Florida Department of Revenue DR 26S R 0723 Appl 2019

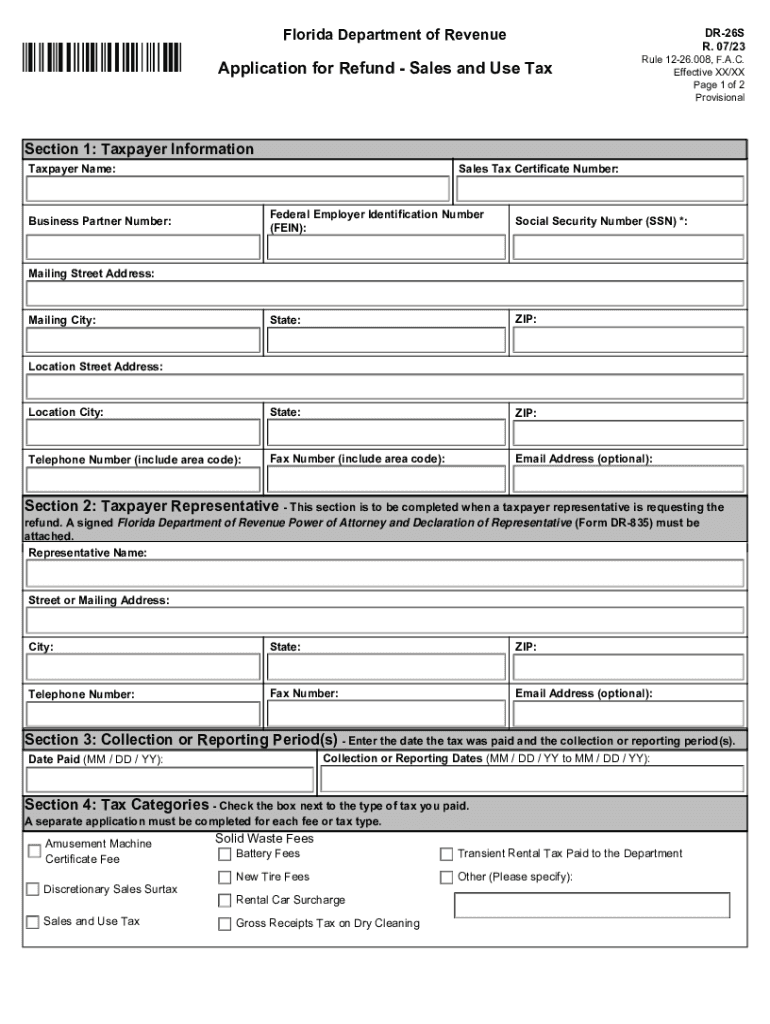

What is the Florida Department Of Revenue DR 26S R 0723 Application?

The Florida Department of Revenue DR 26S R 0723 Application is a specific form designed for individuals and businesses seeking a refund of sales and use tax. This form allows taxpayers to apply for refunds on taxes paid on purchases that are later deemed exempt or for which a tax was incorrectly assessed. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and for recovering potential overpayments.

Steps to Complete the Florida Department Of Revenue DR 26S R 0723 Application

Completing the DR 26S form involves several key steps:

- Gather necessary documentation, including receipts and proof of payment.

- Fill out the form accurately, providing all required information such as your name, address, and tax identification number.

- Detail the items or services for which you are requesting a refund, including the amount of tax paid.

- Sign and date the application to certify that the information provided is correct.

- Submit the completed form along with any supporting documents to the Florida Department of Revenue.

Eligibility Criteria for the Florida Department Of Revenue DR 26S R 0723 Application

To qualify for a refund using the DR 26S application, certain eligibility criteria must be met:

- The applicant must have paid sales and use tax on eligible purchases.

- The items or services must fall under categories that allow for tax refunds, such as exempt purchases or erroneous assessments.

- The request must be submitted within the designated time frame set by the Florida Department of Revenue.

Required Documents for the Florida Department Of Revenue DR 26S R 0723 Application

When submitting the DR 26S application, it is essential to include the following documents:

- Original receipts or invoices showing tax paid.

- Proof of eligibility for the refund, such as exemption certificates.

- Any correspondence related to the tax payment or refund request.

Form Submission Methods for the Florida Department Of Revenue DR 26S R 0723 Application

The DR 26S application can be submitted through various methods, ensuring convenience for taxpayers:

- Online submission via the Florida Department of Revenue's official website.

- Mailing the completed form and documents to the appropriate address provided by the department.

- In-person submission at designated Florida Department of Revenue offices.

Key Elements of the Florida Department Of Revenue DR 26S R 0723 Application

Understanding the key elements of the DR 26S application is vital for successful completion:

- Taxpayer identification details, including name and address.

- Specific details regarding the purchases for which the refund is requested.

- A clear statement of the reason for the refund request.

Quick guide on how to complete florida department of revenue dr 26s r 0723 appl

Complete Florida Department Of Revenue DR 26S R 0723 Appl easily on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Florida Department Of Revenue DR 26S R 0723 Appl on any platform with airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign Florida Department Of Revenue DR 26S R 0723 Appl effortlessly

- Obtain Florida Department Of Revenue DR 26S R 0723 Appl and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure private information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tiresome form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Florida Department Of Revenue DR 26S R 0723 Appl and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida department of revenue dr 26s r 0723 appl

Create this form in 5 minutes!

How to create an eSignature for the florida department of revenue dr 26s r 0723 appl

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida tax form sales and use?

The Florida tax form sales and use is a document used by businesses to report and remit sales tax collected on taxable transactions. It is essential for maintaining compliance with Florida state tax regulations. Properly completing this form ensures that businesses fulfill their tax obligations efficiently.

-

How does airSlate SignNow help with Florida tax form sales and use?

airSlate SignNow simplifies the process of preparing and eSigning the Florida tax form sales and use. Our user-friendly platform allows you to fill out, approve, and send documents instantly, reducing paperwork and saving time. This efficiency ensures that your tax form is submitted accurately and on time.

-

Is airSlate SignNow affordable for small businesses handling Florida tax forms?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses needing to manage the Florida tax form sales and use. With different tiers available, you can select a plan that fits your budget while accessing all necessary features. This affordability makes it easier for small businesses to remain compliant without overspending.

-

Can I integrate airSlate SignNow with other tax software for the Florida tax form sales and use?

Absolutely! airSlate SignNow integrates seamlessly with multiple accounting and tax software, enhancing your workflow when handling the Florida tax form sales and use. This integration allows for better data management, ensuring all necessary information is accurately reflected on your forms.

-

What features does airSlate SignNow offer for managing Florida tax forms?

airSlate SignNow provides several features tailored for managing Florida tax forms, including eSignature capabilities, document templates, and secure cloud storage. These features streamline the collection of approvals and make it easy to access past submissions of the Florida tax form sales and use whenever needed, easing the compliance process.

-

How do I ensure my Florida tax form sales and use is filed on time?

Using airSlate SignNow, you can set reminders and deadlines for submitting the Florida tax form sales and use. Our platform allows you to track the status of your documents, so you'll always be alerted when it’s time to file. This helps you avoid penalties for late submissions.

-

Is my data safe when using airSlate SignNow for Florida tax forms?

Yes, airSlate SignNow prioritizes data security with advanced encryption and compliance with industry standards. Your information related to the Florida tax form sales and use is protected, ensuring that your sensitive business data remains confidential throughout the signing process.

Get more for Florida Department Of Revenue DR 26S R 0723 Appl

- Myaccident orgpennsylvania accident reportsonline crash reports for franklin township police department form

- Financial disclosure form public defender

- Home detention application jackson county oregon form

- Student brag sheet for college recommendations www1 pgcps form

- Umattiillllaa yccoouunntty permit no burnn ippeerrmmitt form

- Baltimore city health department form

- Lake arbor foundation inc camp inspiration thelafi org form

- Senate district 3 old oksenate gov form

Find out other Florida Department Of Revenue DR 26S R 0723 Appl

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online