Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When is it Due?Instructions for Form 706 09Internal Revenue Servi 2022

Understanding the Estate Tax 706M

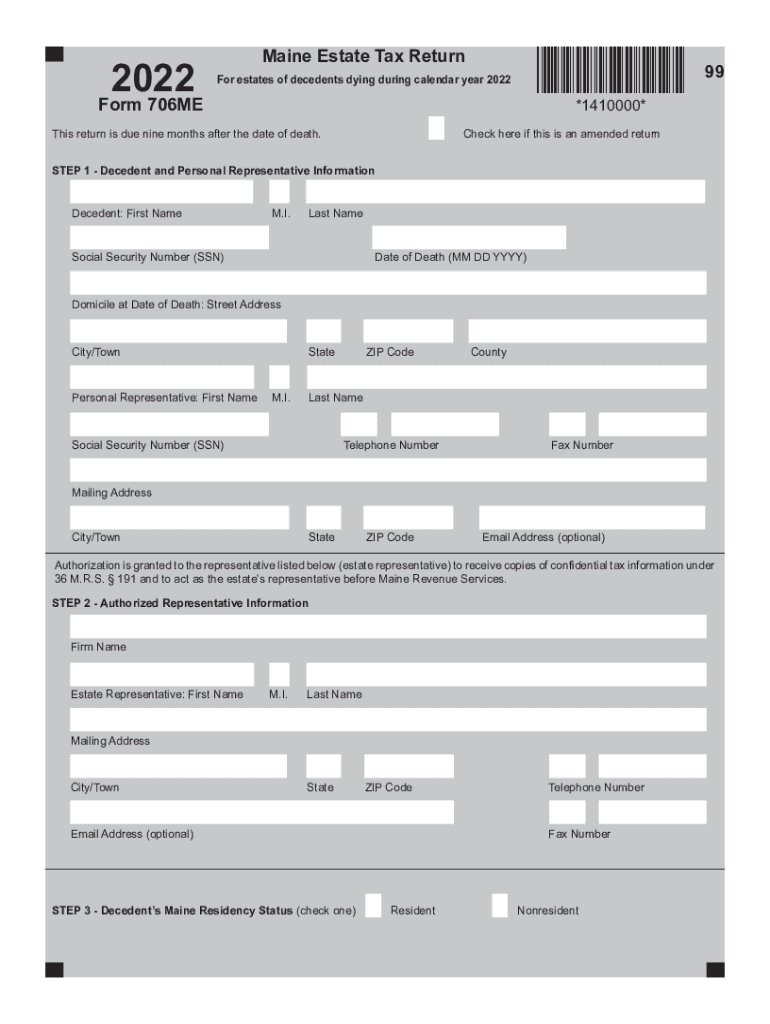

The Estate Tax 706M is a crucial form used for reporting the estate tax liability of deceased individuals. This form is essential for estates that exceed the federal estate tax exemption threshold. It helps determine the tax owed to the Internal Revenue Service (IRS) and ensures compliance with federal tax regulations. The form includes detailed information about the decedent's assets, liabilities, and deductions, which are necessary for calculating the taxable estate. Understanding the nuances of this form can help executors and administrators fulfill their legal obligations effectively.

How to Obtain the Estate Tax 706M

Obtaining the Estate Tax 706M form is straightforward. The form can be downloaded directly from the IRS website or requested through the mail. It is essential to ensure that you are using the most current version of the form, as tax laws and requirements may change. Additionally, state-specific guidelines may apply, so checking with local tax authorities can provide further clarity. If assistance is needed, consulting a tax professional or legal advisor can be beneficial in navigating the complexities of estate tax filings.

Steps to Complete the Estate Tax 706M

Completing the Estate Tax 706M involves several important steps:

- Gather Documentation: Collect all necessary documents, including the decedent's financial records, property deeds, and outstanding debts.

- Complete the Form: Fill out the form accurately, providing detailed information about the estate's assets and liabilities.

- Calculate the Tax: Use the provided instructions to calculate the estate tax owed based on the total taxable estate.

- Review for Accuracy: Double-check the completed form for errors or omissions, as mistakes can lead to penalties.

- Submit the Form: File the completed form with the IRS by the due date, ensuring compliance with all submission guidelines.

Filing Deadlines and Important Dates

Filing deadlines for the Estate Tax 706M are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. However, an extension may be available under certain circumstances. It is important to mark these dates on your calendar and prepare in advance to ensure timely submission. Late filings can incur significant penalties and interest, emphasizing the importance of adhering to these deadlines.

Required Documents for Filing

When preparing to file the Estate Tax 706M, several documents are required to support the information provided on the form. Key documents include:

- Death certificate of the decedent

- Financial statements, including bank and investment account statements

- Property appraisals for real estate and personal property

- Documentation of any debts or liabilities

- Previous tax returns, if applicable

Having these documents organized and readily available will streamline the filing process and ensure compliance with IRS requirements.

Legal Use of the Estate Tax 706M

The Estate Tax 706M serves a legal purpose in the estate settlement process. Filing this form is not only a requirement but also a means of ensuring that the estate is settled according to federal laws. Proper completion and submission of the form can protect executors from potential legal issues related to estate tax liabilities. Understanding the legal implications of the form can help individuals navigate the complexities of estate management and compliance.

Quick guide on how to complete estate tax 706memaine revenue servicesestate income tax return when is it dueinstructions for form 706 092020internal revenue

Manage Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue Servi with ease on any device

Digital document management has gained traction among companies and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and eSign your documents quickly and without delays. Handle Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue Servi on any device using the airSlate SignNow Android or iOS apps and simplify any document-centric tasks today.

The simplest way to modify and eSign Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue Servi effortlessly

- Locate Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue Servi and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or errors that necessitate printing new copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device of your choice. Edit and eSign Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue Servi to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estate tax 706memaine revenue servicesestate income tax return when is it dueinstructions for form 706 092020internal revenue

Create this form in 5 minutes!

People also ask

-

What is the purpose of Form 706?

Form 706 is used to compute the estate tax liability for estates that exceed the exclusion amount. Understanding how to fill out this form is crucial for accurately reporting the estate's value to the Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue ServiceInstructions For Form 706 09Internal Revenue Service.

-

When is the Estate Tax 706 due?

The Estate Tax 706 is generally due within nine months after the date of the decedent's death. It is important to file promptly to avoid penalties. For guidance on timing, refer to the Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue ServiceInstructions For Form 706 09Internal Revenue Service.

-

What are the fees associated with filing Form 706?

Filing Form 706 does not incur direct fees, but there may be costs associated with hiring professionals to assist in preparation. It is advisable to weigh these costs against the potential tax implications of the Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue ServiceInstructions For Form 706 09Internal Revenue Service.

-

How can airSlate SignNow assist with Form 706?

airSlate SignNow provides a seamless platform to eSign and manage documentation vital for filing Form 706. The solution enhances organization and tracking, ensuring that you meet the requirements of the Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue ServiceInstructions For Form 706 09Internal Revenue Service.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers intuitive features such as templates, in-app notifications, and secure cloud storage. These tools not only simplify the eSigning process but also align with requirements for the Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue ServiceInstructions For Form 706 09Internal Revenue Service.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates with various business applications, making it easier to incorporate into your existing workflows. This flexibility supports efficient management of documents related to the Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue ServiceInstructions For Form 706 09Internal Revenue Service.

-

What are the benefits of using airSlate SignNow for estate tax documentation?

Using airSlate SignNow streamlines the signing and sending process, saving time and reducing errors. This is crucial when dealing with forms such as the Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue ServiceInstructions For Form 706 09Internal Revenue Service.

Get more for Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue Servi

- Correction statement and agreement north carolina form

- North carolina closing form

- Flood zone statement and authorization north carolina form

- Name affidavit of buyer north carolina form

- Name affidavit of seller north carolina form

- Non foreign affidavit under irc 1445 north carolina form

- Owners or sellers affidavit of no liens north carolina form

- Nc affidavit form

Find out other Estate Tax 706MEMaine Revenue ServicesEstate Income Tax Return When Is It Due?Instructions For Form 706 09Internal Revenue Servi

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History