Home Depot Tax Exempt 2016

What is the Home Depot Tax Exempt

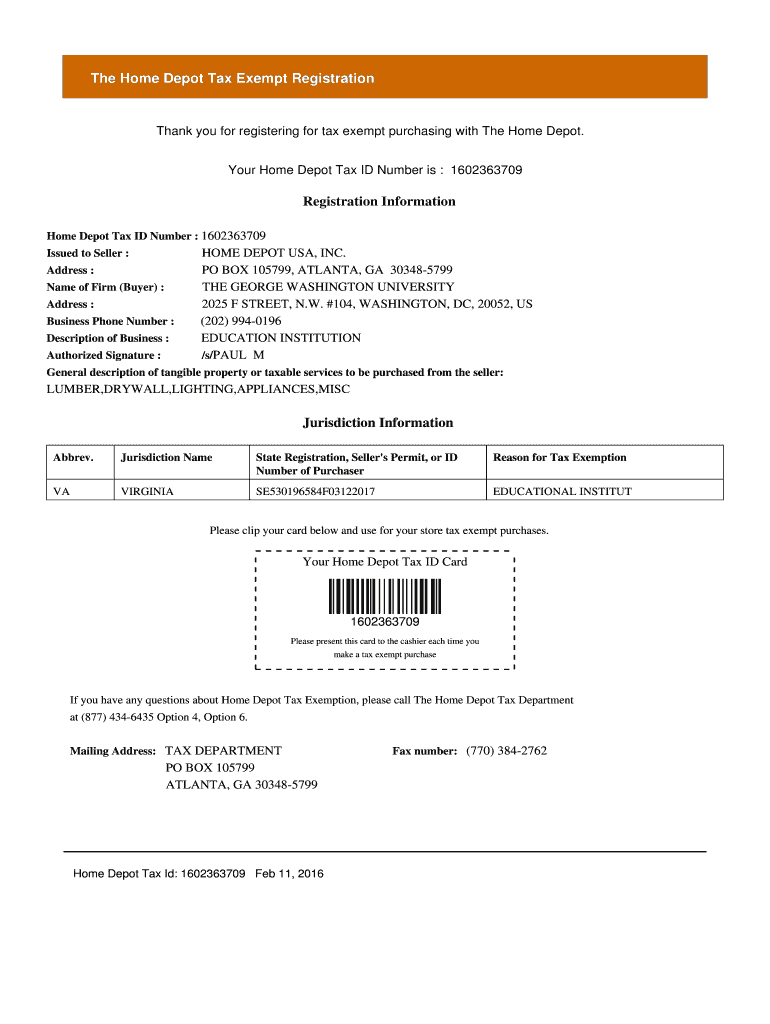

The Home Depot Tax Exempt program allows eligible organizations, such as non-profits and government entities, to make purchases without paying sales tax. This program is designed to support organizations that operate under specific tax exemptions recognized by state and federal laws. By obtaining a Home Depot tax exemption certificate, qualified entities can save on costs associated with purchasing materials and supplies necessary for their operations.

How to Obtain the Home Depot Tax Exempt

To obtain a Home Depot tax exempt status, organizations must complete a specific application process. This typically involves providing documentation that verifies the organization’s tax-exempt status, such as the IRS determination letter or a state-issued tax exemption certificate. After submitting the necessary paperwork, the organization will receive a Home Depot tax exempt ID number, which must be presented during purchases to avoid sales tax.

Steps to Complete the Home Depot Tax Exempt

Completing the Home Depot tax exempt process involves several key steps:

- Gather required documentation, including proof of tax-exempt status.

- Complete the Home Depot tax exemption certificate form accurately.

- Submit the completed form along with supporting documents to Home Depot.

- Receive confirmation of your tax exempt status and ID number.

- Use the tax exempt ID number during purchases to ensure no sales tax is applied.

Key Elements of the Home Depot Tax Exempt

Understanding the key elements of the Home Depot tax exempt program is essential for compliance and effective use. Important aspects include:

- Eligibility criteria, which typically require organizations to be recognized as tax-exempt by the IRS or state.

- Documentation requirements, including proof of tax-exempt status.

- Proper usage of the tax exempt ID number at the point of sale to avoid sales tax.

Legal Use of the Home Depot Tax Exempt

The legal use of the Home Depot tax exempt program is governed by state and federal tax laws. Organizations must ensure that they are using the exemption solely for eligible purchases related to their exempt purpose. Misuse of the tax exempt status can lead to penalties, including back taxes owed and potential fines. It is crucial for organizations to stay informed about the legal requirements and maintain accurate records of their tax exempt purchases.

Required Documents

When applying for the Home Depot tax exempt program, organizations must provide specific documents to verify their eligibility. Required documents typically include:

- IRS determination letter confirming tax-exempt status.

- State-issued tax exemption certificate, if applicable.

- Completed Home Depot tax exemption certificate form.

Quick guide on how to complete home depot tax exempt

Effortlessly Complete Home Depot Tax Exempt on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Home Depot Tax Exempt on any platform using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to Modify and eSign Home Depot Tax Exempt with Ease

- Locate Home Depot Tax Exempt and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Home Depot Tax Exempt and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct home depot tax exempt

Create this form in 5 minutes!

How to create an eSignature for the home depot tax exempt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Home Depot tax ID number and why is it important?

A Home Depot tax ID number is a unique identifier issued to businesses and individuals for tax purposes when making purchases or applying for credit. It helps track tax obligations and ensures compliance with federal and state regulations. Using the correct Home Depot tax ID number can streamline your transactions and prevent tax-related issues.

-

How can I obtain a Home Depot tax ID number?

To obtain a Home Depot tax ID number, businesses typically need to register with the IRS by applying for an Employer Identification Number (EIN). You may also need to provide necessary documentation that verifies your business status. Once you receive your EIN, you can use it as your Home Depot tax ID number for all relevant transactions.

-

Does airSlate SignNow allow me to sign documents associated with my Home Depot tax ID number?

Yes, airSlate SignNow enables you to easily send and eSign documents that require your Home Depot tax ID number. Our platform simplifies the document management process, making it convenient to include tax information securely. You can trust that all your transactions remain organized and compliant.

-

What are the benefits of using airSlate SignNow with my Home Depot tax ID number?

Using airSlate SignNow with your Home Depot tax ID number streamlines the eSigning process, ensuring that your documents are processed quickly and accurately. Our user-friendly platform helps reduce delays and errors related to tax documentation. Additionally, it offers enhanced security features to protect your sensitive information, including tax ID data.

-

Is there a cost associated with using airSlate SignNow for my Home Depot tax ID number?

AirSlate SignNow offers a variety of pricing plans to accommodate businesses of all sizes. Depending on your needs, there may be a subscription fee for using our services, but the efficiency gained from digital signing often outweighs the cost. Plus, with airSlate SignNow, you gain access to features that help manage your Home Depot tax ID number seamlessly.

-

Can I integrate airSlate SignNow with other financial tools when using my Home Depot tax ID number?

Yes, airSlate SignNow integrates seamlessly with numerous financial and accounting tools, making it easy to manage documents that involve your Home Depot tax ID number. By integrating our platform, you can automate workflows and enhance productivity, simplifying your tax management and documentation processes.

-

What types of documents can I sign related to my Home Depot tax ID number?

With airSlate SignNow, you can electronically sign various types of documents that require your Home Depot tax ID number, including purchase orders, supplier agreements, and tax exemption certificates. This ensures that all your business paperwork is processed efficiently online. Our platform supports a wide range of document formats for your convenience.

Get more for Home Depot Tax Exempt

Find out other Home Depot Tax Exempt

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer