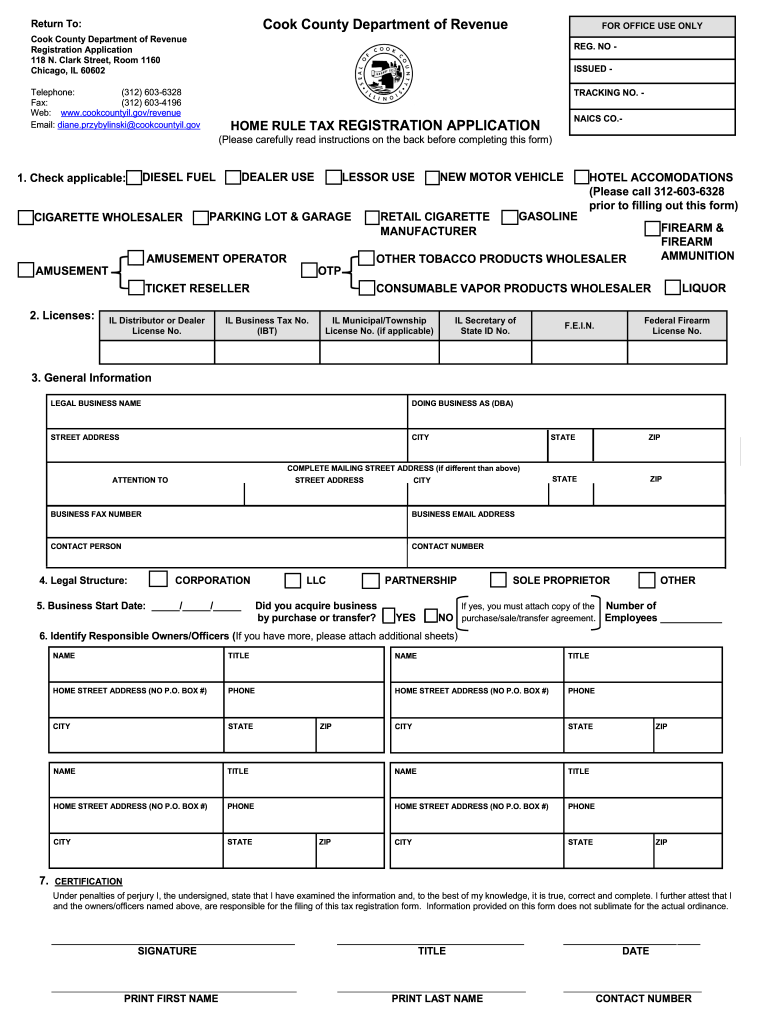

Il Tax Form

What is the Illinois Tax?

The Illinois tax refers to various taxes imposed by the state of Illinois, including income tax, property tax, and sales tax. Each of these taxes serves different purposes and applies to different types of income and transactions. The Illinois income tax is a flat rate applied to individuals and businesses, while property tax is assessed based on the value of real estate. Understanding the Illinois tax system is crucial for residents and businesses to ensure compliance and proper financial planning.

Steps to Complete the Illinois Tax Application

Completing the Illinois tax application involves several key steps:

- Gather necessary documents, including income statements, property assessments, and previous tax returns.

- Determine the appropriate form for your tax situation, such as the IL-1040 for individual income tax or the IL-PTAX for property tax.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review your application for any errors or omissions before submission.

- Submit the completed form by the specified deadline, either online, by mail, or in person.

Required Documents for the Illinois Tax Application

To successfully complete the Illinois tax application, certain documents are required:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any additional income sources, such as freelance work.

- Property tax assessment notices for homeowners.

- Previous tax returns for reference and consistency.

- Any relevant deductions or credits documentation, such as receipts for educational expenses or charitable contributions.

Form Submission Methods

Illinois tax applications can be submitted through several methods:

- Online submission via the Illinois Department of Revenue website, which allows for quick processing.

- Mailing the completed form to the appropriate address provided in the form instructions.

- In-person submission at designated state offices, which may provide assistance if needed.

Eligibility Criteria for the Illinois Tax Application

Eligibility for filing an Illinois tax application varies based on several factors:

- Residency status: Individuals must be residents of Illinois or have income sourced from Illinois.

- Income level: Certain income thresholds may determine the requirement to file.

- Type of income: Different rules apply for wages, self-employment income, and investment income.

- Age and filing status: Special considerations may be available for seniors or dependents.

Penalties for Non-Compliance

Failure to comply with Illinois tax regulations can result in various penalties:

- Late filing penalties, which can accrue if the tax return is not submitted by the deadline.

- Interest on unpaid taxes, which compounds over time until the balance is settled.

- Potential legal action for severe non-compliance, including liens or garnishments.

Quick guide on how to complete il tax

Complete Il Tax effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Handle Il Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Il Tax without hassle

- Find Il Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you’d like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Il Tax and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is home registration and how does it work with airSlate SignNow?

Home registration refers to the process of signing and managing documents related to property ownership from the comfort of your home. With airSlate SignNow, users can easily upload documents, add signatures, and manage the entire registration process electronically, streamlining the workflow and reducing the need for physical visits.

-

What are the pricing plans for airSlate SignNow focused on home registration?

airSlate SignNow offers flexible pricing plans to cater to different needs, including options specifically designed for home registration. Whether you're a single user or a larger organization, you can choose a plan that provides the right features at an affordable price, ensuring you get the best value for your home registration tasks.

-

What features does airSlate SignNow offer for home registration?

Our platform provides key features like document templates, eSignature capabilities, and secure storage, all aimed at simplifying the home registration process. Users can also track the status of documents in real-time, enhancing transparency and effectiveness in completing registrations.

-

How can airSlate SignNow improve the efficiency of home registration?

By allowing users to handle all documentation electronically, airSlate SignNow signNowly speeds up the home registration process. Automated notifications, easy document sharing, and integrated workflows save time and enhance productivity for both individuals and businesses dealing with home registrations.

-

Is airSlate SignNow compliant with regulations regarding home registration?

Yes, airSlate SignNow is fully compliant with eSignature laws and regulations, ensuring that your home registration documents are legally binding. The platform adheres to strict security protocols, giving users peace of mind while handling sensitive information in their home registration processes.

-

Can airSlate SignNow integrate with other tools used in home registration?

Absolutely! airSlate SignNow offers several integrations with popular software applications that enhance the home registration experience. Whether you need to connect with CRM systems, document management tools, or cloud storage solutions, you can streamline your workflows effectively.

-

What benefits does airSlate SignNow provide compared to traditional home registration methods?

Using airSlate SignNow for home registration eliminates the need for paper documents and in-person meetings, thereby reducing costs and improving accessibility. Its user-friendly interface and robust features make the entire process faster and more convenient for all parties involved.

Get more for Il Tax

- Form 941 prrev january employers quarterly federal tax return puerto rican version

- Cers accessid request form

- Word choice exercise 1 answer key form

- Initial application rea 3001 california office of real estate orea ca form

- Medical claim form php carolinas

- Speed ii questionnaire for dry eye diseaseocular surface disease form

- Physician order request form

- Ancillary data intake form providers amerihealth caritas north carolina ancillary data intake form

Find out other Il Tax

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template