Taxes for Individuals Georgia Department of Revenue Form

What is the 2023 IT 511 Tax Form?

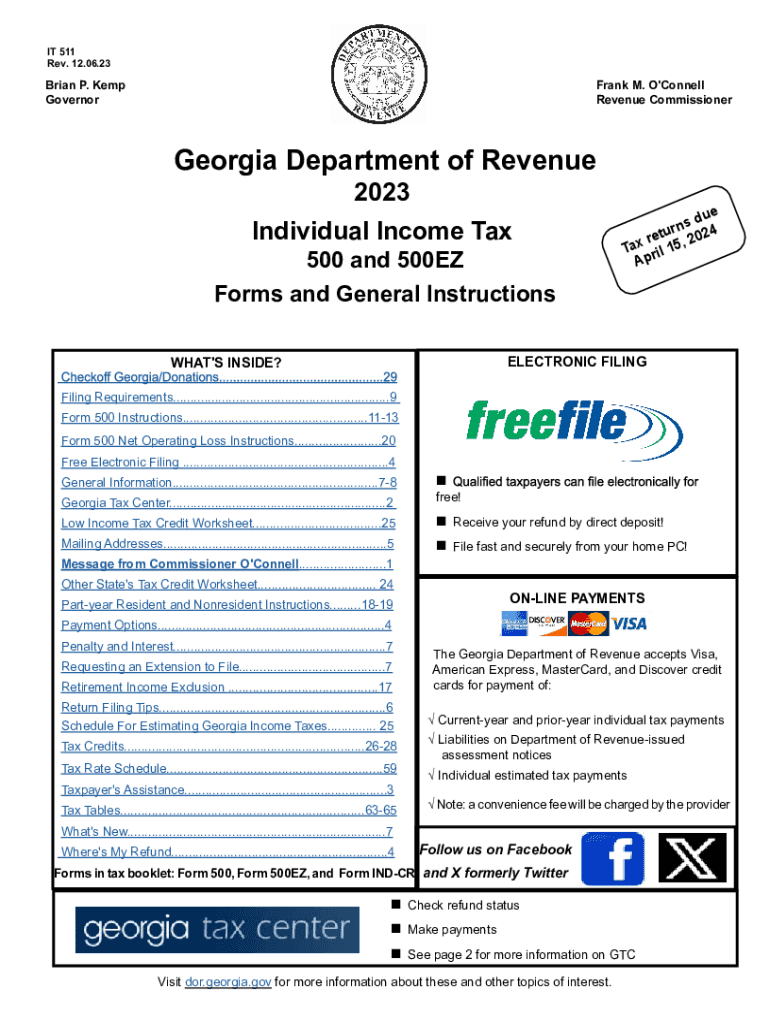

The 2023 IT 511 tax form is a state income tax return used by residents of Georgia to report their income and calculate their tax liability. This form is specifically designed for individual taxpayers and is an essential document for filing state taxes. It includes sections for reporting various types of income, deductions, and credits that may apply to the taxpayer's situation.

Steps to Complete the 2023 IT 511 Tax Form

Completing the 2023 IT 511 tax form involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy in calculations.

- Claim any eligible deductions or credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submission.

Filing Deadlines for the 2023 IT 511 Tax Form

The deadline for filing the 2023 IT 511 tax form is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to file on time to avoid penalties and interest on any owed taxes.

Required Documents for Filing the 2023 IT 511 Tax Form

To accurately complete the 2023 IT 511 tax form, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Form Submission Methods for the 2023 IT 511 Tax Form

The 2023 IT 511 tax form can be submitted through various methods:

- Online filing through the Georgia Department of Revenue website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices.

Penalties for Non-Compliance with the 2023 IT 511 Tax Form

Failure to file the 2023 IT 511 tax form on time can result in penalties, including:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, which is charged monthly.

- Potential legal action for severe cases of non-compliance.

Quick guide on how to complete taxes for individuals georgia department of revenue

Prepare Taxes For Individuals Georgia Department Of Revenue effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely retain it online. airSlate SignNow provides all the resources you require to design, alter, and eSign your documents promptly without delays. Manage Taxes For Individuals Georgia Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest method to modify and eSign Taxes For Individuals Georgia Department Of Revenue without hassle

- Acquire Taxes For Individuals Georgia Department Of Revenue and click on Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Taxes For Individuals Georgia Department Of Revenue while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxes for individuals georgia department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2023 Georgia 500 instructions?

The 2023 Georgia 500 instructions provide detailed guidelines on how to properly complete and submit the Georgia 500 form. This includes information on eligibility, required documents, and deadlines. Understanding these instructions is essential to ensure compliance and avoid errors in your submissions.

-

How can airSlate SignNow help with the 2023 Georgia 500 instructions?

airSlate SignNow simplifies the process of preparing and eSigning documents related to the 2023 Georgia 500 instructions. With our user-friendly platform, you can quickly create, edit, and send your forms securely online. This helps you save time and reduces the risk of errors in your important submissions.

-

Are there any costs associated with using airSlate SignNow for 2023 Georgia 500 instructions?

airSlate SignNow offers a variety of pricing plans designed to meet different needs, including free trials and affordable subscriptions. Utilizing our platform to manage your 2023 Georgia 500 instructions can help reduce administrative costs. Explore our pricing options to find the plan that works best for you.

-

What features does airSlate SignNow offer for the 2023 Georgia 500 instructions?

airSlate SignNow includes key features such as document templates, secure eSigning, and real-time collaboration tools. These features facilitate easier management of the 2023 Georgia 500 instructions and enhance overall efficiency. You can also track document statuses to ensure timely submissions.

-

Can airSlate SignNow integrate with other software for the 2023 Georgia 500 instructions?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow when dealing with the 2023 Georgia 500 instructions. Whether you use CRM systems or cloud storage solutions, our integrations help streamline your processes. This ensures you have everything you need at your fingertips.

-

What are the benefits of using airSlate SignNow for the 2023 Georgia 500 instructions?

Using airSlate SignNow for the 2023 Georgia 500 instructions offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your documents from anywhere, ensuring you have access when needed. Additionally, our user-friendly interface makes the entire process hassle-free.

-

Is support available for questions about the 2023 Georgia 500 instructions?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions regarding the 2023 Georgia 500 instructions. Our knowledgeable team is available through various channels to ensure you have the help you need for a smooth document management experience.

Get more for Taxes For Individuals Georgia Department Of Revenue

- Mc mcd ins signature form ncas nevada county ambulance

- Patient information form 388330372

- Authorization for release of information form roi chase brexton

- Confidential patient information allexi chiropractic and acupuncture

- Return to work form bellin hospital

- Informed consent and release of liability utah dcfs utah

- Dhs code of conduct form

- Nelson labs sample submission form

Find out other Taxes For Individuals Georgia Department Of Revenue

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF