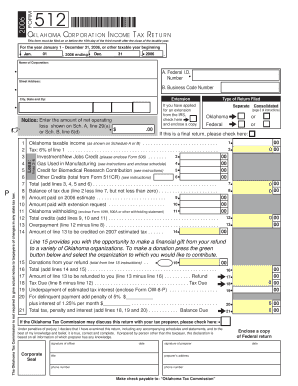

Oklahoma Corporation Income Tax Return Tax Ok Form

What is the Oklahoma Corporation Income Tax Return?

The Oklahoma Corporation Income Tax Return, commonly referred to as Tax Ok, is a form that corporations operating in Oklahoma must file annually to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax laws and regulations. Corporations must provide detailed financial information, including revenue, expenses, and deductions, to accurately determine their taxable income.

Steps to Complete the Oklahoma Corporation Income Tax Return

Completing the Oklahoma Corporation Income Tax Return involves several key steps:

- Gather financial records, including income statements, balance sheets, and any relevant documentation.

- Fill out the form with accurate information regarding your corporation’s income, deductions, and credits.

- Review the completed return for any errors or omissions.

- Submit the form by the specified deadline, ensuring all required signatures are included.

Required Documents

To successfully file the Oklahoma Corporation Income Tax Return, corporations need to prepare the following documents:

- Federal tax return (Form 1120 or 1120-S)

- Financial statements for the tax year

- Records of any tax credits claimed

- Documentation for any deductions taken

Filing Deadlines / Important Dates

The filing deadline for the Oklahoma Corporation Income Tax Return typically aligns with the federal tax return due date. Corporations must file by the fifteenth day of the fourth month following the end of their fiscal year. For most corporations with a calendar year end, this means the return is due on April 15. It is crucial to stay informed about any changes to these dates, as they can vary.

Form Submission Methods

Corporations have several options for submitting the Oklahoma Corporation Income Tax Return:

- Online Submission: Many corporations opt to file electronically through authorized e-filing services.

- Mail: Corporations can also print the completed form and send it via postal mail to the appropriate state tax office.

- In-Person: Some businesses may choose to deliver their forms in person at local tax offices.

Penalties for Non-Compliance

Failure to file the Oklahoma Corporation Income Tax Return on time can result in significant penalties. These may include:

- Late filing penalties based on the amount of tax owed.

- Interest on unpaid taxes, accruing from the due date until payment is made.

- Potential legal consequences for persistent non-compliance, including audits and additional fines.

Quick guide on how to complete oklahoma corporation income tax return tax ok

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents rapidly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The Most Efficient Way to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Access Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Complete button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Oklahoma Corporation Income Tax Return Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the oklahoma corporation income tax return tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Corporation Income Tax Return Tax Ok process?

The Oklahoma Corporation Income Tax Return Tax Ok process involves preparing and submitting tax documents required by the state. Using airSlate SignNow, businesses can streamline this process by electronically signing and securely sending their tax returns, ensuring compliance with state regulations.

-

How can airSlate SignNow help me with my Oklahoma Corporation Income Tax Return Tax Ok?

airSlate SignNow simplifies your Oklahoma Corporation Income Tax Return Tax Ok by providing a user-friendly platform for document management. You can easily track the status of your signatures, store documents securely, and ensure that all necessary fields are completed correctly before submission.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans designed to fit various business sizes and needs when handling Oklahoma Corporation Income Tax Return Tax Ok documentation. Each plan includes features for electronic signing, document templates, and integrations with other software to enhance your workflow.

-

Is airSlate SignNow secure for filing Oklahoma Corporation Income Tax Return Tax Ok?

Yes, airSlate SignNow employs industry-standard security measures to keep your documents safe when filing your Oklahoma Corporation Income Tax Return Tax Ok. Features such as encryption, two-factor authentication, and secure cloud storage ensure that your sensitive data is well-protected.

-

Can I integrate airSlate SignNow with my accounting software for the Oklahoma Corporation Income Tax Return Tax Ok?

Absolutely! airSlate SignNow supports integrations with various accounting software, making it easier to manage your Oklahoma Corporation Income Tax Return Tax Ok. You can sync data seamlessly to ensure accuracy and streamline the preparation of your tax returns.

-

What benefits can I expect from using airSlate SignNow for my tax returns?

By using airSlate SignNow for your Oklahoma Corporation Income Tax Return Tax Ok, you can expect improved efficiency, reduced paperwork, and faster turnaround times. The platform allows for easy collaboration among team members and clients, enhancing communication and ensuring deadlines are met effortlessly.

-

How long does it take to set up airSlate SignNow for filing my Oklahoma Corporation Income Tax Return Tax Ok?

Setting up airSlate SignNow for your Oklahoma Corporation Income Tax Return Tax Ok is quick and easy, typically taking just minutes. With a user-friendly interface and step-by-step guidance, you can be ready to start eSigning and managing documents almost immediately.

Get more for Oklahoma Corporation Income Tax Return Tax Ok

Find out other Oklahoma Corporation Income Tax Return Tax Ok

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter