CT 186 P Employer Identification Number Taxpayer's Business Name New York State Department of Taxation and Finance Utility Form

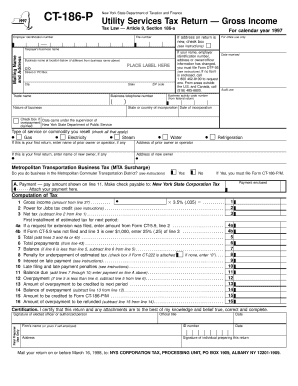

Understanding the CT 186 P Form

The CT 186 P is a tax form used by businesses in New York State to report utility services tax. This form requires the Employer Identification Number (EIN) and the taxpayer's business name, ensuring proper identification of the entity filing the return. It is essential for compliance with the Gross Income Tax Law, specifically Article 9, Section 186-a, which outlines the taxation of utility services. Businesses must accurately complete this form to avoid penalties and ensure proper processing by the New York State Department of Taxation and Finance.

Steps to Complete the CT 186 P Form

Completing the CT 186 P form involves several important steps:

- Gather necessary information, including your Employer Identification Number and business name.

- Determine the applicable filing period for the utility services tax.

- Calculate the gross income derived from utility services for the reporting period.

- Fill out the form accurately, ensuring all sections are completed, including the file number and address.

- Review the completed form for any errors before submission.

Legal Use of the CT 186 P Form

The CT 186 P form is legally required for businesses that provide utility services in New York. Filing this form accurately and on time ensures compliance with state tax laws. Failure to file or inaccuracies in the form can result in penalties, including fines and interest on unpaid taxes. It is crucial for businesses to understand their obligations under the Gross Income Tax Law to maintain good standing with the New York State Department of Taxation and Finance.

Required Documents for Filing the CT 186 P Form

When preparing to file the CT 186 P form, businesses should have the following documents ready:

- Employer Identification Number (EIN)

- Business name and address

- Financial records showing gross income from utility services

- Previous tax returns, if applicable

Filing Deadlines for the CT 186 P Form

It is important for businesses to be aware of the filing deadlines associated with the CT 186 P form. Typically, the form must be submitted annually by a specified date, which can vary based on the business's fiscal year. Businesses should check the New York State Department of Taxation and Finance website or consult with a tax professional to confirm the exact deadlines to avoid late fees and penalties.

Examples of Using the CT 186 P Form

Businesses may encounter various scenarios when using the CT 186 P form. For instance, a utility company providing electricity must report its gross income from sales to customers. Similarly, a telecommunications provider would need to detail its income from service subscriptions. Each business type may have unique considerations, but all must adhere to the same filing requirements under the Gross Income Tax Law.

Quick guide on how to complete ct 186 p employer identification number taxpayers business name new york state department of taxation and finance utility

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 186 p employer identification number taxpayers business name new york state department of taxation and finance utility

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 186 P Employer Identification Number?

The CT 186 P Employer Identification Number is a unique identifier assigned by the New York State Department of Taxation and Finance, specifically for Utility Services Tax Return purposes. It is crucial for businesses operating in New York to file their Gross Income Tax Law obligations accurately. This number should be included when submitting the gross income tax return for your business.

-

How can I file my Utility Services Tax Return using SignNow?

You can easily file your Utility Services Tax Return using airSlate SignNow by creating and electronically signing your documents online. The platform simplifies the process of submitting documents to the New York State Department of Taxation and Finance, streamlining compliance with Gross Income Tax Law. Just ensure that your CT 186 P Employer Identification Number Taxpayer's Business Name is clearly listed on the form.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing tiers to accommodate businesses of all sizes. Each plan provides features that help you manage your documents, including the necessary forms for the CT 186 P Employer Identification Number Taxpayer's Business Name. Check our pricing page for details on different plans and what each one includes.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides a wide array of features, including document creation, digital signatures, and the ability to store and share forms like the Utility Services Tax Return. These features ensure your CT 186 P Employer Identification Number Taxpayer's Business Name is always accurately represented in your filings. Additionally, real-time tracking helps you monitor the status of your documents.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with numerous third-party applications. This flexibility allows for efficient workflows, particularly for businesses that require the CT 186 P Employer Identification Number Taxpayer's Business Name to be included in various systems. Integrating with your existing software simplifies the document management process.

-

What benefits does eSigning bring to my business?

eSigning with airSlate SignNow provides numerous benefits, such as increased efficiency and reduced paper waste. By ensuring that your CT 186 P Employer Identification Number Taxpayer's Business Name documents are signed electronically, you can expedite the filing process with the New York State Department of Taxation and Finance. This helps compliance with Gross Income Tax Law in a timely manner.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security using advanced encryption protocols and secure storage. Your CT 186 P Employer Identification Number Taxpayer's Business Name data is protected to ensure compliance with confidentiality regulations. This robust security helps safeguard sensitive business information during the filing process for your Utility Services Tax Return.

Get more for CT 186 P Employer Identification Number Taxpayer's Business Name New York State Department Of Taxation And Finance Utility

Find out other CT 186 P Employer Identification Number Taxpayer's Business Name New York State Department Of Taxation And Finance Utility

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF