Form 58 Partnership Return of Income Nd

What is the Form 58 Partnership Return Of Income Nd

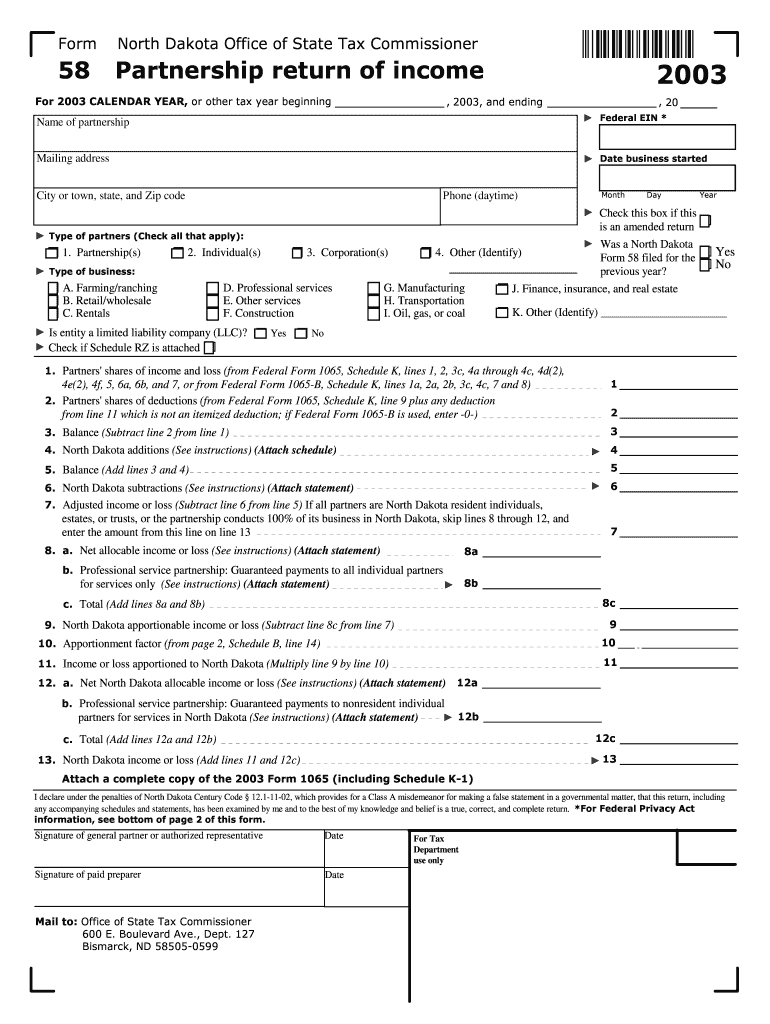

The Form 58 Partnership Return Of Income Nd is a tax document used by partnerships to report their annual income, deductions, and credits to the state of North Dakota. This form is essential for partnerships operating within the state, as it provides the necessary information for the state to assess the partnership's tax obligations. It is important for partnerships to accurately complete this form to ensure compliance with state tax laws and to avoid potential penalties.

How to use the Form 58 Partnership Return Of Income Nd

Using the Form 58 involves several steps to ensure that all required information is accurately reported. Partnerships must gather financial records, including income statements and expense reports, before filling out the form. Each section of the form corresponds to specific financial data, such as gross income, allowable deductions, and credits. It is crucial to follow the instructions provided with the form to ensure that all necessary information is included and correctly formatted.

Steps to complete the Form 58 Partnership Return Of Income Nd

Completing the Form 58 requires a systematic approach to ensure accuracy. The following steps can help guide partnerships through the process:

- Gather all financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the partnership's identifying information, including the partnership name, address, and federal identification number.

- Report total income earned during the tax year, including sales, services, and any other income sources.

- Detail allowable deductions, such as operating expenses, salaries, and benefits paid to partners.

- Calculate the partnership's taxable income by subtracting total deductions from total income.

- Complete any additional sections required for specific credits or adjustments.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Partnerships must adhere to specific deadlines when filing the Form 58. Generally, the form is due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is typically due by April 15. It is important to keep track of these dates to avoid late filing penalties and interest charges.

Legal use of the Form 58 Partnership Return Of Income Nd

The legal use of the Form 58 is vital for partnerships to comply with North Dakota tax regulations. By accurately completing and submitting the form, partnerships fulfill their legal obligation to report income and pay taxes. Failure to file the form or filing inaccurate information can result in penalties, including fines and interest on unpaid taxes. Partnerships should maintain thorough records to support the information reported on the form, as these may be subject to review by state tax authorities.

Required Documents

To successfully complete the Form 58, partnerships need to gather several key documents, including:

- Income statements detailing all sources of revenue.

- Expense reports that outline all business-related costs.

- Previous tax returns for reference and consistency.

- Any supporting documentation for deductions claimed, such as receipts and invoices.

Quick guide on how to complete form 58 partnership return of income nd

Complete [SKS] seamlessly on any device

Digital document management has gained increased popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents rapidly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact confidential information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to distribute your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 58 Partnership Return Of Income Nd

Create this form in 5 minutes!

How to create an eSignature for the form 58 partnership return of income nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 58 Partnership Return Of Income Nd?

Form 58 Partnership Return Of Income Nd is a tax form used by partnerships in North Dakota to report income, deductions, and credits. This form must be filed annually and is essential for compliance with state tax regulations. Understanding how to properly complete this form can signNowly impact your partnership’s tax obligations.

-

How can airSlate SignNow help with Form 58 Partnership Return Of Income Nd?

airSlate SignNow simplifies the process of preparing and submitting the Form 58 Partnership Return Of Income Nd by providing electronic signature capabilities and document management tools. Users can easily collaborate on documents, ensuring all stakeholders can provide necessary approvals without delays. The platform enhances efficiency and minimizes the likelihood of errors.

-

What are the pricing options for using airSlate SignNow for Form 58 Partnership Return Of Income Nd?

airSlate SignNow offers several pricing tiers to accommodate businesses of all sizes. Features that support the completion and filing of Form 58 Partnership Return Of Income Nd are available at competitive prices, ensuring you get value for your investment. Additionally, there are no hidden fees, making budgeting straightforward.

-

What features are included with airSlate SignNow for managing Form 58 Partnership Return Of Income Nd?

AirSlate SignNow includes features such as document templates, secure eSignature, and real-time collaboration that are all beneficial for handling Form 58 Partnership Return Of Income Nd. You can also track the status of your documents and send reminders for signatures, ensuring timely filing. These tools help streamline your tax preparation process.

-

Can I integrate airSlate SignNow with other software for Form 58 Partnership Return Of Income Nd?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software necessary for completing Form 58 Partnership Return Of Income Nd. This helps ensure that all your financial data is synchronized and up-to-date. Integrating with existing systems can reduce the time spent on manual data entry and enhance accuracy.

-

What are the benefits of using airSlate SignNow for Form 58 Partnership Return Of Income Nd?

Using airSlate SignNow for your Form 58 Partnership Return Of Income Nd offers numerous benefits, including improved organization, efficient document routing, and enhanced security. The platform allows for quick edits and updates, making it easier to adhere to tax deadlines. Additionally, the electronic signature feature speeds up the approval process signNowly.

-

Is airSlate SignNow user-friendly for completing Form 58 Partnership Return Of Income Nd?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate its features related to Form 58 Partnership Return Of Income Nd. The interface is intuitive, which helps reduce the learning curve and allows users to swiftly focus on completing their tax forms without unnecessary complications.

Get more for Form 58 Partnership Return Of Income Nd

- Form no 15h see rule 29c 1a

- Sample deed joint tenancy with right of survivorship florida form

- Kukkiwon application form eng ontario taekwondo association

- Drms form apr

- Iowa dhs training form

- Tesda cookery nc ii reviewer pdf form

- Zppf part final withdrawal application form

- Insulation certificate 101095645 form

Find out other Form 58 Partnership Return Of Income Nd

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online