Dr 0021w Colorado Form

What is the Dr 0021w Colorado Form

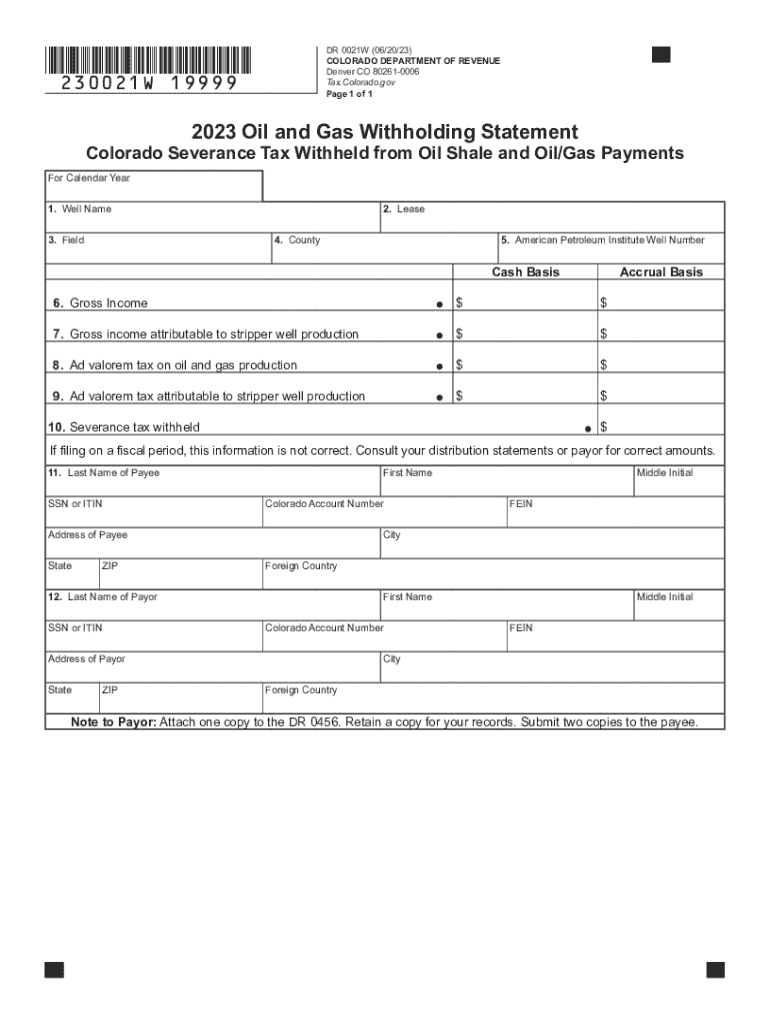

The Dr 0021w Colorado form, also known as the Colorado Withholding Statement, is a tax document used primarily in the oil and gas industry. This form is essential for reporting state income tax withholding on payments made to non-resident individuals or entities. It ensures compliance with Colorado tax laws and helps facilitate the proper collection of state taxes from income generated within Colorado.

How to use the Dr 0021w Colorado Form

To effectively use the Dr 0021w Colorado form, businesses must complete it accurately to report the amount of state income tax withheld from payments. The form is typically submitted to the Colorado Department of Revenue. It is important to ensure that all required fields are filled out correctly, including the payer's information, payee details, and the total amount withheld. This form aids in maintaining transparency and compliance with state tax regulations.

Steps to complete the Dr 0021w Colorado Form

Completing the Dr 0021w Colorado form involves several key steps:

- Gather necessary information, including payer and payee details.

- Input the total payments made to the payee during the tax year.

- Calculate the amount of state income tax that has been withheld.

- Review the form for accuracy and completeness.

- Submit the form to the Colorado Department of Revenue by the appropriate deadline.

Legal use of the Dr 0021w Colorado Form

The legal use of the Dr 0021w Colorado form is crucial for ensuring compliance with state tax laws. It is required for businesses making payments to non-residents who are subject to Colorado state income tax withholding. Failure to use this form correctly can result in penalties or fines, highlighting the importance of understanding its legal implications and requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Dr 0021w Colorado form are typically aligned with the state’s tax calendar. It is essential for businesses to be aware of these deadlines to avoid late penalties. Generally, the form must be submitted by January 31 of the year following the tax year in which the payments were made. Keeping track of these dates ensures timely compliance with Colorado tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Dr 0021w Colorado form can be submitted through various methods, providing flexibility for businesses. It can be filed online through the Colorado Department of Revenue's e-filing system, mailed directly to the department, or delivered in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the business's needs.

Quick guide on how to complete dr 0021w colorado form

Prepare Dr 0021w Colorado Form seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, edit, and eSign your files quickly without delays. Manage Dr 0021w Colorado Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Dr 0021w Colorado Form effortlessly

- Locate Dr 0021w Colorado Form and click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure confidential details with tools that airSlate SignNow has specifically for that purpose.

- Create your signature using the Sign tool, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Dr 0021w Colorado Form and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0021w colorado form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of DR 0021W Colorado?

DR 0021W Colorado refers to a specific regulatory guideline that impacts the electronic signing of documents. Understanding this guideline is essential for businesses using eSignature solutions like airSlate SignNow. It helps ensure that your document transactions comply with state laws in Colorado.

-

How can airSlate SignNow assist with DR 0021W Colorado compliance?

airSlate SignNow provides features that streamline compliance with DR 0021W Colorado. Our platform ensures that all eSigned documents meet legal requirements, giving businesses peace of mind. By using our service, you can confidently manage your documents while adhering to necessary regulations.

-

What are the pricing options for airSlate SignNow under DR 0021W Colorado guidelines?

Our pricing for airSlate SignNow is competitive and designed to cater to businesses of all sizes looking to comply with DR 0021W Colorado. We offer various plans that include essential features for efficient signing while remaining cost-effective. You can choose a plan that fits your volume and specific needs.

-

What features does airSlate SignNow offer that align with DR 0021W Colorado?

airSlate SignNow includes features tailored to comply with DR 0021W Colorado, such as audit trails, robust security measures, and customizable workflows. These features enable businesses to maintain compliance and enhance the eSigning process. Our user-friendly interface ensures an efficient signing experience.

-

What are the benefits of using airSlate SignNow related to DR 0021W Colorado?

Using airSlate SignNow allows businesses to simplify the signing process while ensuring compliance with DR 0021W Colorado. The benefits include faster document turnaround, reduced manual errors, and enhanced security. Businesses can focus more on their core operations rather than worrying about compliance issues.

-

Can airSlate SignNow integrate with other platforms considering DR 0021W Colorado?

Yes, airSlate SignNow offers integrations with various platforms that can support your compliance with DR 0021W Colorado. This flexibility ensures that you can streamline operations and maintain a cohesive system for document management. Integrations with tools like CRM software enhance productivity while upholding compliance.

-

Is airSlate SignNow suitable for small businesses that need to comply with DR 0021W Colorado?

Absolutely! airSlate SignNow is perfectly suited for small businesses that require compliance with DR 0021W Colorado. Our affordable pricing and straightforward features make it easy for smaller organizations to access eSigning capabilities without overspending. It levels the playing field for all business sizes.

Get more for Dr 0021w Colorado Form

- Intake assessment childadolescent bethany form

- Nrr w 2 must be attached city of toledo form

- Gait trainer lmn sample inspired by drive form

- Hipaa notice of privacy practices dental andor vision 11276 pdf gr 79854 form

- Nemb notice of exclusions from medicare benefitsdoc form

- Fastaff travel nursing form

- Eff jan2019424 west obrien drive julale center su form

- Exhibit 1 242 fw 12 bloodborne pathogens exposure control plan fws form

Find out other Dr 0021w Colorado Form

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online