Form CT 3 S AC , Report by an S Corporation Included in a Tax Ny

Understanding the Form CT 3 S AC

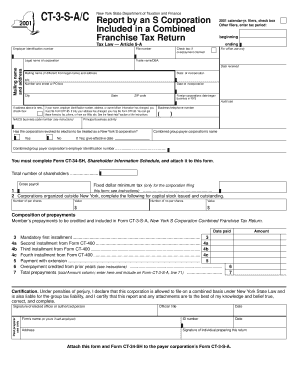

The Form CT 3 S AC, also known as the Report By An S Corporation Included In A Tax NY, is a tax form that S corporations in New York use to report their income, deductions, and credits. This form is essential for S corporations as it provides the New York State Department of Taxation and Finance with necessary financial information to assess the corporation's tax obligations. The form is designed to capture various financial details, including total income, expenses, and any applicable tax credits, ensuring compliance with state tax laws.

How to Complete the Form CT 3 S AC

Completing the Form CT 3 S AC involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, accurately fill out each section of the form, ensuring that all figures are correct and supported by your documentation. Pay special attention to the income and deduction sections, as these will significantly impact your tax liability. After completing the form, review it for accuracy before submission to avoid potential penalties.

Obtaining the Form CT 3 S AC

The Form CT 3 S AC can be obtained from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing for easy access and printing. Additionally, individuals can request a physical copy by contacting the department directly. Ensure you have the most current version of the form to comply with any recent tax law changes.

Key Elements of the Form CT 3 S AC

Several key elements must be included when filling out the Form CT 3 S AC. These include the corporation's name, Employer Identification Number (EIN), and the tax year for which the report is being filed. Additionally, the form requires detailed information regarding total income, deductions, and credits claimed. Accurate reporting of these elements is crucial, as they determine the corporation's tax liability and compliance status.

Filing Deadlines for the Form CT 3 S AC

Filing deadlines for the Form CT 3 S AC are typically aligned with the federal tax deadlines for S corporations. Generally, the form must be filed by the fifteenth day of the third month following the end of the tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is essential to adhere to these deadlines to avoid late filing penalties and interest on any taxes owed.

Submission Methods for the Form CT 3 S AC

The Form CT 3 S AC can be submitted through various methods. Corporations have the option to file electronically via the New York State Department of Taxation and Finance's online portal, which is often the quickest and most efficient method. Alternatively, the form can be mailed to the appropriate address provided on the form instructions. In-person submissions may also be possible at designated tax offices, though electronic filing is recommended for its convenience and speed.

Quick guide on how to complete form ct 3 s ac report by an s corporation included in a tax ny

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally-friendly substitute for conventional printed and signed papers, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without holdups. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

Effortlessly Edit and eSign [SKS]

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or missing files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form CT 3 S AC , Report By An S Corporation Included In A Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 s ac report by an s corporation included in a tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny?

Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny is a tax reporting form used by S Corporations in New York to report their income, deductions, and other necessary information to the state. This form helps ensure compliance with New York tax laws and allows businesses to accurately report their financial status.

-

How can airSlate SignNow help with completing Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny?

airSlate SignNow offers an easy-to-use platform that enables users to fill out and eSign Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny electronically. By providing customizable templates and an intuitive interface, airSlate SignNow streamlines the process, ensuring accuracy and saving time.

-

Are there any pricing options for using airSlate SignNow for Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. These plans provide access to essential features for managing documents and eSigning, making it cost-effective for those needing to complete Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny.

-

What features does airSlate SignNow offer that are beneficial for filing Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny?

airSlate SignNow provides features such as customizable document templates, secure electronic signatures, and compliance tracking, which are essential for accurately filing Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny. These functionalities help eliminate errors and enhance the efficiency of the filing process.

-

Can airSlate SignNow integrate with other software for managing Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and business management software, allowing for easy data transfer and enhanced workflow for managing Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny. This integration simplifies record-keeping and document management.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny?

Using airSlate SignNow for tax-related documents like Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny ensures streamlined processes, reduced turnaround times, and improved document security. Additionally, users can track document status in real-time, enhancing transparency and efficiency.

-

Is airSlate SignNow compliant with legal regulations for signing Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny?

Yes, airSlate SignNow is fully compliant with all relevant eSignature laws and regulations, which applies to Form CT 3 S AC, Report By An S Corporation Included In A Tax Ny. This compliance ensures that signatures are legally binding and meet the requirements set forth by regulatory authorities.

Get more for Form CT 3 S AC , Report By An S Corporation Included In A Tax Ny

Find out other Form CT 3 S AC , Report By An S Corporation Included In A Tax Ny

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile