Blue Moon Estate Sales Premier Estate Sale Services 2019

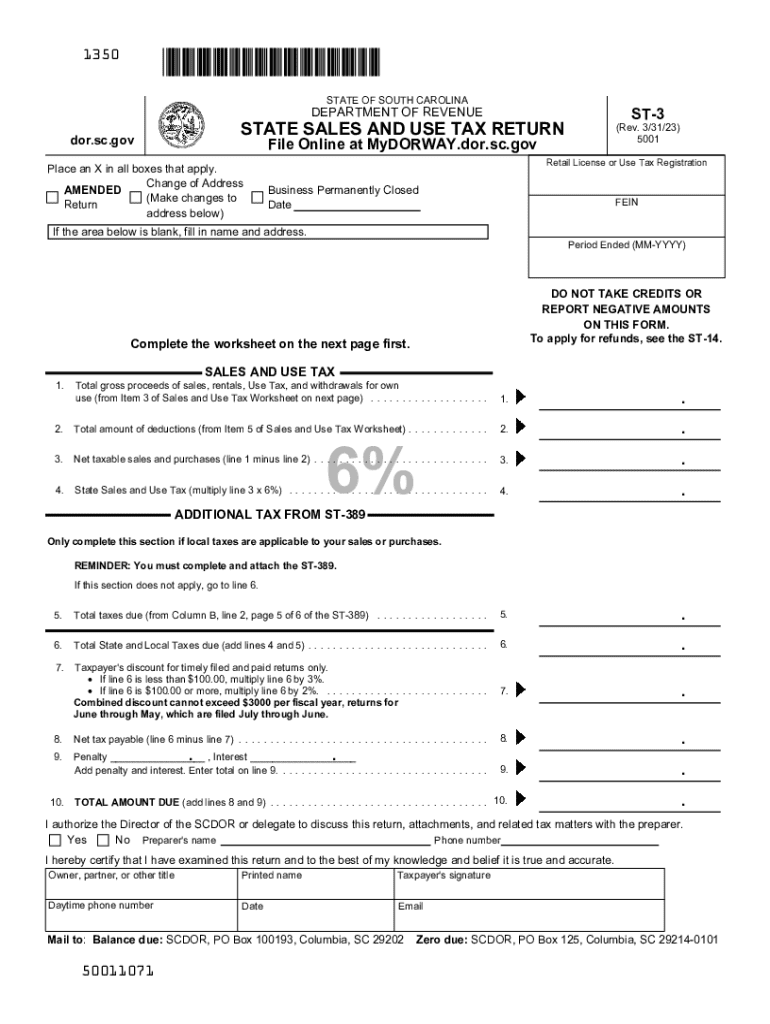

Understanding South Carolina Sales and Use Tax

The South Carolina Department of Revenue administers the sales and use tax, which is applied to the sale of tangible personal property and certain services. The state sales tax rate is six percent, with local jurisdictions able to impose additional taxes. This tax is crucial for funding state and local services, including education and infrastructure. Businesses operating in South Carolina must collect this tax from customers and remit it to the Department of Revenue.

Steps to Complete the ST-3 Form

The ST-3 form is used by businesses in South Carolina to claim an exemption from sales tax for certain purchases. To complete this form, follow these steps:

- Provide your business name and address at the top of the form.

- Indicate the reason for the exemption by checking the appropriate box.

- List the items being purchased that qualify for the exemption.

- Include the purchaser's signature and date at the bottom of the form.

Ensure that all information is accurate to avoid delays in processing.

Required Documents for Sales Tax Exemption

When filing the ST-3 form, certain documents may be required to substantiate your claim for exemption. These include:

- A valid South Carolina sales tax number.

- Proof of the nature of the business and its operations.

- Invoices or receipts for the purchases being claimed.

Having these documents ready can streamline the process and ensure compliance with state requirements.

Filing Deadlines for Sales Tax Returns

Businesses in South Carolina must adhere to specific filing deadlines for sales tax returns. Generally, sales tax returns are due on the 20th of the month following the end of a reporting period. For example, the return for sales made in January is due by February 20. It is important to stay informed about these deadlines to avoid penalties and interest on late payments.

Penalties for Non-Compliance

Failure to comply with South Carolina sales tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can be up to ten percent of the tax due.

- Interest on unpaid taxes, accruing daily.

- Potential legal action for continued non-compliance.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Digital vs. Paper Submission of Forms

Businesses have the option to submit the ST-3 form either digitally or via paper. Digital submissions can be completed through the South Carolina Department of Revenue's online portal, providing a quicker processing time. Paper submissions require mailing the completed form to the appropriate address, which may result in longer processing times. Choosing the digital route can enhance efficiency and tracking.

Quick guide on how to complete blue moon estate sales premier estate sale services

Effortlessly prepare Blue Moon Estate Sales Premier Estate Sale Services on any device

Digital document management has gained popularity among enterprises and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely maintain it online. airSlate SignNow provides you with all the essential tools to create, edit, and electronically sign your documents quickly without delays. Manage Blue Moon Estate Sales Premier Estate Sale Services on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and electronically sign Blue Moon Estate Sales Premier Estate Sale Services with ease

- Locate Blue Moon Estate Sales Premier Estate Sale Services and click Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specially offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, be it through email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Blue Moon Estate Sales Premier Estate Sale Services and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct blue moon estate sales premier estate sale services

Create this form in 5 minutes!

How to create an eSignature for the blue moon estate sales premier estate sale services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Carolina Department of Revenue sales tax rate?

The South Carolina Department of Revenue sales tax rate is currently set at 6%. However, additional local taxes may apply, leading to varying rates depending on the jurisdiction. For detailed and up-to-date tax information, it is advisable to consult the official South Carolina Department of Revenue website.

-

How does airSlate SignNow facilitate sales tax compliance in South Carolina?

airSlate SignNow provides businesses with the tools needed to streamline their document management and eSignature processes. With our platform, users can easily track and manage documents related to sales tax filings and compliance with the South Carolina Department of Revenue sales tax regulations.

-

Are there any additional fees associated with handling South Carolina Department of Revenue sales tax?

While airSlate SignNow offers a cost-effective solution for document management, businesses should be aware that additional fees related to sales tax might be imposed by the South Carolina Department of Revenue. It is important to account for these potential fees in your budgeting for compliance.

-

What features does airSlate SignNow offer for improving eSignature processes in tax documentation?

airSlate SignNow includes a range of features designed to enhance the eSignature experience for tax documentation. These features include customizable templates, secure cloud storage, and easy integration with various accounting software to ensure compliance with the South Carolina Department of Revenue sales tax documentation requirements.

-

Is airSlate SignNow suitable for small businesses dealing with the South Carolina Department of Revenue sales tax?

Absolutely! airSlate SignNow is a cost-effective solution that is particularly beneficial for small businesses managing documentation related to the South Carolina Department of Revenue sales tax. Our platform enables efficient document handling and eSigning, allowing small companies to focus on growth without worrying about compliance.

-

Can airSlate SignNow integrate with accounting software for South Carolina sales tax management?

Yes, airSlate SignNow offers seamless integration with various accounting software systems. This capability ensures that businesses can manage their sales tax documentation and compliance efficiently in conjunction with the South Carolina Department of Revenue sales tax requirements.

-

How does airSlate SignNow help streamline the process of filing sales tax returns?

airSlate SignNow streamlines the filing of sales tax returns by providing easy access to eSigned documents and organized document management. By using our platform, businesses can ensure they have all necessary documentation ready for submission to the South Carolina Department of Revenue sales tax office.

Get more for Blue Moon Estate Sales Premier Estate Sale Services

- Www pdffiller com597186941 fillable online theget the online the trial court probate and family court form

- Boston municipal court pretrial conference report massgov mass form

- New or renewal business license form

- My home inventory orangeburg county south carolina orangeburgcounty form

- Affidavit in support of dissolution with children doc form

- 375 0034 8 19 general bail bond affidavit missouri department of commerce and insurance form

- Respondents answer to petition for child custody and form

- Fillable online end of life planning guide millhorn ampampamp form

Find out other Blue Moon Estate Sales Premier Estate Sale Services

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement