New Jersey Inheritance Tax Form

Understanding the New Jersey Inheritance Tax

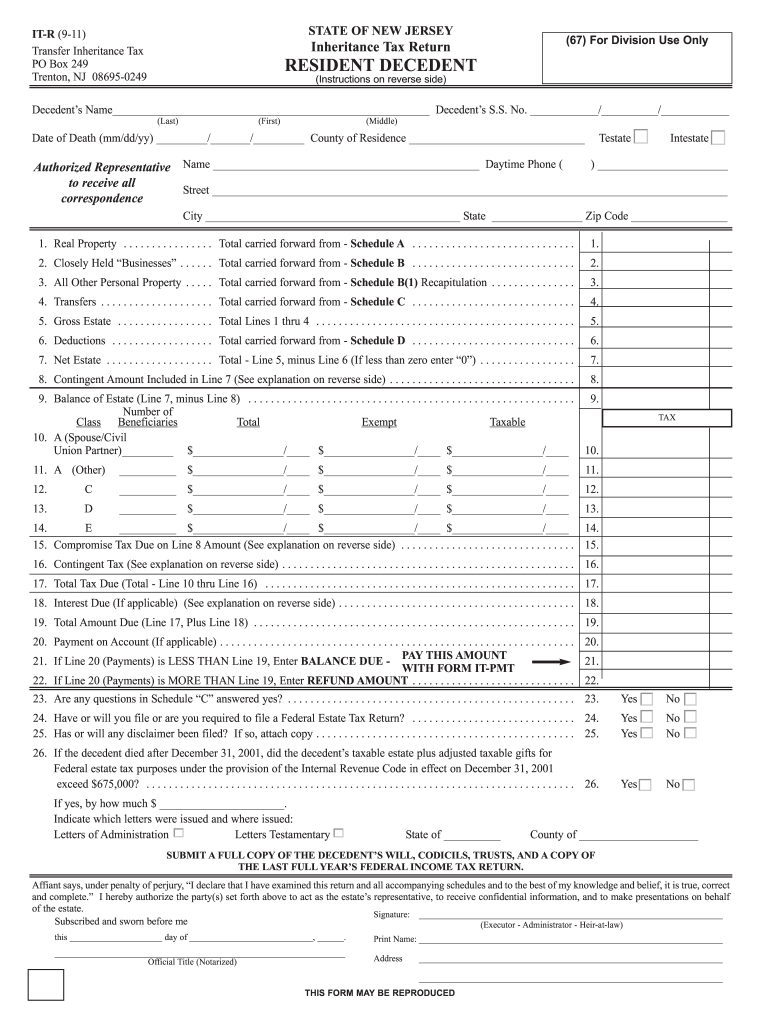

The New Jersey inheritance tax is a tax levied on the transfer of assets from a deceased individual to their beneficiaries. This tax applies to all estates in New Jersey, regardless of the total value, and is based on the relationship between the decedent and the beneficiary. Close relatives, such as spouses, children, and parents, may be exempt from this tax or may face lower rates, while more distant relatives and non-relatives may incur higher rates. Understanding these distinctions is crucial for effective estate planning and financial management.

Steps to Complete the New Jersey Inheritance Tax

Filing the New Jersey inheritance tax involves several steps that must be followed carefully to ensure compliance. First, gather all necessary documentation, including the death certificate and a list of the decedent's assets. Next, determine the relationship between the decedent and each beneficiary, as this affects the tax rate. After calculating the tax owed, complete the New Jersey inheritance tax return form accurately. Finally, submit the form along with any required payment to the New Jersey Division of Taxation by the designated deadline.

Required Documents for Filing

To file the New Jersey inheritance tax return, specific documents are required. These typically include:

- The decedent's death certificate

- A list of all assets owned by the decedent at the time of death

- Valuation documents for significant assets, such as real estate or investments

- Information regarding the beneficiaries, including their relationship to the decedent

Ensuring that all documents are accurate and complete will facilitate a smoother filing process.

Filing Deadlines and Important Dates

Timely filing of the New Jersey inheritance tax return is essential to avoid penalties. The return is generally due within eight months of the decedent's date of death. If the return is not filed by this deadline, interest may accrue on any unpaid tax. Additionally, if the estate is subject to federal estate tax, it is important to be aware of the different deadlines that may apply.

Penalties for Non-Compliance

Failure to comply with the New Jersey inheritance tax requirements can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is crucial for beneficiaries and executors to understand their responsibilities and ensure that all filings are completed accurately and on time to avoid these consequences.

Eligibility Criteria for Exemptions

Certain beneficiaries may qualify for exemptions or reduced tax rates under the New Jersey inheritance tax law. Generally, spouses, children, and parents of the decedent fall into Class A, which is exempt from the inheritance tax. Other relatives, such as siblings or grandparents, may face lower rates based on their relationship to the decedent. Understanding these eligibility criteria can significantly impact the overall tax liability of an estate.

Quick guide on how to complete new jersey inheritance tax

Effortlessly Prepare New Jersey Inheritance Tax on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly and without complications. Manage New Jersey Inheritance Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign New Jersey Inheritance Tax with minimal effort

- Find New Jersey Inheritance Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and press the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Modify and electronically sign New Jersey Inheritance Tax to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new jersey inheritance tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new jersey inheritance tax?

The New Jersey inheritance tax is a tax imposed on the transfer of assets from deceased individuals to their beneficiaries. It primarily affects larger estates and varies based on the relationship between the deceased and the beneficiaries. Understanding this tax is crucial for estate planning in New Jersey.

-

How does the new jersey inheritance tax impact beneficiaries?

The new jersey inheritance tax can signNowly affect the amount of inheritance received by beneficiaries. Depending on their relation to the deceased, beneficiaries may face different tax rates. It's essential for them to be informed about these tax implications to avoid surprises during the estate settlement process.

-

Are there exemptions to the new jersey inheritance tax?

Yes, certain exemptions are available under the new jersey inheritance tax law. Spouses, civil union partners, and children may have high exemption thresholds compared to distant relatives or non-relatives. Consulting with a tax professional can help clarify these exemptions for individual circumstances.

-

How can airSlate SignNow help with New Jersey inheritance tax documents?

airSlate SignNow simplifies the process of preparing and signing documents related to the new jersey inheritance tax. With its user-friendly interface, you can easily create, send, and store essential forms securely. This streamlines the documentation needed for tax filing and estate administration.

-

What are the costs associated with handling the new jersey inheritance tax?

Costs related to the new jersey inheritance tax can vary depending on estate size and complexity. Legal fees for tax preparation and filing, as well as potential payment of the tax itself, should be anticipated. Using affordable solutions like airSlate SignNow can help reduce administrative costs related to these processes.

-

Can airSlate SignNow integrate with estate planning software for New Jersey inheritance tax?

Yes, airSlate SignNow offers integrations with various estate planning software, enhancing the management of documents related to the new jersey inheritance tax. This allows users to seamlessly coordinate their documents and workflows, ensuring that everything from eSignatures to document storage is efficient and streamlined.

-

What documents are needed for filing the new jersey inheritance tax?

To file the new jersey inheritance tax, you'll typically need death certificates, a copy of the will, and an inventory of the estate's assets. Additional documents may be required depending on the specific circumstances of the estate. Using airSlate SignNow can help organize these documents for easy access and management.

Get more for New Jersey Inheritance Tax

Find out other New Jersey Inheritance Tax

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple