I 030 Wisconsin Schedule CC, Request for a Closing Certificate for Fiduciaries Form

Understanding the I-030 Wisconsin Schedule CC

The I-030 Wisconsin Schedule CC is a crucial form used to request a closing certificate for fiduciaries. This form is essential for individuals handling the estates of deceased persons or managing trusts. The closing certificate serves as proof that all tax obligations have been fulfilled, allowing fiduciaries to close their accounts with the Wisconsin Department of Revenue. It is important to understand the specific requirements and implications of this form to ensure compliance with state regulations.

Steps to Complete the I-030 Wisconsin Schedule CC

Completing the I-030 Wisconsin Schedule CC involves several key steps:

- Gather all necessary information regarding the estate or trust, including financial records and tax filings.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documentation that may be required, such as tax returns or proof of payments.

- Review the completed form for accuracy before submission.

Following these steps carefully can help prevent delays in processing your request.

How to Obtain the I-030 Wisconsin Schedule CC

The I-030 Wisconsin Schedule CC can be obtained directly from the Wisconsin Department of Revenue’s official website or through their office. It is available in both digital and printable formats, allowing users to choose their preferred method of access. Ensure that you are using the most current version of the form to avoid any issues during submission.

Legal Use of the I-030 Wisconsin Schedule CC

The I-030 Wisconsin Schedule CC is legally binding and must be used in accordance with Wisconsin state law. It is essential for fiduciaries to use this form to demonstrate that all tax liabilities related to the estate or trust have been settled. Failure to obtain a closing certificate can result in legal complications, including penalties or fines from the Wisconsin Department of Revenue.

Key Elements of the I-030 Wisconsin Schedule CC

Key elements of the I-030 Wisconsin Schedule CC include:

- Fiduciary Information: Details about the fiduciary, including name and contact information.

- Estate Information: Information regarding the deceased or the trust being managed.

- Tax Compliance: A declaration of compliance with all tax obligations.

- Signature: The fiduciary's signature is required to validate the request.

Each of these elements plays a vital role in the processing of the form and the issuance of the closing certificate.

Form Submission Methods

The I-030 Wisconsin Schedule CC can be submitted through various methods, including:

- Online Submission: Some users may have the option to submit the form electronically through the Wisconsin Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate address provided by the department.

- In-Person: Individuals can also submit the form in person at designated department offices.

Choosing the right submission method can help ensure timely processing of your request.

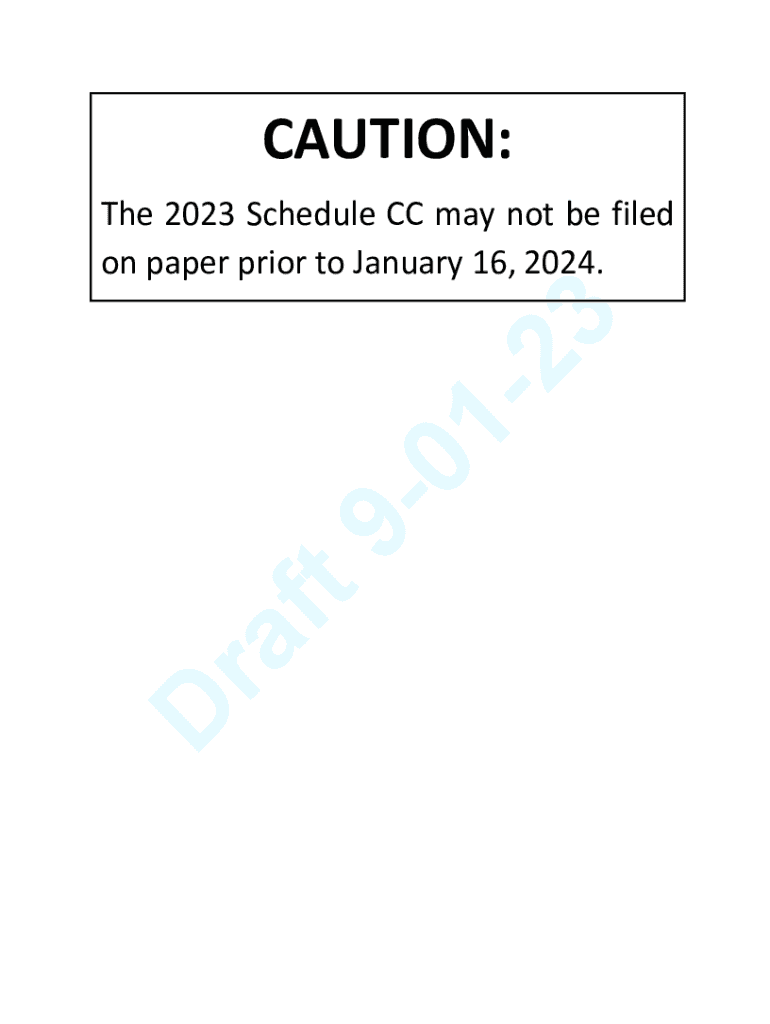

Important Dates and Filing Deadlines

It is crucial to be aware of important dates and filing deadlines associated with the I-030 Wisconsin Schedule CC. Typically, the request should be filed as soon as all tax obligations have been met, but it is advisable to check with the Wisconsin Department of Revenue for specific deadlines that may apply to your situation. Missing a deadline can result in delays or complications in obtaining the closing certificate.

Quick guide on how to complete i 030 wisconsin schedule cc request for a closing certificate for fiduciaries

Complete I 030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools you need to create, edit, and eSign your documents promptly without delays. Manage I 030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign I 030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries with ease

- Find I 030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign I 030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries and ensure outstanding communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 030 wisconsin schedule cc request for a closing certificate for fiduciaries

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Wisconsin Department of Revenue forms available through airSlate SignNow?

airSlate SignNow offers a variety of Wisconsin Department of Revenue forms that can be easily created, signed, and shared. This includes forms for tax reporting, exemptions, and other financial documentation required by the state. Utilizing these forms streamlines your filing process and ensures compliance.

-

How does airSlate SignNow simplify the process of completing Wisconsin Department of Revenue forms?

With airSlate SignNow, completing Wisconsin Department of Revenue forms is made simple with easy-to-use templates and an intuitive interface. You can fill out forms electronically, reducing the need for paper documentation. The platform also supports electronic signatures, which expedites the submission process.

-

Are there any costs associated with using airSlate SignNow for Wisconsin Department of Revenue forms?

Yes, airSlate SignNow operates on a subscription model, with various pricing tiers to suit different business needs. While there’s an initial cost, many users find that the time saved on managing Wisconsin Department of Revenue forms offsets the expense. Additionally, potential savings can occur through efficient document management.

-

Can I integrate airSlate SignNow with other software for managing Wisconsin Department of Revenue forms?

Absolutely! airSlate SignNow offers integrations with popular business software, making it easy to manage Wisconsin Department of Revenue forms alongside your other tools. Whether it’s cloud storage services or CRM platforms, you can streamline your workflow to enhance efficiency.

-

What features does airSlate SignNow provide for Wisconsin Department of Revenue forms?

airSlate SignNow provides robust features for Wisconsin Department of Revenue forms, including document sharing, collaborative editing, and real-time notifications. These features ensure that all stakeholders can stay informed and involved in the document process without any hassle.

-

Is electronic signing for Wisconsin Department of Revenue forms legally binding?

Yes, electronic signatures created through airSlate SignNow for Wisconsin Department of Revenue forms are legally binding. The platform complies with e-signature laws, ensuring that your signed documents hold legal weight. This helps you maintain compliance while streamlining your workflow.

-

How can I ensure my Wisconsin Department of Revenue forms are secure with airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and authentication protocols, ensuring your Wisconsin Department of Revenue forms remain confidential and protected. You can also customize access permissions to control who can view or edit your forms, enhancing document security.

Get more for I 030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries

- Ph071 authority to request or disclose personal information to

- Drivers license forms minnesota department of public safety

- Living skills assessment form

- Ccweb sdro parramatta form

- F3520cfd pdf print form reset form vehicle registration

- Bond refund form services

- Retail mail order form thermo gel australia

- Queensland garaging address statement queensland garaging address statement form

Find out other I 030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement