Printable Nebraska Form 2210N Individual Underpayment of Estimated Tax 2020

What is the Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax

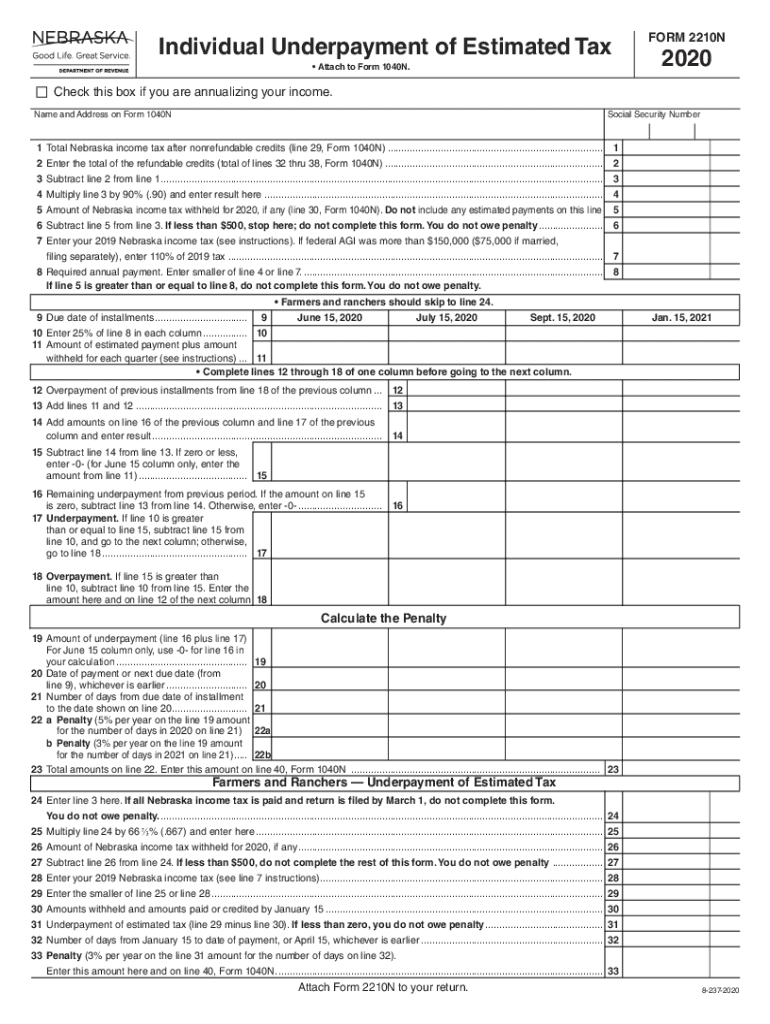

The Printable Nebraska Form 2210N is designed for individual taxpayers who may not have paid enough estimated tax throughout the year. This form helps determine if you owe any penalties for underpayment of estimated taxes. It is specifically tailored for Nebraska residents and aligns with state tax regulations. By using this form, taxpayers can assess their tax liability and ensure compliance with Nebraska tax laws.

Steps to Complete the Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax

Completing the Nebraska Form 2210N involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total income for the year, including wages, self-employment income, and any other sources.

- Determine the amount of estimated tax you should have paid based on your income.

- Fill out the form by entering your total income, the estimated tax due, and any payments made throughout the year.

- Review the form for accuracy and ensure all required information is included.

- Sign and date the form before submission.

Legal Use of the Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax

The Nebraska Form 2210N is legally recognized for assessing underpayment penalties. To ensure the form is valid, it must be completed accurately and submitted on time. The form complies with Nebraska tax regulations and is accepted by the Nebraska Department of Revenue. Proper use of this form can help avoid unnecessary penalties and ensure that taxpayers meet their obligations under state law.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Nebraska Form 2210N. Typically, the form should be filed along with your annual tax return. Key dates include:

- April 15: Deadline for filing individual tax returns and associated forms.

- Estimated tax payments are generally due quarterly, with specific deadlines for each quarter.

Missing these deadlines can result in penalties, so it is crucial to stay informed and file on time.

Examples of Using the Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax

Consider a scenario where an individual has income from self-employment but did not make sufficient estimated tax payments throughout the year. By using the Nebraska Form 2210N, they can calculate any penalties owed and ensure compliance with state tax laws. Another example involves a taxpayer who had a significant increase in income during the year and failed to adjust their estimated tax payments accordingly. This form allows them to assess their tax situation and avoid potential penalties.

Key Elements of the Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax

The Nebraska Form 2210N includes several critical components that taxpayers must understand:

- Income Calculation: Accurate reporting of total income is essential for determining tax liability.

- Estimated Tax Payments: Taxpayers must report any payments made to assess underpayment accurately.

- Penalty Assessment: The form helps calculate any penalties due for underpayment based on the information provided.

Understanding these elements is vital for successful completion and compliance with Nebraska tax regulations.

Quick guide on how to complete printable 2020 nebraska form 2210n individual underpayment of estimated tax

Complete Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the resources you require to create, alter, and eSign your documents quickly without delays. Handle Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax with minimal effort

- Obtain Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from your preferred device. Modify and eSign Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 nebraska form 2210n individual underpayment of estimated tax

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 nebraska form 2210n individual underpayment of estimated tax

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the 2210n tax form and why is it important?

The 2210n tax form is used by taxpayers to determine whether they owe a penalty for underpayment of estimated tax. Understanding this form is crucial as it helps ensure compliance with IRS regulations, avoiding potential penalties.

-

How does airSlate SignNow simplify the process of completing the 2210n tax form?

AirSlate SignNow streamlines the process by allowing users to fill out and eSign the 2210n tax form electronically. This saves time and reduces errors, making tax filing more efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the 2210n tax form?

AirSlate SignNow offers flexible pricing plans that are cost-effective for businesses of all sizes. Users can choose a plan that meets their needs, ensuring they can effectively manage their 2210n tax form without breaking the bank.

-

What features does airSlate SignNow provide for managing tax documents like the 2210n tax?

AirSlate SignNow offers features such as template creation, cloud storage for easy access, and secure eSign capabilities. These features help users efficiently manage their 2210n tax documents and other forms.

-

Can I integrate airSlate SignNow with other software for handling the 2210n tax form?

Yes, airSlate SignNow easily integrates with various business applications, enabling seamless workflow management for the 2210n tax form. This integration helps consolidate all your tax-related processes within a single platform.

-

What are the benefits of using airSlate SignNow for the 2210n tax form?

Utilizing airSlate SignNow for the 2210n tax form offers benefits such as enhanced security, improved efficiency, and reduced turnaround times for document processing. This allows users to focus more on their business and less on administrative tasks.

-

How secure is airSlate SignNow when handling sensitive tax documents like the 2210n tax?

AirSlate SignNow ensures top-notch security for all documents, including the 2210n tax form, by employing advanced encryption and storage protocols. Your sensitive information is protected throughout the entire eSigning process.

Get more for Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax

- South dakota relationships disclosure form

- South dakota sellers property condition disclosure statement form

- Agency agreement purchaser south dakota buyer agency form

- Exclusive agency agreement fillable form

- Free oklahoma real estate power of attorney form word

- Real estate auciton listing agreement dlr sd form

- Auction real estate purchase agreement this is a legally form

- Rhode island month to month leasefindlegalformscom

Find out other Printable Nebraska Form 2210N Individual Underpayment Of Estimated Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors