Wine and Mixed Beverage Tax Return for A2 B2a and or Form

What is the Wine And Mixed Beverage Tax Return For A2 B2a And Or

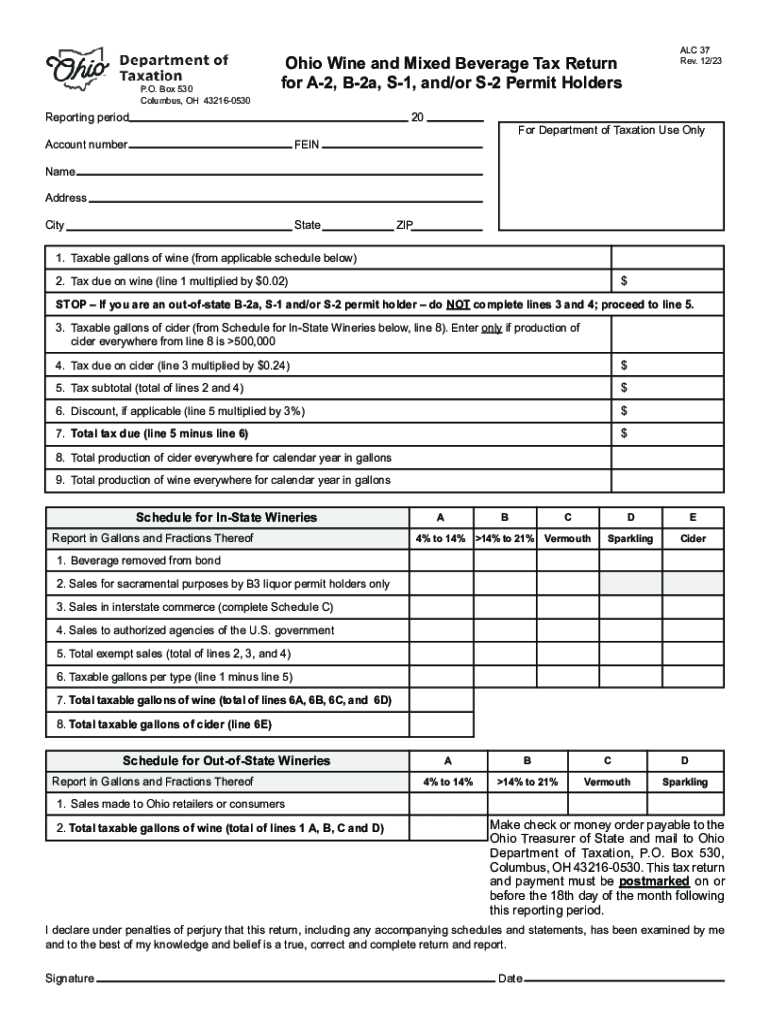

The Wine And Mixed Beverage Tax Return For A2 B2a And Or is a tax document used by businesses involved in the production, distribution, or sale of alcoholic beverages. This form is essential for reporting the excise taxes owed to the federal government on wine and mixed beverages. It includes details about the quantity of products sold, the applicable tax rates, and the total tax liability. Understanding this form is crucial for compliance with federal tax regulations, ensuring that businesses meet their financial obligations accurately and on time.

How to use the Wine And Mixed Beverage Tax Return For A2 B2a And Or

Using the Wine And Mixed Beverage Tax Return For A2 B2a And Or involves several steps to ensure accurate reporting. First, gather all relevant sales data, including the volume of wine and mixed beverages sold during the reporting period. Next, calculate the total excise tax based on the applicable rates for different types of beverages. Once the calculations are complete, fill out the form with the necessary information, including your business details and tax calculations. Finally, submit the form to the appropriate federal agency by the specified deadline to avoid penalties.

Steps to complete the Wine And Mixed Beverage Tax Return For A2 B2a And Or

Completing the Wine And Mixed Beverage Tax Return For A2 B2a And Or involves a systematic approach:

- Collect sales records for the reporting period.

- Determine the applicable tax rates for each type of beverage.

- Calculate the total excise tax owed based on sales volume.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors before submission.

- Submit the form electronically or by mail, as per the guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Wine And Mixed Beverage Tax Return For A2 B2a And Or are crucial for compliance. Generally, the form must be filed on a monthly basis, with specific deadlines falling on the last day of each month for the previous month's sales. It is important to keep track of these dates to avoid late fees and penalties. Additionally, businesses should be aware of any changes in deadlines that may occur due to holidays or other factors.

Required Documents

To complete the Wine And Mixed Beverage Tax Return For A2 B2a And Or, certain documents are necessary. These typically include:

- Sales records detailing the quantity of wine and mixed beverages sold.

- Tax rate schedules applicable to the products sold.

- Any previous tax returns for reference.

- Business identification information, such as an Employer Identification Number (EIN).

Penalties for Non-Compliance

Failure to comply with the requirements of the Wine And Mixed Beverage Tax Return For A2 B2a And Or can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is essential for businesses to adhere to filing deadlines and ensure the accuracy of their tax returns to avoid these consequences.

Quick guide on how to complete wine and mixed beverage tax return for a2 b2a and or

Complete Wine And Mixed Beverage Tax Return For A2 B2a And Or seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers you all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Wine And Mixed Beverage Tax Return For A2 B2a And Or on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The most efficient way to edit and eSign Wine And Mixed Beverage Tax Return For A2 B2a And Or effortlessly

- Find Wine And Mixed Beverage Tax Return For A2 B2a And Or and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive content with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Alter and eSign Wine And Mixed Beverage Tax Return For A2 B2a And Or and guarantee efficient communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wine and mixed beverage tax return for a2 b2a and or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wine And Mixed Beverage Tax Return For A2 B2a And Or?

The Wine And Mixed Beverage Tax Return For A2 B2a And Or is a specific form that businesses need to complete and submit to comply with tax regulations concerning wine and mixed beverages. This tax return ensures that businesses accurately report their production and sales figures, thus maintaining compliance with state and federal requirements.

-

How can airSlate SignNow assist with the Wine And Mixed Beverage Tax Return For A2 B2a And Or?

AirSlate SignNow streamlines the process of sending and electronically signing the Wine And Mixed Beverage Tax Return For A2 B2a And Or. Our platform makes it easy to prepare, sign, and submit documents electronically, ensuring that your tax return is filed quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for Wine And Mixed Beverage Tax Return For A2 B2a And Or?

AirSlate SignNow offers various pricing plans to accommodate different business needs, including plans tailored for small businesses and larger enterprises. You can choose a plan that fits your budget while still benefiting from our features targeted at managing the Wine And Mixed Beverage Tax Return For A2 B2a And Or.

-

Is it easy to integrate airSlate SignNow with other software for managing the Wine And Mixed Beverage Tax Return For A2 B2a And Or?

Yes, airSlate SignNow seamlessly integrates with a variety of software solutions, making it easier to manage your Wine And Mixed Beverage Tax Return For A2 B2a And Or along with your other business operations. Our integrations ensure that data flows smoothly between platforms, improving your overall efficiency.

-

What features does airSlate SignNow offer for effectively handling the Wine And Mixed Beverage Tax Return For A2 B2a And Or?

AirSlate SignNow includes features like customizable templates, real-time tracking, and automated reminders that help simplify the management of the Wine And Mixed Beverage Tax Return For A2 B2a And Or. These tools ensure that your documentation process is not only efficient but also compliant with regulatory standards.

-

Can airSlate SignNow help ensure compliance when submitting the Wine And Mixed Beverage Tax Return For A2 B2a And Or?

Yes, airSlate SignNow offers features designed to help ensure compliance when submitting the Wine And Mixed Beverage Tax Return For A2 B2a And Or. With eSignature capabilities and compliance checks, our platform helps mitigate risks associated with tax filing.

-

What benefits can businesses expect when using airSlate SignNow for their tax returns?

Using airSlate SignNow for your Wine And Mixed Beverage Tax Return For A2 B2a And Or provides numerous benefits, such as reduced processing times, improved accuracy, and the ability to track document status in real-time. This efficiency ultimately saves your business time and resources, allowing you to focus on growth.

Get more for Wine And Mixed Beverage Tax Return For A2 B2a And Or

- Sampleaffidavit for marriage license applicant i form

- Attorney39s name arizona superior court in pima county sc pima form

- Foia request form gloucester county virginia

- Form of identification 23517570

- Affidavit of indigency lake county ohio gt home form

- Person making statement renopd com form

- Justice court henderson township clark county neva form

- Certificate of fictitious name for individual b form

Find out other Wine And Mixed Beverage Tax Return For A2 B2a And Or

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors