Www Taxformfinder Orgforms20142014 Michigan Home Heating Credit Claim MI 1040CR 7 2021

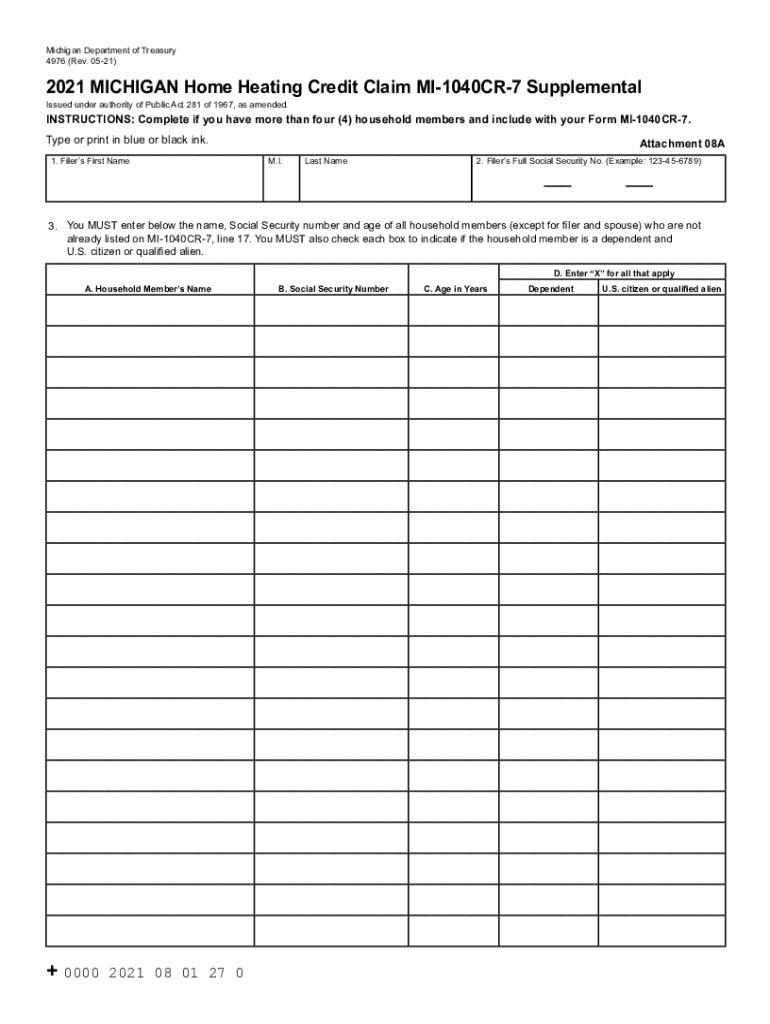

What is the home heating credit supplemental?

The home heating credit supplemental is a financial assistance program designed to help eligible households in the United States with their heating costs. This program provides credits to low-income individuals and families to ease the burden of heating expenses during the colder months. The credit is typically applied to the household's energy bill, ensuring that those in need can maintain a warm living environment without facing financial hardship.

Eligibility criteria for the home heating credit supplemental

To qualify for the home heating credit supplemental, applicants must meet specific income guidelines set by their state. Generally, eligibility is based on household size and total income, which should fall below a certain threshold. Additionally, applicants must be responsible for paying heating costs, either directly or through rental agreements. It is essential to review state-specific requirements, as they may vary.

Steps to complete the home heating credit supplemental

Completing the home heating credit supplemental form involves several key steps:

- Gather necessary documentation, including proof of income, identification, and heating bills.

- Obtain the appropriate form, which may be available online or through local government offices.

- Fill out the form accurately, ensuring all required information is provided.

- Submit the completed form along with any supporting documents by the designated deadline.

Taking these steps can help ensure that your application is processed smoothly and efficiently.

Required documents for the home heating credit supplemental

When applying for the home heating credit supplemental, several documents are typically required:

- Proof of income, such as pay stubs or tax returns.

- Identification, which may include a driver's license or Social Security card.

- Heating bills or statements that confirm the household's heating costs.

Having these documents ready can expedite the application process and increase the likelihood of approval.

Form submission methods for the home heating credit supplemental

Applicants can submit the home heating credit supplemental form through various methods, including:

- Online submission via the state’s designated website.

- Mailing the completed form to the appropriate government office.

- In-person submission at local assistance offices.

Each method has its advantages, and applicants should choose the one that best suits their needs and circumstances.

Filing deadlines for the home heating credit supplemental

Filing deadlines for the home heating credit supplemental vary by state, but they typically align with the heating season. It is crucial to check specific deadlines to ensure timely submission of applications. Missing the deadline may result in the denial of assistance, so staying informed about these dates is essential for eligible households.

Quick guide on how to complete wwwtaxformfinderorgforms20142014 michigan home heating credit claim mi 1040cr 7

Complete Www taxformfinder orgforms20142014 Michigan Home Heating Credit Claim MI 1040CR 7 easily on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed forms, as you can locate the appropriate document and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Www taxformfinder orgforms20142014 Michigan Home Heating Credit Claim MI 1040CR 7 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Www taxformfinder orgforms20142014 Michigan Home Heating Credit Claim MI 1040CR 7 effortlessly

- Obtain Www taxformfinder orgforms20142014 Michigan Home Heating Credit Claim MI 1040CR 7 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of the documents or conceal sensitive information with the tools that airSlate SignNow supplies expressly for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Www taxformfinder orgforms20142014 Michigan Home Heating Credit Claim MI 1040CR 7 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxformfinderorgforms20142014 michigan home heating credit claim mi 1040cr 7

Create this form in 5 minutes!

People also ask

-

What is the home heating credit supplemental?

The home heating credit supplemental is a financial assistance program designed to help eligible households cover the costs of their heating expenses. It provides supplemental financial support for those facing higher energy bills during colder months. By utilizing this credit, families can alleviate some of their financial burdens associated with heating.

-

Who qualifies for the home heating credit supplemental?

Eligibility for the home heating credit supplemental typically includes low-income households that meet specific income and resource guidelines. Factors such as family size and heating costs can influence eligibility. It’s recommended to check your local state requirements for detailed qualification criteria.

-

How can I apply for the home heating credit supplemental?

To apply for the home heating credit supplemental, you can usually complete an application form through your state’s energy assistance program. Many states offer online applications for ease of access. Make sure to have your household income details and heating costs available to complete your application accurately.

-

What are the benefits of the home heating credit supplemental?

The home heating credit supplemental provides signNow financial relief during cold weather months, allowing families to prioritize essential needs. It can help in reducing the risk of utility disconnections, ensuring that you stay warm throughout winter. This credit also supports overall energy efficiency and well-being for participating households.

-

Is the home heating credit supplemental a one-time benefit?

The home heating credit supplemental can vary in terms of availability and how often you can receive benefits. Some programs offer it as a one-time benefit for the heating season, while others may provide recurring assistance annually. It’s important to check with your local agency for specific details regarding the duration of benefits.

-

How does the home heating credit supplemental impact my taxes?

Generally, the home heating credit supplemental does not need to be reported as taxable income, as it is considered a form of assistance rather than income. However, tax regulations can vary by state, so it’s advisable to consult with a tax professional for accurate guidance. This ensures that you remain compliant while benefiting from the credits.

-

Can I receive the home heating credit supplemental and other forms of assistance?

Yes, in many cases, you can receive the home heating credit supplemental alongside other forms of financial assistance, such as federal aid or local energy assistance programs. This combination can signNowly enhance your support during challenging financial periods. Always check for program compatibility and requirements to maximize your benefits.

Get more for Www taxformfinder orgforms20142014 Michigan Home Heating Credit Claim MI 1040CR 7

- Scheduling order agreement form

- Mississippi agreement purchase form

- Addendum to commercial lease mississippi form

- Amended and restated security agreement mississippi form

- Answer garnishment form

- Affidavit in support of default regarding tax sale mississippi form

- Ms purchase sale form

- Annual account and petition for approval mississippi form

Find out other Www taxformfinder orgforms20142014 Michigan Home Heating Credit Claim MI 1040CR 7

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation