for ESTATES of DECEDENTS DYING during CALENDAR YEAR 2020

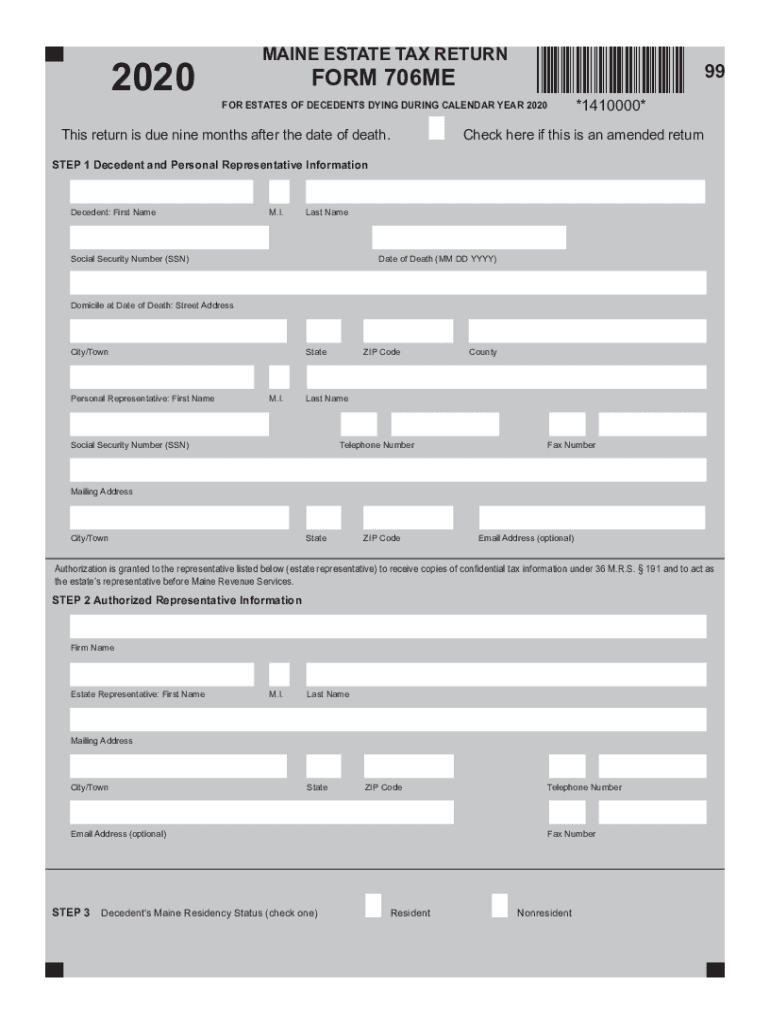

What is the form 706me?

The form 706me is a tax document used for estates of decedents who pass away during a specific calendar year. This form is essential for reporting the estate's value and calculating any estate taxes owed to the Internal Revenue Service (IRS). It is specifically designed to ensure compliance with federal tax obligations related to the transfer of wealth after death. Understanding the nuances of the form is crucial for executors and beneficiaries to navigate the complexities of estate taxation effectively.

Steps to complete the form 706me

Completing the form 706me involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including the decedent's financial records, property valuations, and any outstanding debts. Next, fill out the form by providing detailed information about the estate's assets, liabilities, and deductions. It is essential to double-check all entries for accuracy before submission. Finally, ensure that the form is signed by the executor and submitted to the IRS by the applicable deadline to avoid penalties.

Legal use of the form 706me

The legal use of the form 706me is governed by IRS regulations, which outline the requirements for filing and the implications of estate taxes. Proper completion of this form is necessary to establish the estate's tax liability and ensure that all legal obligations are met. The form serves as a formal declaration of the estate's worth and is critical for the distribution of assets to beneficiaries. Failure to file or inaccuracies in the form can lead to legal complications and potential penalties.

Filing deadlines and important dates

Filing deadlines for the form 706me are crucial for compliance with IRS regulations. Generally, the form must be filed within nine months of the decedent's date of death. However, an extension may be granted under certain circumstances. It is important to be aware of these deadlines to avoid late fees and interest charges on any taxes owed. Executors should also keep track of any changes in tax laws that may affect filing requirements.

Required documents for form 706me

To successfully complete the form 706me, several documents are required. These include the decedent's will, financial statements, appraisals of real estate and other assets, and records of any debts or liabilities. Additionally, documentation supporting any deductions claimed on the form, such as funeral expenses or debts owed by the estate, should be included. Having these documents organized and readily available will facilitate a smoother filing process.

IRS guidelines for form 706me

The IRS provides specific guidelines for completing the form 706me, which include instructions on how to report various types of assets and liabilities. These guidelines detail the necessary calculations for determining the gross estate value and the allowable deductions. It is essential for filers to familiarize themselves with these guidelines to ensure compliance and to accurately reflect the estate's financial situation. Consulting the IRS website or a tax professional can provide additional clarity on these requirements.

Examples of using the form 706me

Examples of using the form 706me can help clarify its application in real-life scenarios. For instance, if an individual passes away leaving behind a house, investments, and debts, the executor would need to list these assets and liabilities on the form. Another example may involve estates that qualify for deductions, such as charitable contributions made before death. Understanding these examples can aid executors in accurately reporting the estate's financial status and ensuring compliance with tax laws.

Quick guide on how to complete for estates of decedents dying during calendar year 2020

Complete FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR effortlessly on any gadget

Web-based document management has gained immense traction among enterprises and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to access the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without holdups. Handle FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR effortlessly

- Obtain FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR and click on Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for estates of decedents dying during calendar year 2020

Create this form in 5 minutes!

How to create an eSignature for the for estates of decedents dying during calendar year 2020

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is 706me and how does it relate to airSlate SignNow?

706me is a unique identifier associated with airSlate SignNow, a powerful solution that allows businesses to send and eSign documents efficiently. This platform streamlines the signing process, making it easier for organizations to manage their documents and improve workflow.

-

What features does airSlate SignNow offer for 706me users?

For users identified by 706me, airSlate SignNow provides a variety of features including template creation, document sharing, and advanced electronic signature capabilities. These tools enhance productivity and ensure that businesses can expedite their document workflows without sacrificing security.

-

How much does airSlate SignNow cost under the 706me pricing plan?

The pricing for airSlate SignNow varies depending on the features included in the 706me plan. Typically, the platform offers flexible pricing options to accommodate businesses of all sizes, ensuring they have access to the tools they need at a competitive rate.

-

What benefits can businesses expect when using 706me with airSlate SignNow?

Businesses using 706me with airSlate SignNow can expect enhanced efficiency, reduced turnaround times for document signing, and improved compliance through secure electronic signatures. This leads to faster transactions and a more streamlined workflow.

-

Can 706me integrate with other software systems?

Yes, airSlate SignNow supports integrations with a variety of software systems, allowing 706me users to seamlessly connect their existing tools. This makes it possible to automate workflows and enhance overall productivity across different platforms.

-

Is there a mobile app available for 706me users of airSlate SignNow?

Absolutely! AirSlate SignNow offers a mobile app that allows 706me users to manage their documents and signatures on the go. This is ideal for businesses that need to facilitate signing anywhere, enhancing flexibility and convenience.

-

How secure is the signing process for 706me in airSlate SignNow?

The signing process for 706me in airSlate SignNow is highly secure, employing encryption and compliance standards to protect sensitive information. Users can trust that their documents are safe and that their signing actions are legally binding.

Get more for FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497430609 form

- Letter tenant notice rent 497430610 form

- Rent letter least form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase wisconsin form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant wisconsin form

- Wisconsin tenant landlord 497430614 form

- Wi tenant landlord 497430615 form

- Temporary lease agreement to prospective buyer of residence prior to closing wisconsin form

Find out other FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile