Form 8332 2018-2026

What is the Form 8332

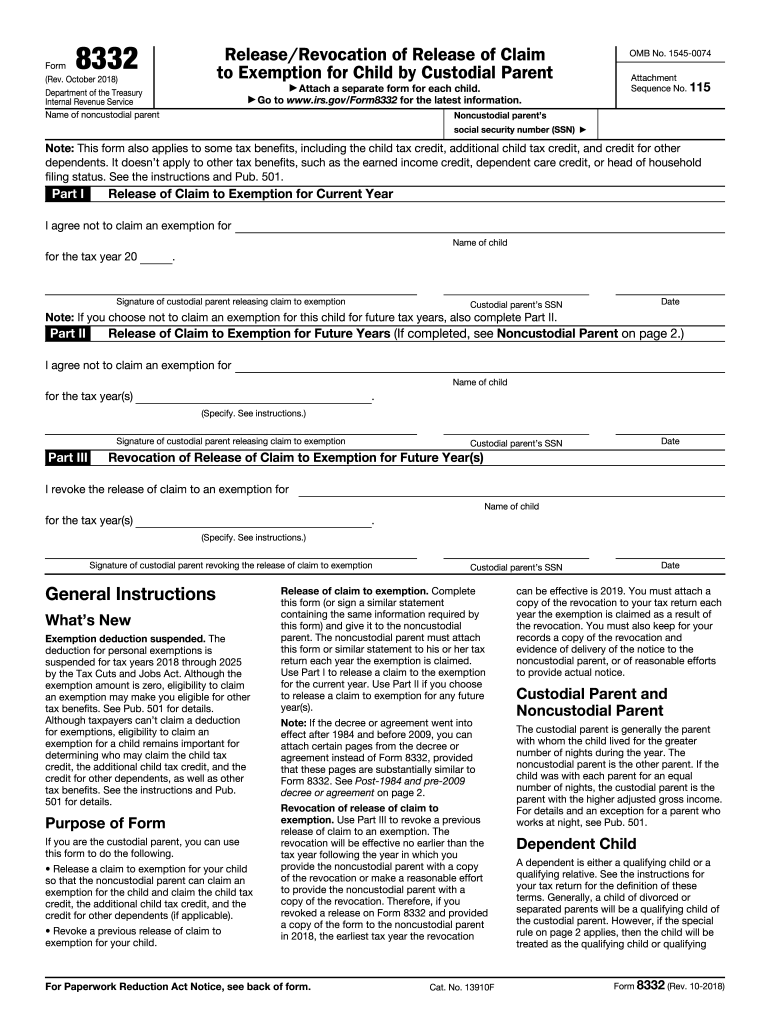

The Form 8332, officially known as the IRS Form 8332, is a tax document used by custodial parents to release their claim to the child’s tax exemption for a specific tax year. This form allows the non-custodial parent to claim the child as a dependent on their tax return. The IRS Form 8332 is particularly relevant in situations involving divorce or separation, where parents may share custody of a child. By completing this form, custodial parents can facilitate the non-custodial parent's ability to benefit from tax deductions associated with claiming a child.

How to use the Form 8332

To effectively use the Form 8332, custodial parents need to fill it out accurately and provide it to the non-custodial parent. The form must include essential information such as the names of both parents, the child’s name, and the tax year for which the exemption is being released. Once completed, the custodial parent should sign the form. The non-custodial parent can then attach the signed Form 8332 to their tax return to claim the child as a dependent. It is important to ensure that the form is filled out correctly to avoid any issues with the IRS.

Steps to complete the Form 8332

Completing the Form 8332 involves several straightforward steps:

- Obtain the latest version of the Form 8332 from the IRS website or a tax preparation service.

- Fill in the required fields, including the names of both parents and the child, as well as the tax year.

- Review the form for accuracy, ensuring all information is correct and complete.

- Sign the form as the custodial parent, confirming the release of the tax exemption.

- Provide the signed form to the non-custodial parent for their records and tax filing.

Legal use of the Form 8332

The legal use of the Form 8332 is crucial for ensuring that both parents comply with IRS regulations regarding tax exemptions. The form must be properly executed to be valid. It is essential to understand that the custodial parent can only release the exemption for the child for the specified tax year. Additionally, if the custodial parent has previously signed a Form 8332 for a different tax year, they must complete a new form for each year they wish to release the exemption. This legal framework helps prevent disputes and ensures clarity in tax matters between parents.

Filing Deadlines / Important Dates

When using the Form 8332, it is important to be aware of relevant filing deadlines. Typically, tax returns for individuals must be filed by April 15 of the following year. If the custodial parent provides the Form 8332 to the non-custodial parent, it should ideally be done before this deadline to ensure that the non-custodial parent can claim the exemption on their tax return. If additional time is needed, taxpayers may file for an extension, but they should still ensure that the Form 8332 is submitted in a timely manner to avoid complications.

Eligibility Criteria

Eligibility for using the Form 8332 hinges on a few key criteria. The custodial parent must have legal custody of the child and must choose to release their claim to the child’s tax exemption for the specified tax year. The non-custodial parent must not have been granted the exemption in prior years unless specifically stated in a signed Form 8332. Additionally, both parents must agree on the arrangement, as the form serves as a mutual agreement regarding the tax exemption.

Quick guide on how to complete irs form 8332 2018 2019

Discover the simplest method to complete and endorse your Form 8332

Are you still spending time preparing your official documents on paper instead of handling it online? airSlate SignNow offers a superior way to fill out and sign your Form 8332 and similar forms for public services. Our intelligent electronic signature solution equips you with everything required to manage documents efficiently and comply with official regulations - comprehensive PDF editing, managing, securing, signing, and sharing features all available within an intuitive interface.

Only a few steps are needed to complete the process to fill out and endorse your Form 8332:

- Insert the editable template into the editor using the Get Form button.

- Review the information you need to input in your Form 8332.

- Move between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill the blanks with your information.

- Modify the content using Text boxes or Images from the top menu.

- Emphasize what is signNow or Cover areas that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred method.

- Add the Date beside your signature and finalize your work with the Done button.

Store your completed Form 8332 in the Documents folder within your account, download it, or send it to your preferred cloud storage. Our service also provides adaptable file sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - you can do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 8332 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 8332 2018 2019

How to make an eSignature for the Irs Form 8332 2018 2019 online

How to generate an electronic signature for the Irs Form 8332 2018 2019 in Chrome

How to make an electronic signature for putting it on the Irs Form 8332 2018 2019 in Gmail

How to create an electronic signature for the Irs Form 8332 2018 2019 right from your smart phone

How to generate an electronic signature for the Irs Form 8332 2018 2019 on iOS

How to generate an eSignature for the Irs Form 8332 2018 2019 on Android devices

People also ask

-

What is Form 8332 and how is it used?

Form 8332 is a tax form that allows custodial parents to release their claim to exemption for a child to the non-custodial parent. This form is essential for those looking to claim child tax credits during tax filing. With airSlate SignNow, you can easily eSign and send Form 8332 securely and efficiently.

-

How does airSlate SignNow help with completing Form 8332?

airSlate SignNow simplifies the process of completing Form 8332 by allowing users to fill in the necessary information digitally. You can easily customize the form, add dates, and signatures directly within the platform. This streamlines the entire process, removing the hassle of printing and scanning.

-

What features does airSlate SignNow offer for eSigning Form 8332?

With airSlate SignNow, you can eSign Form 8332 quickly and securely. The platform provides comprehensive features such as workflow automation, customizable templates, and real-time tracking. These tools help ensure that all necessary parties sign the form on time, reducing delays.

-

Are there any costs associated with using airSlate SignNow for Form 8332?

airSlate SignNow offers a variety of pricing plans suited for different business needs, including options for eSigning Form 8332. Each plan includes features that make the document signing process easy and efficient, with no hidden fees. A free trial allows users to explore the platform risk-free.

-

Can I integrate airSlate SignNow with other applications for Form 8332?

Yes, airSlate SignNow easily integrates with various applications like Google Drive, Dropbox, and CRM platforms. This makes it simple to import and export Form 8332, ensuring a smooth workflow across your operations. Automation features enhance productivity and save time when managing your documents.

-

Is it secure to use airSlate SignNow for sensitive documents like Form 8332?

Absolutely, airSlate SignNow prioritizes security, using industry-standard encryption to protect your Form 8332 and other sensitive documents. The platform also complies with regulations such as GDPR and HIPAA, providing peace of mind when handling critical information. You can trust that your data is safe.

-

What are the benefits of using airSlate SignNow for Form 8332 over paper methods?

Using airSlate SignNow for Form 8332 eliminates the need for physical paperwork, signNowly reducing processing time. You can digitally sign and share the form instantly, saving time and resources. This electronic method also reduces the risk of errors associated with manual entry and ensures greater accuracy.

Get more for Form 8332

Find out other Form 8332

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now