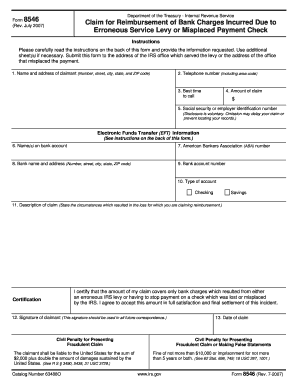

Irs Form 8546

What is the IRS Form 8546

The IRS Form 8546 is a specific document utilized for tax purposes, primarily focusing on the reporting of certain transactions. This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It provides the IRS with necessary information regarding specific financial activities, helping to maintain transparency and accuracy in tax reporting.

How to use the IRS Form 8546

Using the IRS Form 8546 involves several steps to ensure accurate completion. First, gather all relevant financial documents that pertain to the transactions you need to report. Next, carefully fill out the form, ensuring that all required fields are completed with accurate information. After completing the form, review it for any errors before submission. It is advisable to keep a copy for your records.

Steps to complete the IRS Form 8546

Completing the IRS Form 8546 requires attention to detail. Follow these steps:

- Obtain the form from the IRS website or your tax professional.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the transactions you are reporting, ensuring all amounts are accurate.

- Sign and date the form to certify that the information is correct.

- Submit the form as per the instructions provided, either electronically or via mail.

Legal use of the IRS Form 8546

The IRS Form 8546 is legally binding when filled out correctly and submitted in accordance with IRS guidelines. Compliance with tax laws is crucial, as failure to submit this form or providing inaccurate information can lead to penalties. It is important to understand the legal implications of the information reported on this form, as it may be subject to review by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8546 vary depending on the type of transaction being reported. Generally, forms must be submitted by the tax filing deadline, which is typically April fifteenth for individual taxpayers. It is important to stay informed about any changes to deadlines or specific requirements that may apply to your situation.

Required Documents

When preparing to complete the IRS Form 8546, gather the necessary documents to support the information you will report. This may include:

- Financial statements related to the transactions.

- Receipts or invoices that provide proof of the amounts reported.

- Any correspondence from the IRS regarding previous filings.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 8546 can be submitted through various methods, depending on your preference and the requirements of the IRS. Options include:

- Online submission through the IRS e-filing system, which is often the quickest method.

- Mailing the completed form to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated IRS offices, though this may require an appointment.

Quick guide on how to complete irs form 8546

Effortlessly Prepare Irs Form 8546 on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly solution to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without any delays. Manage Irs Form 8546 on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Alter and Electronically Sign Irs Form 8546 with Ease

- Locate Irs Form 8546 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark pertinent sections of the documents or conceal sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere moments and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misfiled documents, annoying form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Irs Form 8546 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8546

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8546 used for?

Form 8546 is utilized for various certification processes within businesses, providing a streamlined way to manage and authorize agreements electronically. By using airSlate SignNow, you can easily fill out and eSign Form 8546, ensuring compliance and reducing paperwork.

-

How does airSlate SignNow handle Form 8546 signing?

With airSlate SignNow, signing Form 8546 is a hassle-free process. Users can upload the form, add necessary fields, and send it for eSignature within minutes, ensuring swift approval without the need for printing or scanning.

-

Is there a cost associated with eSigning Form 8546 using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, allowing you to eSign Form 8546 at a cost-effective rate. The affordability ensures that even small businesses can take advantage of efficient document management solutions.

-

What features does airSlate SignNow offer for Form 8546 users?

airSlate SignNow provides a variety of features for Form 8546 users, including customizable templates, automated workflows, and real-time tracking. These functionalities help streamline the signing process and enhance overall productivity.

-

Can I integrate airSlate SignNow with other applications for handling Form 8546?

Absolutely! airSlate SignNow supports integrations with many popular applications, enabling seamless handling of Form 8546. This compatibility allows you to synchronize data and workflows across different platforms for enhanced efficiency.

-

What are the benefits of using airSlate SignNow for Form 8546?

Using airSlate SignNow for Form 8546 offers numerous benefits, including reduced turnaround time, improved security, and better organization of documents. The electronic signing process minimizes errors, ensuring that your form is completed correctly.

-

Is airSlate SignNow secure for eSigning Form 8546?

Yes, airSlate SignNow prioritizes security, employing industry-leading encryption methods to safeguard your Form 8546 and sensitive data. Compliance with security standards ensures that your documents remain protected throughout the signing process.

Get more for Irs Form 8546

- Business recovery grant ncdor form

- Wwwncdorgov media 11655north carolina department of revenue third party ncdorgov form

- Wwwncdorgov media 1143north carolina department of revenue ncdorgov form

- E 585 form

- Form e 585 nonprofit and governmental entity claim for

- Case 15 16885 lmi doc 195 filed 050615 page 1 of 281 form

- Hm revenue and customs self assessment form

- Budget message fiscal year 2019 2020 town of form

Find out other Irs Form 8546

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien