MI 1040ES, Michigan Estimated Income Tax for Individuals MI 1040ES, Michigan Estimated Income Tax for Individuals Form

Understanding the MI 1040ES

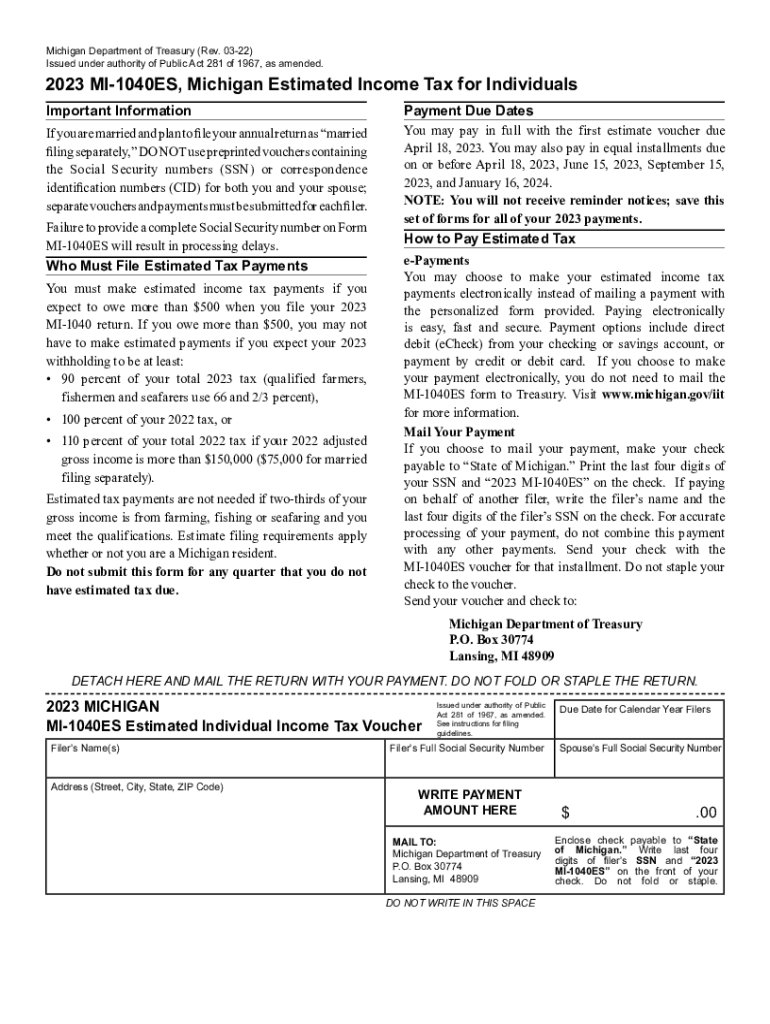

The MI 1040ES is a form used by individuals in Michigan to estimate their income tax obligations for the upcoming tax year. This form is essential for taxpayers who expect to owe a certain amount in state income tax and wish to make estimated payments throughout the year. By submitting the MI 1040ES, individuals can avoid penalties for underpayment and ensure they stay compliant with state tax regulations.

Steps to Complete the MI 1040ES

Completing the MI 1040ES involves several key steps:

- Gather your financial information, including income sources and deductions.

- Calculate your estimated taxable income for the year.

- Determine your estimated tax liability based on current Michigan tax rates.

- Complete the MI 1040ES form, entering your estimated income and tax amounts.

- Submit the form by the specified deadlines, along with any required payments.

Filing Deadlines for the MI 1040ES

It is important to be aware of the filing deadlines associated with the MI 1040ES. Generally, estimated tax payments are due on the following dates:

- April 15 for the first quarter payment

- June 15 for the second quarter payment

- September 15 for the third quarter payment

- January 15 of the following year for the fourth quarter payment

Filing on time helps avoid penalties and interest on unpaid taxes.

Key Elements of the MI 1040ES

The MI 1040ES includes several important sections that taxpayers must complete:

- Personal Information: Name, address, and Social Security number.

- Estimated Income: A section to report anticipated income from various sources.

- Estimated Tax Liability: Calculation of the expected tax based on income.

- Payment Information: Options for submitting estimated tax payments.

Obtaining the MI 1040ES

Taxpayers can obtain the MI 1040ES form through various means:

- Download from the Michigan Department of Treasury website.

- Request a paper form by contacting the state tax office.

- Access through tax preparation software that includes Michigan tax forms.

Legal Use of the MI 1040ES

The MI 1040ES is legally recognized by the state of Michigan for estimating individual income tax obligations. Proper use of this form ensures compliance with state tax laws and helps individuals manage their tax responsibilities effectively. Failure to submit the form or make required payments can result in penalties and interest charges.

Quick guide on how to complete mi 1040es michigan estimated income tax for individuals mi 1040es michigan estimated income tax for individuals

Complete MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals effortlessly on any device

Digital document management has become well-liked among companies and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals seamlessly

- Obtain MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or mask sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040es michigan estimated income tax for individuals mi 1040es michigan estimated income tax for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI 1040ES, Michigan Estimated Income Tax for Individuals form?

The MI 1040ES is a form used by individuals in Michigan to estimate their income tax obligation for the upcoming year. By submitting this form, taxpayers can make quarterly estimated tax payments, ensuring they meet their tax liabilities while avoiding penalties.

-

How do I complete the MI 1040ES, Michigan Estimated Income Tax for Individuals form?

To complete the MI 1040ES, Michigan Estimated Income Tax for Individuals form, you need income estimates, deductions, and prior tax returns. Accurate data will help you determine the correct payment amounts to report and remit every quarter.

-

What are the benefits of using airSlate SignNow for submitting the MI 1040ES?

Using airSlate SignNow for the MI 1040ES allows for a streamlined eSigning process, ensuring that your documents are signed quickly and securely. The platform also offers cost-effective solutions that save time and reduce paperwork, making tax season less stressful.

-

Are there any fees associated with eSigning the MI 1040ES form using airSlate SignNow?

airSlate SignNow is known for its competitive pricing structure, which includes various packages to cater to different business needs. Users can often find affordable options for securely eSigning the MI 1040ES, Michigan Estimated Income Tax for Individuals form without hidden fees.

-

Can airSlate SignNow integrate with other accounting software for filing the MI 1040ES?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage your tax documents and filings. This ensures that you can efficiently track and submit your MI 1040ES, Michigan Estimated Income Tax for Individuals without juggling multiple tools.

-

What features does airSlate SignNow offer for managing tax documents like the MI 1040ES?

airSlate SignNow provides features like template creation, document storage, and status tracking that help users efficiently manage their MI 1040ES submissions. The user-friendly interface simplifies the eSigning process, allowing you to keep your tax documents organized.

-

How secure is the eSigning process for the MI 1040ES with airSlate SignNow?

The eSigning process with airSlate SignNow adheres to the highest security standards to protect your sensitive information when submitting the MI 1040ES, Michigan Estimated Income Tax for Individuals form. With encryption and compliance with eSignature laws, your documents are safe and legally binding.

Get more for MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals

- Standard for small unmanned aircraft systems suas used form

- Medication order form catawba county catawbacountync

- Grant utilities fill and sign printable template online form

- Rescue program information sheet oxbow animal health

- Automatic withdrawal aw authorization form

- Godparents permission form aganaarch

- Guam board of accountancy addressname change form guamboa

- Wire transfer instructions form

Find out other MI 1040ES, Michigan Estimated Income Tax For Individuals MI 1040ES, Michigan Estimated Income Tax For Individuals

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement