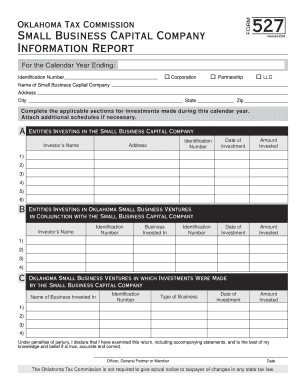

Information Report Oklahoma Tax Commission Tax Ok

What is the Information Report Oklahoma Tax Commission Tax Ok

The Information Report from the Oklahoma Tax Commission is a crucial document used for reporting specific financial and tax-related information to the state. It serves multiple purposes, including tracking income, ensuring compliance with state tax laws, and providing necessary data for tax assessments. This report may be required for various entities, including businesses and individuals, depending on their tax obligations.

How to use the Information Report Oklahoma Tax Commission Tax Ok

To effectively use the Information Report, individuals and businesses should first determine their specific reporting requirements based on their tax situation. This involves understanding the types of income or transactions that need to be reported. Once the relevant information is gathered, the report can be completed accurately, ensuring all required fields are filled. This document can then be submitted to the Oklahoma Tax Commission as part of the tax filing process.

Steps to complete the Information Report Oklahoma Tax Commission Tax Ok

Completing the Information Report involves several steps:

- Gather necessary financial documents, including income statements and prior tax returns.

- Review the specific instructions provided by the Oklahoma Tax Commission for the report.

- Fill out the report accurately, ensuring all required information is included.

- Double-check for any errors or omissions before submission.

- Submit the completed report by the designated deadline to avoid penalties.

Required Documents

When preparing the Information Report, certain documents may be required to support the information reported. These documents often include:

- Income statements from employers or clients.

- Bank statements that reflect income deposits.

- Previous tax returns for reference.

- Any additional documentation that substantiates deductions or credits claimed.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Information Report is essential to ensure compliance. Typically, the report must be submitted by a specific date each year, often aligning with the overall tax filing deadline. It is advisable to check the Oklahoma Tax Commission's official calendar for the most current deadlines to avoid late fees or penalties.

Penalties for Non-Compliance

Failure to submit the Information Report on time or providing inaccurate information can result in penalties. These penalties may include fines, interest on unpaid taxes, and potential legal repercussions. It is crucial to adhere to the submission guidelines and ensure the accuracy of the information provided to avoid these consequences.

Quick guide on how to complete information report oklahoma tax commission tax ok

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, as you can easily access the correct template and safely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your edits.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Information Report Oklahoma Tax Commission Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the information report oklahoma tax commission tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Information Report from the Oklahoma Tax Commission?

The Information Report from the Oklahoma Tax Commission provides detailed insights into tax-related matters for residents and businesses in Oklahoma. It includes data essential for compliance with state tax laws and effectively managing your tax obligations. Understanding this report can help streamline your tax processes and ensure accuracy.

-

How can airSlate SignNow assist with Information Reports for the Oklahoma Tax Commission?

airSlate SignNow allows you to electronically sign and send documents related to Information Reports for the Oklahoma Tax Commission. This user-friendly platform makes it easy to manage tax documents efficiently, ensuring that your submissions are timely and compliant with state regulations. Leverage airSlate SignNow to enhance your tax reporting process.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs, starting from a free trial to affordable monthly subscriptions. Each plan provides access to features that simplify document signing, including those related to the Information Report for the Oklahoma Tax Commission. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide to streamline tax document management?

airSlate SignNow offers several features such as custom templates, real-time document tracking, and secure electronic signatures. These tools are particularly beneficial when handling Information Reports for the Oklahoma Tax Commission, as they enhance collaboration and efficiency. Automating your tax document processes can save you signNow time and effort.

-

Is airSlate SignNow compliant with Oklahoma Tax Commission regulations?

Yes, airSlate SignNow is compliant with state and federal regulations, ensuring that all documents, including Information Reports for the Oklahoma Tax Commission, are signed securely and legally. This compliance helps protect your business from potential tax issues and provides peace of mind when managing sensitive tax information.

-

Can airSlate SignNow integrate with other tools to manage tax reports?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage Information Reports for the Oklahoma Tax Commission. Whether you're using accounting software or document management systems, these integrations facilitate efficient workflows and improve overall productivity.

-

What benefits does eSigning provide for Oklahoma tax documents?

eSigning with airSlate SignNow signNowly speeds up the process of submitting Information Reports for the Oklahoma Tax Commission by eliminating the need for printing and mailing physical documents. It ensures that all parties can access and sign documents from anywhere, which reduces delays and enhances compliance with submission deadlines.

Get more for Information Report Oklahoma Tax Commission Tax Ok

- Swiss bank account opening form

- Peoples health medical necessity form 46315167

- Nana regional corporation dividend form

- Clear grammar 1 pdf download form

- Agriinvest program appeal submission form

- Annual confidential report form for teachers

- Weightlifting score sheet form

- Small claims court rochester ny form

Find out other Information Report Oklahoma Tax Commission Tax Ok

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself