Individual Underpayment of Estimated Tax 2021-2026

Understanding the Individual Underpayment of Estimated Tax

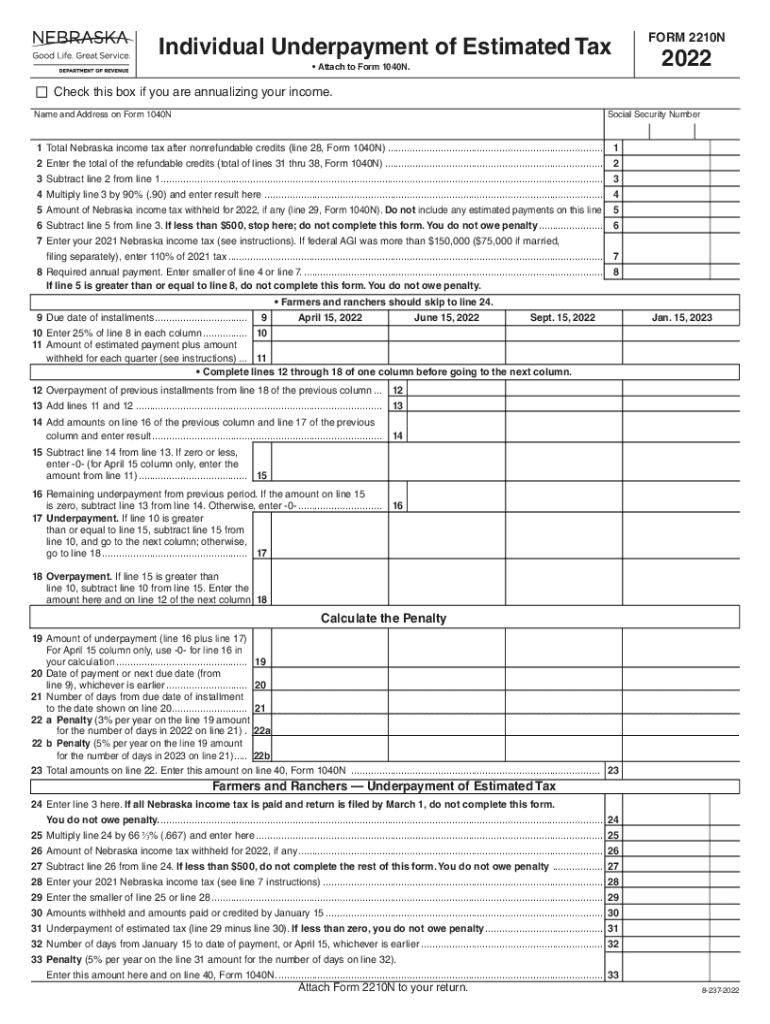

The Individual Underpayment of Estimated Tax refers to a situation where a taxpayer has not paid enough estimated tax during the year, resulting in a potential penalty. This form is particularly relevant for individuals who do not have sufficient withholding from their income sources, such as self-employed individuals or those with significant investment income. Understanding this concept is crucial for managing tax liabilities effectively.

Steps to Complete the Individual Underpayment of Estimated Tax

Completing the 2210n underpayment form involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine the amount of estimated tax you have already paid.

- Compare your total tax liability with your estimated payments to identify any underpayment.

- Fill out the 2210n form accurately, ensuring all calculations are correct.

- Submit the completed form by the appropriate deadline.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 2210n underpayment form. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. If you are unable to file by this date, you may request an extension, but any estimated taxes owed should still be paid by the original deadline to avoid penalties.

Required Documents

To complete the 2210n underpayment form, you will need several documents, including:

- Your most recent tax return, which provides a basis for your estimated tax calculations.

- Records of any estimated tax payments made throughout the year.

- Income statements, such as W-2s or 1099s, detailing your earnings.

- Any other documentation that supports your income and deductions.

Penalties for Non-Compliance

Failing to submit the 2210n underpayment form or underpaying estimated taxes can result in penalties. The IRS may impose a penalty based on the amount of underpayment and the duration of the underpayment period. It is important to address any underpayment promptly to minimize potential penalties and interest charges.

Eligibility Criteria

The eligibility criteria for using the 2210n underpayment form typically include being an individual taxpayer who has underpaid estimated taxes. This situation often arises for self-employed individuals, retirees, or those with significant income not subject to withholding. Understanding these criteria can help you determine if you need to file this form.

Quick guide on how to complete individual underpayment of estimated tax

Accomplish Individual Underpayment Of Estimated Tax easily on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Individual Underpayment Of Estimated Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Individual Underpayment Of Estimated Tax effortlessly

- Find Individual Underpayment Of Estimated Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your template.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal status as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Individual Underpayment Of Estimated Tax to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual underpayment of estimated tax

Create this form in 5 minutes!

How to create an eSignature for the individual underpayment of estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2210n underpayment form and how can airSlate SignNow help?

The 2210n underpayment form is a tax document used to calculate and report any underpayment of estimated taxes. With airSlate SignNow, you can easily fill out, send, and eSign your 2210n underpayment form, streamlining your tax preparation process.

-

How much does it cost to use airSlate SignNow for the 2210n underpayment form?

airSlate SignNow offers competitive pricing plans tailored to various business needs. You can efficiently manage your 2210n underpayment form without breaking the bank, ensuring you stay within budget while accessing essential features.

-

What features does airSlate SignNow provide for managing the 2210n underpayment form?

airSlate SignNow provides a user-friendly interface, customizable templates, and secure eSignature capabilities for your 2210n underpayment form. These features help ensure accuracy and efficiency in completing your tax documents.

-

How can using airSlate SignNow benefit my business in handling tax forms like the 2210n underpayment form?

Using airSlate SignNow to handle your 2210n underpayment form can save your business time and reduce errors. The platform’s automation features allow for quicker processing and help maintain compliance with tax regulations.

-

Does airSlate SignNow integrate with other platforms for filing the 2210n underpayment form?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, allowing for a smoother workflow when handling your 2210n underpayment form. This integration ensures all your documents are easily accessible and manageable.

-

Is it secure to eSign the 2210n underpayment form using airSlate SignNow?

Absolutely! airSlate SignNow uses advanced encryption and security protocols to protect your sensitive information while eSigning the 2210n underpayment form. You can trust that your data is safe and secure throughout the process.

-

Can I get assistance while filling out the 2210n underpayment form with airSlate SignNow?

Yes, airSlate SignNow offers comprehensive support resources, including tutorials and customer service, to assist you in filling out the 2210n underpayment form. Our team is dedicated to ensuring you have a smooth experience.

Get more for Individual Underpayment Of Estimated Tax

- Bangladesh telecommunication regulatory commission form

- Asha securities ltd 60 5th lane colombo 03 tel form

- 4828 4th street form

- Canine good citizen evaluator application form

- 18 iscrizioni per via franco zorzi 36 bellinzona search ch form

- Alpha kappa alpha sorority inc transfer verific form

- Form 19 application for registration of overseas company on the tongan register form 19 application for registration of

- Preschool intake form for children with special needs mcleanbible

Find out other Individual Underpayment Of Estimated Tax

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe