Introduction to Nevada Commerce Tax Video Training Series Form

Understanding the Modified Business Tax Return PDF

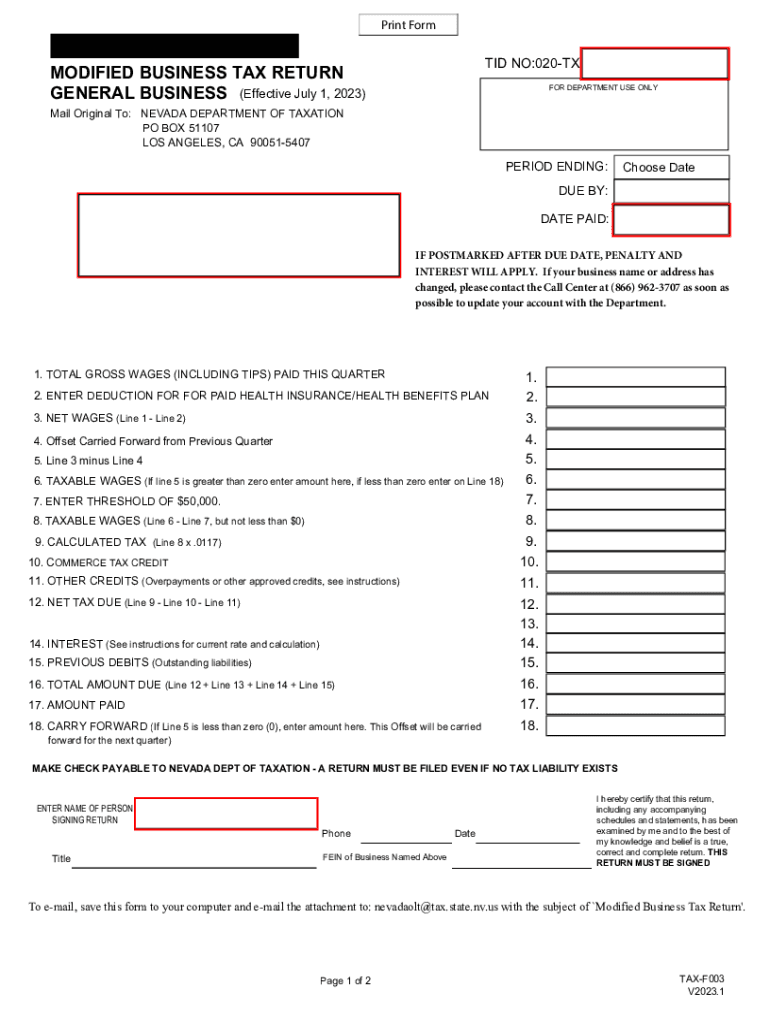

The modified business tax return PDF is a specific form used by businesses in Nevada to report their income and calculate their commerce tax obligations. This form is essential for ensuring compliance with state tax regulations. It allows businesses to accurately report their financial activities and determine their tax liabilities based on their gross revenue. Understanding this form is crucial for any business owner operating in Nevada.

Required Documents for Filing

To complete the modified business tax return, several documents are necessary. These typically include:

- Financial statements, including profit and loss statements

- Balance sheets that reflect the company's financial position

- Supporting documentation for any deductions or credits claimed

- Previous tax returns for reference

Having these documents ready can streamline the filing process and ensure that all necessary information is included.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the modified business tax return. Generally, businesses must submit their returns by the due date specified by the Nevada Department of Taxation. Missing these deadlines can result in penalties and interest on unpaid taxes. Keeping a calendar of important dates can help ensure timely submissions.

Form Submission Methods

The modified business tax return can be submitted through various methods, including:

- Online submission via the Nevada Department of Taxation's website

- Mailing a paper copy to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method can depend on the business's preferences and the urgency of the filing.

Penalties for Non-Compliance

Failure to file the modified business tax return on time or inaccuracies in the information provided can lead to significant penalties. These may include:

- Late filing fees

- Interest on unpaid taxes

- Potential audits by the state tax authorities

Understanding these penalties emphasizes the importance of accurate and timely filing.

IRS Guidelines for State Tax Returns

While the modified business tax return is specific to Nevada, it is important to consider how it aligns with IRS guidelines. Businesses should ensure that their state filings are consistent with federal tax requirements. This includes reporting income accurately and understanding how state taxes interact with federal obligations.

Quick guide on how to complete introduction to nevada commerce tax video training series

Manage Introduction To Nevada Commerce Tax Video Training Series seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing easy access to the right form and secure online storage. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Handle Introduction To Nevada Commerce Tax Video Training Series on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to alter and electronically sign Introduction To Nevada Commerce Tax Video Training Series effortlessly

- Obtain Introduction To Nevada Commerce Tax Video Training Series and click on Access Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Authorize tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click on the Finish button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Introduction To Nevada Commerce Tax Video Training Series and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the introduction to nevada commerce tax video training series

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a modified business tax return PDF?

A modified business tax return PDF represents altered versions of standard tax returns typically used by businesses. This document may incorporate adjustments for clarity or compliance with specific tax regulations, making it essential for accurate filing. airSlate SignNow allows easy creation and management of modified business tax return PDFs for your convenience.

-

How can I create a modified business tax return PDF with airSlate SignNow?

Creating a modified business tax return PDF with airSlate SignNow is straightforward. Simply upload your existing tax return document, make the necessary modifications, and save it in PDF format. This process ensures that your documents are both easily accessible and compliant with tax requirements.

-

What are the benefits of using airSlate SignNow for modified business tax return PDFs?

Using airSlate SignNow for your modified business tax return PDFs streamlines your document management process. You'll benefit from easy eSignature capabilities, secure document storage, and intuitive editing tools. These features allow you to enhance collaboration within your team while ensuring compliance with tax-related documents.

-

Are there any pricing plans for using airSlate SignNow to manage my modified business tax return PDFs?

Yes, airSlate SignNow offers flexible pricing plans tailored to accommodate different business needs. Whether you require basic features or advanced integrations, there is a plan that suits your budget. This cost-effective solution will help you effectively manage your modified business tax return PDFs without breaking the bank.

-

Can I share a modified business tax return PDF with my accountant using airSlate SignNow?

Absolutely! airSlate SignNow makes it easy to share your modified business tax return PDFs securely. You can invite your accountant to review, sign, or make annotations directly on the document, ensuring a seamless collaboration experience while maintaining document integrity.

-

What integrations does airSlate SignNow offer for modified business tax return PDFs?

airSlate SignNow supports various integrations that enhance your workflow with modified business tax return PDFs. You can seamlessly connect with tools like Google Drive, Salesforce, and Outlook to streamline document management and signature processes. This creates a more efficient way to handle all your business documentation needs.

-

Is it safe to store my modified business tax return PDFs on airSlate SignNow?

Yes, storing your modified business tax return PDFs on airSlate SignNow is secure. The platform employs advanced encryption and security measures to protect your sensitive documents. This way, you can be confident that your financial information remains confidential and safeguarded against unauthorized access.

Get more for Introduction To Nevada Commerce Tax Video Training Series

- City of milton building permit application form

- Release form headwaters outfitters

- Maintenance bond release city of westfield upon executing form

- Indiana application certificate compliance form

- Indiana development plan westfield form

- Westfield united kingdomthe destination for fashion form

- City and borough of sitka send completed application to form

- Request to change license record form

Find out other Introduction To Nevada Commerce Tax Video Training Series

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample