24 IRS Form 2678 Employer Appointment of Agent 2023

Understanding IRS Form 2678: Employer Appointment of Agent

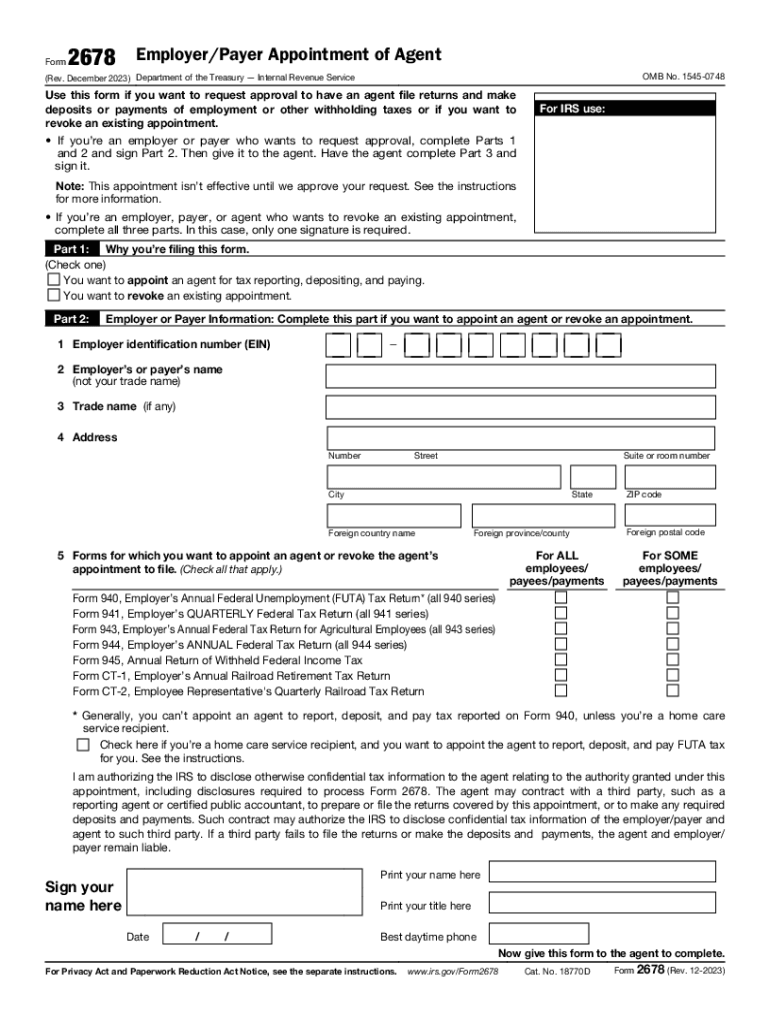

The IRS Form 2678, also known as the Employer Appointment of Agent, is a crucial document used by employers to designate an agent to act on their behalf for specific tax-related responsibilities. This form is particularly relevant for employers who wish to delegate their authority regarding employment tax matters to a third party. By completing this form, employers can streamline their tax processes and ensure compliance with IRS regulations.

Steps to Complete IRS Form 2678

Filling out the IRS Form 2678 involves several important steps:

- Gather Necessary Information: Collect the employer's name, address, and Employer Identification Number (EIN), along with the agent's details.

- Complete the Form: Fill in the required fields accurately, including the specific tax responsibilities being delegated.

- Sign and Date: Ensure that the form is signed by an authorized representative of the employer and dated appropriately.

- Submit the Form: Choose the appropriate submission method, whether online, by mail, or in person.

Obtaining IRS Form 2678

The IRS Form 2678 can be easily obtained from the official IRS website. It is available in a fillable PDF format, allowing employers to complete the form digitally. Additionally, physical copies can be requested through IRS offices or by contacting the IRS directly. Ensuring that you have the most current version of the form is essential for compliance.

Legal Use of IRS Form 2678

The legal framework surrounding the IRS Form 2678 allows employers to appoint an agent for various tax responsibilities, including the filing of payroll taxes and other related obligations. This delegation is legally binding, meaning that the appointed agent is authorized to act on behalf of the employer in matters specified on the form. It is important for employers to understand the implications of this appointment, including the responsibilities and liabilities that may arise.

Key Elements of IRS Form 2678

When completing the IRS Form 2678, several key elements must be included:

- Employer Information: Name, address, and EIN of the employer.

- Agent Information: Name, address, and contact details of the appointed agent.

- Scope of Authority: Clearly define the specific tax responsibilities being delegated to the agent.

- Signatures: Required signatures from both the employer and the agent to validate the appointment.

Filing Deadlines for IRS Form 2678

It is important to be aware of the filing deadlines associated with the IRS Form 2678. Typically, the form should be submitted before the agent begins performing any tax-related duties on behalf of the employer. Timely submission ensures that the appointment is recognized by the IRS and that the agent can act without delay. Employers should keep track of any updates or changes to deadlines as outlined by the IRS.

Quick guide on how to complete 24 irs form 2678 employer appointment of agent

Create 24 IRS Form 2678 Employer Appointment of Agent effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can acquire the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to compose, modify, and electronically sign your documents quickly and efficiently. Manage 24 IRS Form 2678 Employer Appointment of Agent on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to alter and electronically sign 24 IRS Form 2678 Employer Appointment of Agent with ease

- Find 24 IRS Form 2678 Employer Appointment of Agent and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to finalize your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Adjust and electronically sign 24 IRS Form 2678 Employer Appointment of Agent and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 24 irs form 2678 employer appointment of agent

Create this form in 5 minutes!

How to create an eSignature for the 24 irs form 2678 employer appointment of agent

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow provide that are relevant to the '2678' workflow?

airSlate SignNow includes a variety of features tailored for the '2678' workflow, such as customizable templates, document tracking, and automated reminders. These tools streamline the eSigning process, ensuring efficiency and organization in document management. The platform is designed to enhance your business operations, making it ideal for teams handling similar workflows.

-

How does pricing work for airSlate SignNow concerning the '2678' solution?

airSlate SignNow offers competitive pricing plans tailored to various business needs, including those specific to the '2678' solution. Subscription options range from monthly to annual plans, making it affordable for teams of any size. By comparing plan features, your business can select the best value that aligns with your execution of the '2678' workflow.

-

What benefits can businesses expect from using airSlate SignNow for the '2678' process?

By utilizing airSlate SignNow for the '2678' process, businesses can expect increased efficiency, faster turnaround times, and signNow cost savings. The intuitive interface allows users to seamlessly send, sign, and manage documents digitally. Furthermore, this solution enhances collaboration and keeps your team focused on what truly matters.

-

Does airSlate SignNow integrate with other tools for the '2678' process?

Yes, airSlate SignNow integrates with various platforms to enhance the '2678' process seamlessly. Popular CRM, cloud storage, and project management tools can be connected to facilitate data flow and document management. This integration capability ensures that workflows remain uninterrupted, ultimately boosting productivity.

-

Is the airSlate SignNow platform secure for managing '2678' documents?

Absolutely, airSlate SignNow implements advanced security measures to protect your '2678' documents. These include data encryption, two-factor authentication, and compliance with industry standards. Your sensitive information remains safe, giving you peace of mind as you manage your documents electronically.

-

How user-friendly is the airSlate SignNow interface for those handling '2678' transactions?

The airSlate SignNow interface is designed with user-friendliness in mind, particularly for '2678' transactions. Users can easily navigate through document creation, sending, and signing processes without extensive training. This accessibility helps ensure that all team members can participate effectively in the '2678' workflow.

-

What support options are available for airSlate SignNow users dealing with the '2678' process?

airSlate SignNow provides various support options for users, especially for those managing the '2678' process. Options include comprehensive online resources, responsive customer service teams, and live chat support. This ensures that any questions or issues can be promptly addressed, allowing users to stay focused on their primary tasks.

Get more for 24 IRS Form 2678 Employer Appointment of Agent

- Maryland essential form

- Postnuptial agreements package maryland form

- Letters of recommendation package maryland form

- Maryland construction or mechanics lien package individual maryland form

- Md corporation 497310576 form

- Storage business package maryland form

- Child care services package maryland form

- Special or limited power of attorney for real estate sales transaction by seller maryland form

Find out other 24 IRS Form 2678 Employer Appointment of Agent

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now