State of Maine Estimated Tax for Individuals Form 1040es

Understanding the Arizona 140ES Form

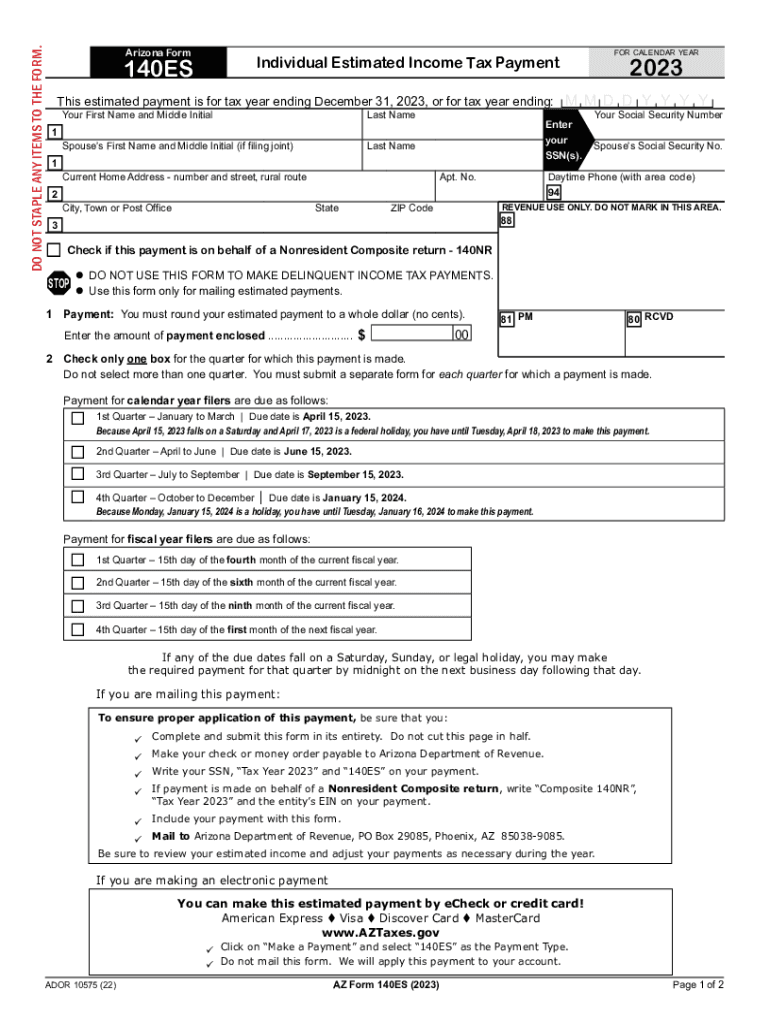

The Arizona 140ES form is used for making estimated tax payments for individuals in the state of Arizona. This form is essential for those who anticipate owing tax of $1,000 or more when they file their annual return. It helps taxpayers manage their tax liabilities throughout the year rather than facing a large payment at tax time.

How to Complete the Arizona 140ES Form

To fill out the Arizona 140ES form, begin by providing your personal information, including your name, address, and Social Security number. Next, calculate your estimated tax liability for the year based on your expected income, deductions, and credits. The form includes sections to report your estimated tax payments for each quarter, ensuring you meet your tax obligations timely.

Filing Deadlines for the Arizona 140ES Form

It is crucial to adhere to the filing deadlines for the Arizona 140ES form to avoid penalties. Payments are typically due on the 15th of April, June, September, and January of the following year. Mark these dates on your calendar to ensure timely submission and maintain compliance with Arizona tax regulations.

Submission Methods for the Arizona 140ES Form

The Arizona 140ES form can be submitted in several ways. Taxpayers can mail the completed form to the Arizona Department of Revenue or make payments online through the state’s tax portal. This flexibility allows individuals to choose the method that best suits their preferences and ensures that payments are processed efficiently.

Key Elements of the Arizona 140ES Form

The Arizona 140ES form includes several key elements that taxpayers must understand. These elements consist of personal identification information, estimated tax calculations, payment amounts for each quarter, and instructions for submission. Familiarizing yourself with these components can simplify the filing process and enhance accuracy.

Consequences of Non-Compliance with the Arizona 140ES Form

Failure to file or pay estimated taxes using the Arizona 140ES form can lead to penalties and interest charges. The Arizona Department of Revenue may assess a penalty for underpayment or late payment, which can increase your overall tax liability. Staying compliant is essential to avoid these additional costs and maintain a good standing with tax authorities.

Quick guide on how to complete state of maine estimated tax for individuals form 1040es

Easily Prepare State Of Maine Estimated Tax For Individuals Form 1040es on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers a sustainable alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage State Of Maine Estimated Tax For Individuals Form 1040es on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign State Of Maine Estimated Tax For Individuals Form 1040es Effortlessly

- Locate State Of Maine Estimated Tax For Individuals Form 1040es and click Get Form to initiate the process.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or conceal sensitive data with the features that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign State Of Maine Estimated Tax For Individuals Form 1040es while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of maine estimated tax for individuals form 1040es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Arizona estimated tax payment?

An Arizona estimated tax payment is a method for taxpayers to pay their expected state income tax liability throughout the year, rather than in a lump sum during tax season. This approach helps prevent underpayment penalties and ensures you stay compliant with Arizona tax laws. Using tools like airSlate SignNow can streamline the process of submitting necessary documents related to these payments.

-

How can airSlate SignNow assist with Arizona estimated tax payment submissions?

airSlate SignNow simplifies the process of submitting documents needed for Arizona estimated tax payments by allowing users to easily eSign and send forms electronically. This not only saves time but also ensures that your payments are documented and submitted securely. With airSlate SignNow, all your tax-related documents can be managed efficiently in one place.

-

What are the deadlines for Arizona estimated tax payments?

Arizona estimated tax payments are typically due four times a year: on April 15, June 15, September 15, and January 15 of the following year. It's essential to pay your estimated taxes by these deadlines to avoid penalties. Leveraging airSlate SignNow can help you keep track of these dates and ensure timely submission of all related documents.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document management, electronic signatures, and automated reminders to help users effectively manage their tax documents, including Arizona estimated tax payments. These features enhance efficiency and reduce the risk of errors or missed deadlines. With airSlate SignNow, you can stay organized and focused on your business instead of worrying about paper forms.

-

Is airSlate SignNow cost-effective for small businesses handling Arizona estimated tax payments?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing Arizona estimated tax payments and other document needs. It provides affordable pricing options that cater to various business sizes, without compromising on essential features. Investing in airSlate SignNow can lead to signNow time savings and efficiency gains for your tax management processes.

-

Can airSlate SignNow integrate with accounting software for Arizona tax management?

Absolutely! airSlate SignNow can integrate with popular accounting software, making it easier to manage Arizona estimated tax payments alongside your financial data. These integrations streamline the workflow by allowing users to access and share tax-related documents directly within their accounting systems. This capability enhances overall productivity and accuracy in financial reporting.

-

What are the benefits of eSigning tax documents for Arizona estimated tax payments?

eSigning tax documents simplifies and expedites the submission process for Arizona estimated tax payments, allowing for immediate confirmation and tracking of your submissions. It also reduces paperwork and the risks associated with lost or delayed mail. With airSlate SignNow, you can confidently eSign your documents from anywhere, ensuring compliance and security.

Get more for State Of Maine Estimated Tax For Individuals Form 1040es

Find out other State Of Maine Estimated Tax For Individuals Form 1040es

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy