therapy competencies confex form

- Ecomap symbols pdf form

- Certification to be issued by ddopaopop spaggregator in case of death claims form

- College scholarship payout form

- Safcgpsafc student travel reimbursement addendum cornell form

- Student confirmation and payment agreement msu northern form

Find out other Statement Of Pension, Retirement, Annuity, And Other Income

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors