for Estates of Decedents Dying during Calendar Year 2022

What is the For Estates Of Decedents Dying During Calendar Year

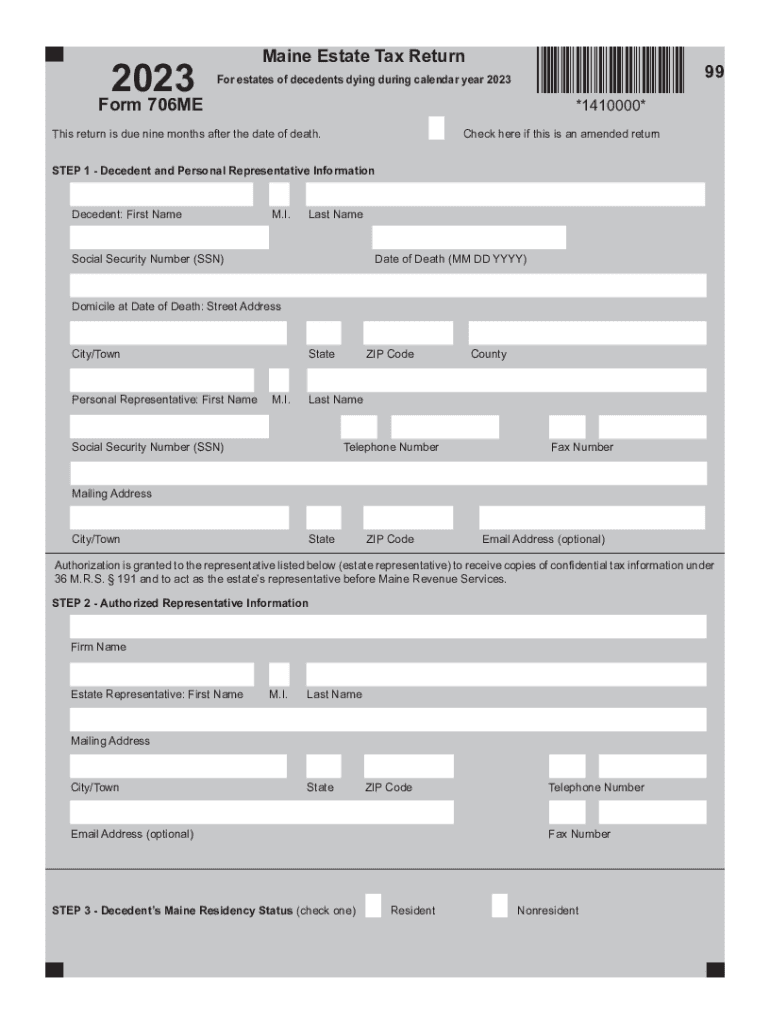

The form for estates of decedents dying during the calendar year is a crucial document used in the administration of an estate following the death of an individual. This form is primarily utilized to report the financial affairs of the deceased, including income, assets, and liabilities, to the appropriate tax authorities. It ensures that the estate is settled in accordance with federal and state laws, allowing for the proper distribution of assets to beneficiaries.

How to use the For Estates Of Decedents Dying During Calendar Year

This form is used by the executor or administrator of the estate to provide a comprehensive overview of the decedent's financial situation. It is essential for filing estate tax returns and may be required for settling debts, distributing assets, and fulfilling legal obligations. Executors should gather all necessary financial documents, including bank statements, property deeds, and investment records, before completing the form.

Steps to complete the For Estates Of Decedents Dying During Calendar Year

Completing the form involves several key steps:

- Gather all relevant financial documents related to the decedent.

- Fill out the required sections accurately, including personal information, asset details, and liabilities.

- Calculate the total value of the estate, ensuring all income and deductions are accounted for.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate tax authority by the designated deadline.

Legal use of the For Estates Of Decedents Dying During Calendar Year

The legal use of this form is essential for compliance with estate tax laws. It serves as an official record of the decedent's financial status and is necessary for settling the estate in a lawful manner. Executors must ensure that the form is filed correctly to avoid potential legal issues or penalties associated with improper estate management.

Filing Deadlines / Important Dates

Filing deadlines for the form are typically aligned with federal and state tax deadlines. Executors should be aware of the specific due dates to ensure timely submission. Generally, the estate tax return must be filed within nine months of the decedent's date of death, although extensions may be available under certain circumstances.

Required Documents

To complete the form accurately, several documents are required, including:

- Death certificate of the decedent.

- Financial statements, including bank and investment accounts.

- Property deeds and titles.

- Records of debts and liabilities.

- Previous tax returns, if applicable.

Who Issues the Form

The form for estates of decedents dying during the calendar year is typically issued by the Internal Revenue Service (IRS) or the relevant state tax authority. Executors should ensure they are using the most current version of the form to comply with any recent tax law changes.

Quick guide on how to complete for estates of decedents dying during calendar year

Complete For Estates Of Decedents Dying During Calendar Year effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents swiftly without interruptions. Manage For Estates Of Decedents Dying During Calendar Year on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign For Estates Of Decedents Dying During Calendar Year effortlessly

- Locate For Estates Of Decedents Dying During Calendar Year and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and bears the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form quests, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your preference. Alter and eSign For Estates Of Decedents Dying During Calendar Year and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for estates of decedents dying during calendar year

Create this form in 5 minutes!

How to create an eSignature for the for estates of decedents dying during calendar year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it benefit estates of decedents dying during the calendar year?

airSlate SignNow is a powerful electronic signature solution specifically designed to simplify document management. For estates of decedents dying during the calendar year, it offers an efficient way to prepare and sign necessary legal documents, ensuring compliance while saving time and resources.

-

How does airSlate SignNow handle digital signatures for estates of decedents dying during the calendar year?

airSlate SignNow provides legally binding digital signatures that comply with industry standards. This feature is essential for estates of decedents dying during the calendar year, streamlining the administrative process and ensuring that all necessary documents are signed accurately and efficiently.

-

What features are available in airSlate SignNow for managing estate-related documents?

airSlate SignNow includes a variety of features such as document templates, bulk send capabilities, and real-time tracking. These tools are particularly useful for estates of decedents dying during the calendar year, enabling quick access to important documents and ensuring they're managed effectively.

-

Are there any costs associated with using airSlate SignNow for estates of decedents dying during the calendar year?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. For estates of decedents dying during the calendar year, investing in our solution can lead to signNow time savings and reduced administrative overhead.

-

Can airSlate SignNow integrate with other tools for managing estate documents?

Absolutely! airSlate SignNow integrates seamlessly with popular third-party applications such as Google Drive, Dropbox, and CRM systems. This makes it an ideal solution for estates of decedents dying during the calendar year, as it allows for efficient workflows and document management across platforms.

-

Is airSlate SignNow user-friendly for individuals managing estates of decedents dying during the calendar year?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for individuals managing estates of decedents dying during the calendar year to navigate the platform. Our intuitive interface ensures that even those with limited tech skills can effectively use our electronic signature solution.

-

What support options does airSlate SignNow offer for users managing estate documents?

airSlate SignNow provides comprehensive customer support, including live chat, email assistance, and an extensive knowledge base. Users managing estates of decedents dying during the calendar year can rely on our support team to help resolve any issues promptly.

Get more for For Estates Of Decedents Dying During Calendar Year

- Automobile insurance acceptance formpub read only

- Release of liability and hold harmless agreement activity ku form

- Vt special excess weight permit form

- Truckingks form

- Have been admitted as an investor griffin capital form

- Opportunity zonesinternal revenue service irs tax forms

- Fes personal commitment agreement form

- Sun life profit beats estimates even as wealth business form

Find out other For Estates Of Decedents Dying During Calendar Year

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template