SC1040TC TAX CREDITS SC Department of Revenue 2020

Understanding the SC1040TC Tax Credits

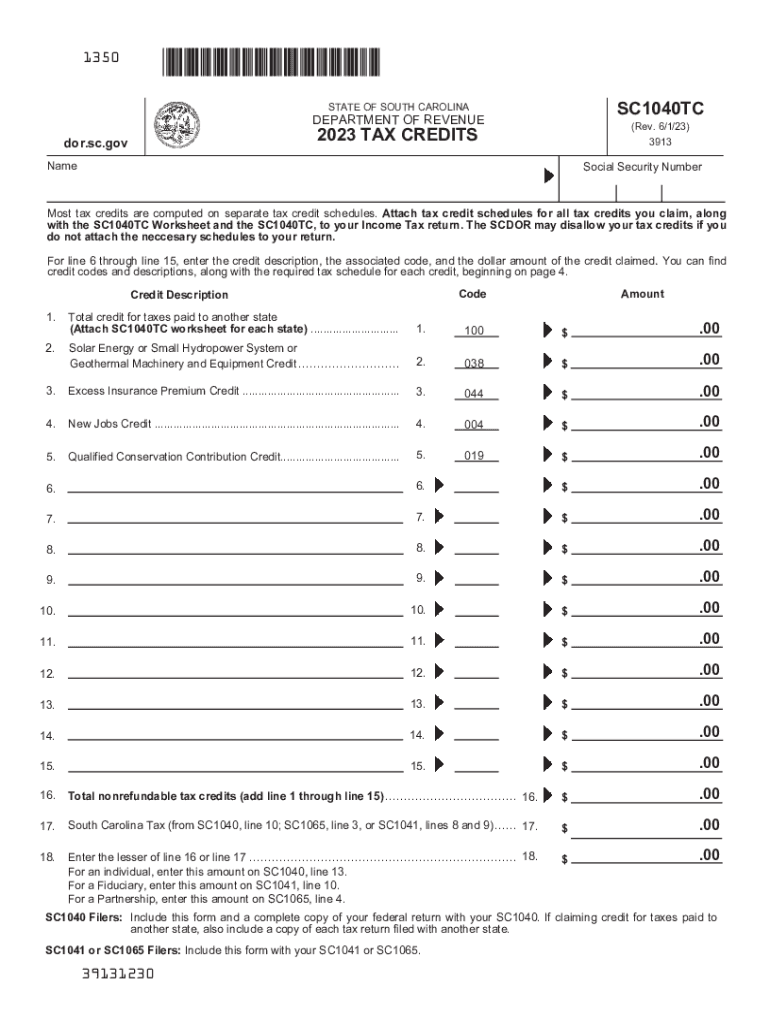

The SC1040TC form is utilized by South Carolina taxpayers to claim tax credits offered by the South Carolina Department of Revenue. These credits are designed to reduce the overall tax liability for eligible individuals and families. The form is particularly relevant for those who qualify for specific tax benefits, such as credits for education expenses, property taxes, and other state-specific deductions.

How to Complete the SC1040TC Form

Completing the SC1040TC form requires careful attention to detail. Taxpayers should gather all necessary documentation, including proof of eligibility for the credits they intend to claim. The form typically includes sections that require personal information, details about income, and specific credit claims. It is essential to follow the instructions provided with the form to ensure accurate completion and submission.

Eligibility Criteria for the SC1040TC Tax Credits

Eligibility for the SC1040TC tax credits varies based on several factors, including income level, filing status, and specific circumstances related to the taxpayer's situation. Generally, individuals or families must meet certain income thresholds and have qualifying expenses to be eligible for these credits. Reviewing the eligibility criteria outlined by the South Carolina Department of Revenue is crucial for determining qualification.

Required Documents for the SC1040TC Submission

When preparing to submit the SC1040TC form, taxpayers should compile all required documents. This may include W-2 forms, 1099 forms, receipts for qualifying expenses, and any other documentation that supports the claims made on the form. Having these documents ready can help streamline the filing process and reduce the likelihood of errors.

Filing Deadlines for the SC1040TC Form

Timely submission of the SC1040TC form is essential to avoid penalties and ensure that tax credits are received. The filing deadlines typically align with the federal tax deadlines, but it is important to verify specific dates with the South Carolina Department of Revenue. Taxpayers should mark their calendars and prepare their forms in advance to ensure compliance.

Form Submission Methods for the SC1040TC

Taxpayers have several options for submitting the SC1040TC form, including online submission, mailing a paper form, or delivering it in person to a local revenue office. Each method has its advantages, and taxpayers should choose the one that best fits their needs. Online submission is often the fastest and most efficient method, while paper submissions may require additional processing time.

Common Mistakes to Avoid When Filing the SC1040TC

When completing the SC1040TC form, it is important to be aware of common mistakes that can lead to delays or rejections. These may include incorrect personal information, failure to sign the form, or not including all necessary documentation. Double-checking the completed form and ensuring that all sections are filled out accurately can help prevent issues during the review process.

Quick guide on how to complete sc1040tc tax credits sc department of revenue

Accomplish SC1040TC TAX CREDITS SC Department Of Revenue effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to devise, amend, and eSign your documents swiftly without hindrances. Handle SC1040TC TAX CREDITS SC Department Of Revenue on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to alter and eSign SC1040TC TAX CREDITS SC Department Of Revenue with ease

- Locate SC1040TC TAX CREDITS SC Department Of Revenue and click Get Form to begin.

- Make use of the instruments we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details carefully and click on the Done button to confirm your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign SC1040TC TAX CREDITS SC Department Of Revenue and guarantee outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1040tc tax credits sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the sc1040tc tax credits sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Carolina instructions state form?

The South Carolina instructions state form is a document that guides users through the proper completion of various state forms required for legal and administrative purposes. By following these instructions, individuals can ensure they fill out the forms correctly, reducing the chances of errors and delays in processing.

-

How can airSlate SignNow help with the South Carolina instructions state form?

airSlate SignNow streamlines the process of completing and signing the South Carolina instructions state form by providing an easy-to-use digital platform. Users can fill out the forms, eSign them, and send them securely without the hassle of printing or mailing, making the entire procedure efficient and cost-effective.

-

Are there any costs associated with using airSlate SignNow for the South Carolina instructions state form?

airSlate SignNow offers various pricing plans, starting from a free trial to flexible subscription options, depending on your needs. Users can access features to complete the South Carolina instructions state form and other documents at a reasonable cost, ensuring businesses of all sizes can benefit from this effective solution.

-

What features does airSlate SignNow provide for the South Carolina instructions state form?

airSlate SignNow offers a range of features for the South Carolina instructions state form, including customizable templates, collaboration tools, and robust security measures. These features allow users to create, fill out, and manage their documents effortlessly while ensuring compliance with state regulations.

-

Can I integrate airSlate SignNow with other platforms for handling the South Carolina instructions state form?

Yes, airSlate SignNow integrates seamlessly with various platforms, such as Google Drive, Salesforce, and others. This connectivity allows users to pull in data and manage the South Carolina instructions state form more efficiently, enhancing overall workflow and productivity.

-

What are the benefits of using airSlate SignNow for legal documents in South Carolina?

Using airSlate SignNow for legal documents, including the South Carolina instructions state form, offers numerous benefits such as enhanced compliance, signNow time savings, and reduced operational costs. Additionally, the simplicity of the platform means that even those without technical expertise can manage their forms quickly and efficiently.

-

Is airSlate SignNow legally binding for the South Carolina instructions state form?

Yes, airSlate SignNow complies with electronic signature laws, making the signatures obtained through the platform legally binding for the South Carolina instructions state form. This compliance enhances the trust and validity of your documents, ensuring they stand up in legal situations.

Get more for SC1040TC TAX CREDITS SC Department Of Revenue

- Special or limited power of attorney for real estate purchase transaction by purchaser maryland form

- Limited power of attorney where you specify powers with sample powers included maryland form

- Limited power of attorney for stock transactions and corporate powers maryland form

- Special durable power of attorney for bank account matters maryland form

- Maryland small business startup package maryland form

- Maryland property management package maryland form

- Maryland annual form

- Maryland bylaws corporation form

Find out other SC1040TC TAX CREDITS SC Department Of Revenue

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement