Form CT 184 R , Foreign Bus and Taxicab Corporation Tax Tax Ny

What is the Form CT 184 R, Foreign Bus and Taxicab Corporation Tax Tax NY

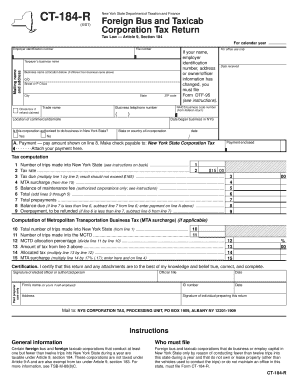

The Form CT 184 R is a tax form specifically designed for foreign corporations operating as bus or taxicab services in New York State. This form is essential for reporting and paying the appropriate taxes that are levied on these foreign entities. It helps ensure compliance with state tax regulations and provides a structured way for foreign businesses to fulfill their tax obligations in New York.

How to use the Form CT 184 R, Foreign Bus and Taxicab Corporation Tax Tax NY

Using the Form CT 184 R involves several steps to ensure accurate completion and submission. First, gather all necessary financial information related to your business operations in New York. This includes revenue generated, expenses incurred, and any other relevant financial data. Once you have this information, fill out the form meticulously, ensuring that all sections are completed as required. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Form CT 184 R, Foreign Bus and Taxicab Corporation Tax Tax NY

Completing the Form CT 184 R requires careful attention to detail. Follow these steps:

- Begin by entering your business's name, address, and contact information at the top of the form.

- Provide details regarding your business activities in New York, including the types of services offered.

- Report your gross income from operations in New York, ensuring accuracy in your calculations.

- List any allowable deductions and calculate your taxable income.

- Determine the tax owed based on the applicable tax rates for foreign corporations.

- Sign and date the form, certifying that the information provided is true and complete.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form CT 184 R. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of your tax year. For businesses operating on a calendar year, this means the deadline is April 15. Missing this deadline can result in penalties and interest on any taxes owed, so timely submission is essential.

Required Documents

When preparing to file the Form CT 184 R, certain documents are necessary to support your submission. These may include:

- Financial statements detailing income and expenses related to your New York operations.

- Proof of any taxes previously paid or credits claimed.

- Documentation of any deductions you plan to claim.

- Records of business activities conducted in New York.

Penalties for Non-Compliance

Failure to file the Form CT 184 R or to pay the associated taxes can lead to significant penalties. These may include fines based on the amount of tax owed and interest on late payments. Additionally, non-compliance can result in legal repercussions and difficulties in maintaining your business operations within New York. It is advisable to stay informed about your tax obligations and to file on time to avoid these issues.

Quick guide on how to complete form ct 184 r foreign bus and taxicab corporation tax tax ny

Effortlessly Prepare [SKS] on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed papers, enabling you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage [SKS] effortlessly on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS], ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form CT 184 R , Foreign Bus And Taxicab Corporation Tax Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 184 r foreign bus and taxicab corporation tax tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 184 R, Foreign Bus And Taxicab Corporation Tax, Tax NY?

Form CT 184 R is a tax form specifically designed for foreign bus and taxicab corporations operating in New York. This form is required to ensure compliance with New York State tax regulations. By submitting this form, businesses can report their earnings and fulfill their tax obligations effectively.

-

How can airSlate SignNow help with filing Form CT 184 R, Foreign Bus And Taxicab Corporation Tax, Tax NY?

airSlate SignNow simplifies the process of gathering the necessary signatures and documentation needed for Form CT 184 R, Foreign Bus And Taxicab Corporation Tax, Tax NY. With our eSigning capabilities, you can easily manage and send your tax documents for quick completion. This streamlines your workflow and helps ensure timely submissions.

-

What features does airSlate SignNow offer for managing tax documents like Form CT 184 R?

airSlate SignNow offers features such as customizable templates, document collaboration tools, and secure storage for your tax documents like Form CT 184 R, Foreign Bus And Taxicab Corporation Tax, Tax NY. Additionally, our platform provides real-time updates and tracking for every document, ensuring you stay informed throughout the process.

-

Is airSlate SignNow cost-effective for small businesses dealing with Form CT 184 R?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses handling documents like Form CT 184 R, Foreign Bus And Taxicab Corporation Tax, Tax NY. Our competitive pricing structure and scalable plans ensure that even small businesses can manage their tax documentation without breaking the bank.

-

Can airSlate SignNow integrate with other software for filing Form CT 184 R?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to manage your Form CT 184 R, Foreign Bus And Taxicab Corporation Tax, Tax NY. These integrations help automate your workflow, reduce manual entry, and ensure accuracy in your filings.

-

What are the key benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like Form CT 184 R, Foreign Bus And Taxicab Corporation Tax, Tax NY provides several benefits. It improves efficiency, enhances collaboration, and reduces the time spent on document management. Our platform is user-friendly and designed to meet the needs of businesses looking to streamline their tax filing processes.

-

How secure is airSlate SignNow when handling sensitive documents such as Form CT 184 R?

Security is a top priority at airSlate SignNow. When managing sensitive documents like Form CT 184 R, Foreign Bus And Taxicab Corporation Tax, Tax NY, we employ advanced encryption methods and stringent security protocols to protect your information. You can rest assured that your data is safe with us.

Get more for Form CT 184 R , Foreign Bus And Taxicab Corporation Tax Tax Ny

Find out other Form CT 184 R , Foreign Bus And Taxicab Corporation Tax Tax Ny

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement