Ny Tax Form

Understanding NY Tax

The NY tax refers to the various taxes imposed by the state of New York, which can include income tax, sales tax, and property tax. Each type of tax has specific regulations and rates that residents and businesses must follow. New York's income tax is progressive, meaning that rates increase with higher income levels. Understanding the nuances of NY tax is essential for compliance and effective financial planning.

How to Complete the NY Tax Form

Completing the NY tax form involves several steps. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant deductions. Next, accurately fill out the form, ensuring that all information is correct and complete. Pay special attention to sections that pertain to deductions and credits, as these can significantly affect your tax liability. Finally, review the form for accuracy before submission.

Required Documents for NY Tax Filing

When filing your NY tax, certain documents are essential to ensure a smooth process. These typically include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Records of any tax credits you are claiming

- Previous year's tax return for reference

Having these documents organized will help streamline your filing process and reduce the likelihood of errors.

Filing Deadlines for NY Tax

Filing deadlines for NY tax are crucial to avoid penalties. Generally, individual income tax returns are due on April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. For businesses, deadlines can vary based on the type of entity. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines and any updates that may affect your filing.

Eligibility Criteria for NY Tax Credits

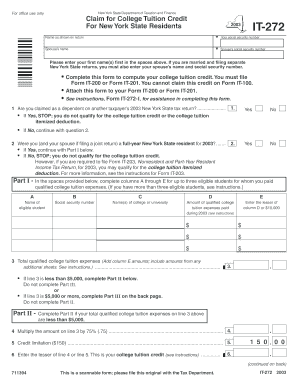

Eligibility for various NY tax credits, such as the college tuition credit, is determined by specific criteria set by the state. Generally, taxpayers must meet income thresholds and have qualifying expenses. For instance, to claim the college tuition credit, you must have paid tuition for an eligible student attending a college in New York. It's important to review the specific requirements for each credit to ensure you qualify before applying.

Digital Submission Methods for NY Tax Forms

New York allows for digital submission of tax forms, making the process more efficient. Taxpayers can file online through the New York State Department of Taxation and Finance website. This method is secure and often results in faster processing times. Additionally, e-filing can help reduce errors, as many online platforms provide prompts and checks to ensure accuracy. Taxpayers may also have the option to use authorized tax software that complies with state regulations.

Penalties for Non-Compliance with NY Tax Regulations

Failure to comply with NY tax regulations can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for serious violations. It is essential to stay informed about your tax obligations and ensure timely filing and payment to avoid these consequences. Understanding the specific penalties associated with your tax situation can help you maintain compliance and protect your financial interests.

Quick guide on how to complete ny tax

Effortlessly Prepare Ny Tax on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Ny Tax from any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Ny Tax with Ease

- Obtain Ny Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or hide sensitive details using the tools that airSlate SignNow provides for this purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of sharing your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Ny Tax to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to NY tax?

airSlate SignNow is a comprehensive eSignature solution that simplifies the process of sending and signing documents online. For professionals dealing with NY tax, our platform enables users to easily manage tax forms and contracts securely, ensuring compliance with state requirements.

-

How does airSlate SignNow assist with NY tax documentation?

With airSlate SignNow, you can streamline the handling of all NY tax-related documents. Our platform allows you to create, edit, and send tax forms quickly, reducing the time spent on paperwork and enabling you to focus on your business needs.

-

What features does airSlate SignNow offer for NY tax filings?

airSlate SignNow includes features like customizable templates, automatic reminders, and secure cloud storage which are perfect for tracking NY tax deadlines and submissions. These features help ensure you're always compliant with tax obligations while maintaining efficient workflows.

-

Is airSlate SignNow cost-effective for managing NY tax paperwork?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes, making it a cost-effective solution for managing NY tax paperwork. By reducing manual processes, our platform can help save time and money, ultimately enhancing your operational efficiency.

-

Does airSlate SignNow integrate with accounting software for NY tax needs?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software to streamline your NY tax processes. This integration helps ensure that your documents are lodged correctly and that your financial data management is efficient and accurate.

-

What security measures does airSlate SignNow implement for NY tax documents?

At airSlate SignNow, we prioritize security, especially for sensitive NY tax documents. Our platform employs industry-standard encryption and secure cloud storage to safeguard your information, ensuring that your tax data is protected against unauthorized access.

-

Can I access airSlate SignNow on mobile devices for NY tax tasks?

Yes, airSlate SignNow offers a mobile-friendly app that allows you to manage your NY tax tasks on the go. This flexibility ensures that you can access, review, and sign documents from anywhere, making tax management a breeze.

Get more for Ny Tax

- Wiltshire marac form

- Lesson 7 extra practice solve systems of equations by graphing answer key form

- Dd form 1902

- Progress report uitm form

- Barmer antrag zuzahlungsbefreiung pdf form

- Easi pay form mcis insurance berhad

- Utah national guard and mwr release and hold harmless agreement ut ngb army form

- B305 architects qualification statement case form

Find out other Ny Tax

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement