Controlling Interest Transfer Taxes Part Two Alston & Bird 2018

Understanding Controlling Interest Transfer Taxes

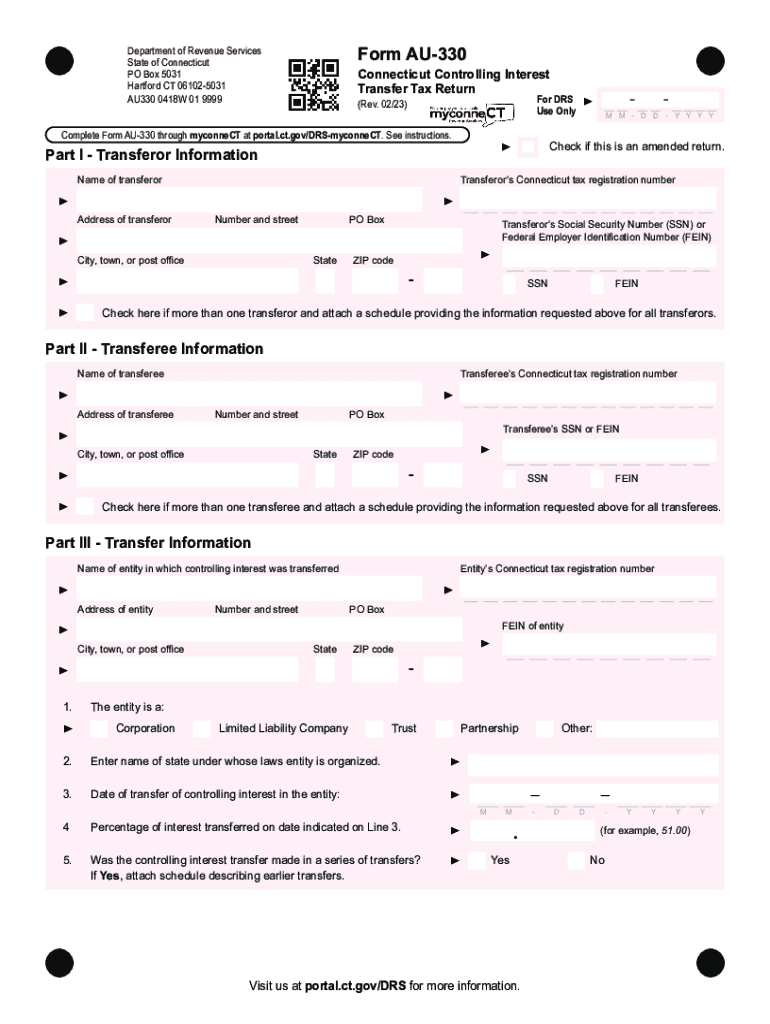

The Controlling Interest Transfer Taxes are essential for businesses and individuals engaged in transferring ownership interests in entities such as corporations and partnerships. These taxes apply when a controlling interest is transferred, typically defined as owning more than fifty percent of an entity's voting rights or equity. Understanding these taxes is crucial for compliance and financial planning.

Steps to Complete the Controlling Interest Transfer Taxes

Completing the Controlling Interest Transfer Taxes involves several key steps:

- Determine if the transfer qualifies as a controlling interest transfer.

- Gather necessary documentation, including ownership records and transfer agreements.

- Calculate the tax owed based on the fair market value of the interest being transferred.

- Complete the appropriate tax forms, ensuring all information is accurate and up-to-date.

- Submit the forms and payment to the relevant state authority, either online or by mail.

Required Documents for Filing

To file the Controlling Interest Transfer Taxes, you will need to prepare several documents:

- Transfer agreements detailing the terms of the ownership change.

- Ownership records that verify the current and new ownership percentages.

- Valuation documents that establish the fair market value of the interest being transferred.

Filing Deadlines for Transfer Taxes

It is important to be aware of the filing deadlines associated with the Controlling Interest Transfer Taxes. Typically, these deadlines align with the date of the transfer. Failing to file on time can result in penalties and interest charges. Always check with the state’s Department of Revenue for specific dates and requirements.

Legal Use of Controlling Interest Transfer Taxes

The legal framework surrounding the Controlling Interest Transfer Taxes is designed to ensure that ownership changes are properly reported and taxed. Compliance with these regulations is essential for avoiding legal issues and ensuring that all parties involved in the transfer fulfill their tax obligations. Consulting with a tax professional can provide clarity on legal requirements.

Examples of Controlling Interest Transfers

Understanding real-world scenarios can help clarify how the Controlling Interest Transfer Taxes apply. For instance:

- A business owner selling a 60 percent stake in their company to a new partner.

- A family transferring ownership of a family business to the next generation.

- Investors acquiring a controlling interest in a startup through a stock purchase.

Quick guide on how to complete controlling interest transfer taxes part two alston ampamp bird

Complete Controlling Interest Transfer Taxes Part Two Alston & Bird effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Controlling Interest Transfer Taxes Part Two Alston & Bird on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Controlling Interest Transfer Taxes Part Two Alston & Bird with no hassle

- Locate Controlling Interest Transfer Taxes Part Two Alston & Bird and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select how you wish to send your form, through email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Controlling Interest Transfer Taxes Part Two Alston & Bird and guarantee seamless communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct controlling interest transfer taxes part two alston ampamp bird

Create this form in 5 minutes!

How to create an eSignature for the controlling interest transfer taxes part two alston ampamp bird

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 06102 drs transfer online?

06102 drs transfer online refers to a quick and efficient process for transferring documents eSigned through airSlate SignNow. It ensures that your DRS transfers are smooth, secure, and compliant with regulations while being accessible from anywhere.

-

How much does the 06102 drs transfer online service cost?

The pricing for 06102 drs transfer online varies based on your business needs and the number of users. airSlate SignNow provides competitive rates, and you can choose from various plans that cater to both small businesses and large enterprises for maximum cost-effectiveness.

-

What features are included with 06102 drs transfer online?

With 06102 drs transfer online, you get features like customizable templates, secure eSignature options, real-time tracking, and integrated workflow management. These features enhance productivity, streamline processes, and ensure every DRS transfer is handled seamlessly.

-

How can 06102 drs transfer online benefit my business?

Using 06102 drs transfer online can signNowly speed up your document processes, reducing turnaround times and increasing efficiency. This leads to improved productivity and allows your team to focus on core business activities while enhancing customer satisfaction.

-

Can I integrate 06102 drs transfer online with other software?

Yes, 06102 drs transfer online can easily integrate with various CRM, ERP, and productivity tools. This seamless integration allows you to manage your documents more effectively, ensuring that your DRS transfer processes align perfectly with your existing systems.

-

Is the 06102 drs transfer online process secure?

Absolutely, security is a top priority for airSlate SignNow. The 06102 drs transfer online process utilizes advanced encryption methods and complies with industry standards to ensure that your documents remain confidential and secure throughout the entire transfer.

-

How do I get started with 06102 drs transfer online?

Getting started with 06102 drs transfer online is simple. You can sign up for an account on the airSlate SignNow website, choose a plan that suits your needs, and follow the easy-to-use setup process to start transferring documents securely and efficiently.

Get more for Controlling Interest Transfer Taxes Part Two Alston & Bird

- Oyster bay planning ampamp development oyster bay opening form

- Oneida county department of planninganthony j vic form

- Adoption policies and fees form

- Membership form st philips episcopal church brooklyn stphilipsbklyn

- Mega sports camp registration form radiant webtools

- Customer release form

- Dps georgia govdocumentdocumentstate of georgia department of public safety application for form

- Transcript request form cherokee county schools cherokee k12 ga

Find out other Controlling Interest Transfer Taxes Part Two Alston & Bird

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word