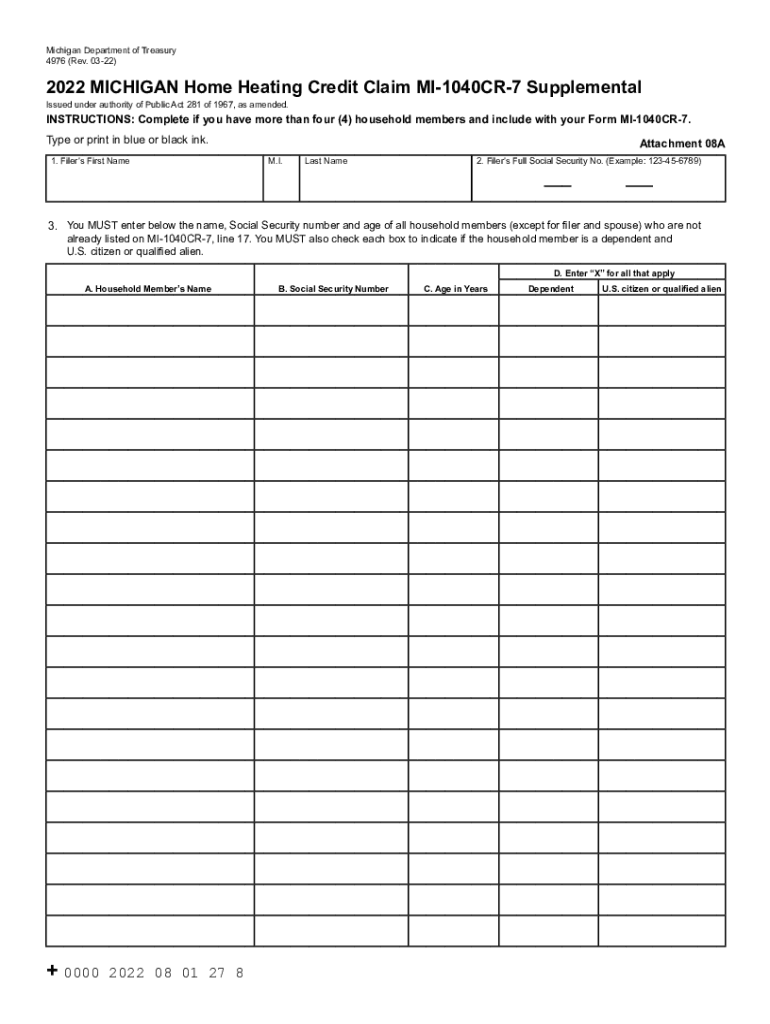

4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemental 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemen 2022

Understanding the Home Heating Credit Supplemental Form 4976

The Home Heating Credit Supplemental form, officially known as Form 4976, is a crucial document for residents of Michigan seeking financial assistance with their home heating costs. This form allows eligible individuals to claim credits that can significantly reduce their heating expenses, especially during the colder months. Understanding the purpose and function of this form is essential for those looking to benefit from state assistance programs.

Steps to Complete the Home Heating Credit Supplemental Form 4976

Completing Form 4976 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income, heating costs, and any other relevant financial information. Next, fill out the form by providing personal details, such as your name, address, and Social Security number. Make sure to accurately report your heating expenses and household income. Finally, review the completed form for any errors before submission to avoid delays in processing your claim.

Eligibility Criteria for the Home Heating Credit Supplemental

To qualify for the Home Heating Credit Supplemental, applicants must meet specific eligibility requirements set by the state of Michigan. Generally, eligibility is based on factors such as household income, the number of household members, and the type of heating used. It is important to check the latest guidelines from the Michigan Department of Treasury to determine if you meet the criteria for assistance.

Required Documents for Form 4976 Submission

When submitting the Home Heating Credit Supplemental form, certain documents are required to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns

- Documentation of heating costs, like utility bills

- Identification documents, such as a driver's license or Social Security card

Having these documents ready will facilitate a smoother application process and help ensure that your claim is processed in a timely manner.

Submission Methods for Form 4976

Form 4976 can be submitted through various methods, providing flexibility to applicants. You can choose to file the form online through the Michigan Department of Treasury's website, mail it to the designated address, or submit it in person at local offices. Each method has its own processing times, so consider your preferences and urgency when selecting a submission method.

Important Filing Deadlines for the Home Heating Credit Supplemental

Staying aware of filing deadlines is crucial for applicants of the Home Heating Credit Supplemental. Typically, the deadline for submitting the form coincides with the state tax filing deadline. It is advisable to check the Michigan Department of Treasury's website for the most current dates, as they can vary each year. Missing the deadline may result in the inability to claim the credit for that heating season.

Quick guide on how to complete 4976 michigan home heating credit claim mi 1040cr 7 supplemental 4976 michigan home heating credit claim mi 1040cr 7

Effortlessly Prepare 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemental 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemen on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemental 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemen on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Edit and eSign 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemental 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemen with Ease

- Find 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemental 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemen and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the document or obscure sensitive information with tools specifically available from airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemental 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemen while ensuring effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4976 michigan home heating credit claim mi 1040cr 7 supplemental 4976 michigan home heating credit claim mi 1040cr 7

Create this form in 5 minutes!

How to create an eSignature for the 4976 michigan home heating credit claim mi 1040cr 7 supplemental 4976 michigan home heating credit claim mi 1040cr 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a home heating credit supplemental?

A home heating credit supplemental helps eligible households cover their heating costs during the colder months. This credit can alleviate financial burdens by contributing to your home heating expenses, making it easier for families to manage their budgets.

-

How do I qualify for the home heating credit supplemental?

To qualify for the home heating credit supplemental, you usually need to meet certain income guidelines and residency requirements. Your local utility company or state agency can provide specific details on eligibility criteria and the application process.

-

What are the benefits of claiming a home heating credit supplemental?

Claiming a home heating credit supplemental can provide signNow financial relief, allowing you to allocate funds to other essential needs. Additionally, it promotes energy efficiency, ensuring that families stay warm during winter while managing their finances effectively.

-

How does the application process for the home heating credit supplemental work?

The application process for the home heating credit supplemental typically involves filling out a form and providing necessary documentation. It’s important to check the specific requirements in your area, which may vary by state and local jurisdiction.

-

Is there a deadline to apply for the home heating credit supplemental?

Yes, there are deadlines to apply for the home heating credit supplemental, which can vary by location. It’s crucial to stay informed about these deadlines to ensure you receive the financial support you need for your heating costs.

-

Will I receive the home heating credit supplemental as a one-time payment or monthly assistance?

The home heating credit supplemental may be provided as a one-time payment or monthly assistance, depending on your specific situation and local regulations. Some states offer a lump sum payment, while others may distribute benefits throughout the heating season.

-

How does the home heating credit supplemental impact my tax return?

Typically, the home heating credit supplemental does not count as taxable income, meaning it should not affect your tax return negatively. However, it’s always best to consult with a tax professional to understand the implications fully in your particular case.

Get more for 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemental 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemen

- Policy number gpt 4850908 her plaza ii 4100 medic form

- Information authorization form 6700

- Mobile food unit variance request template for a central form

- Etactics comblogpatient thank you letterperfect patient thank you letters 5 samples included etactics form

- Form 4120 day habilitation service delivery log form 4120 day habilitation service delivery log

- Adolescentintakeform nancy stroud lcsw rrt

- Fillable online austin thyroid ampamp endocrinology fax email form

- Form 5513 natcep request to take the competency evaluation program

Find out other 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemental 4976, MICHIGAN Home Heating Credit Claim MI 1040CR 7 Supplemen

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template