Make Changes to 2019-2026

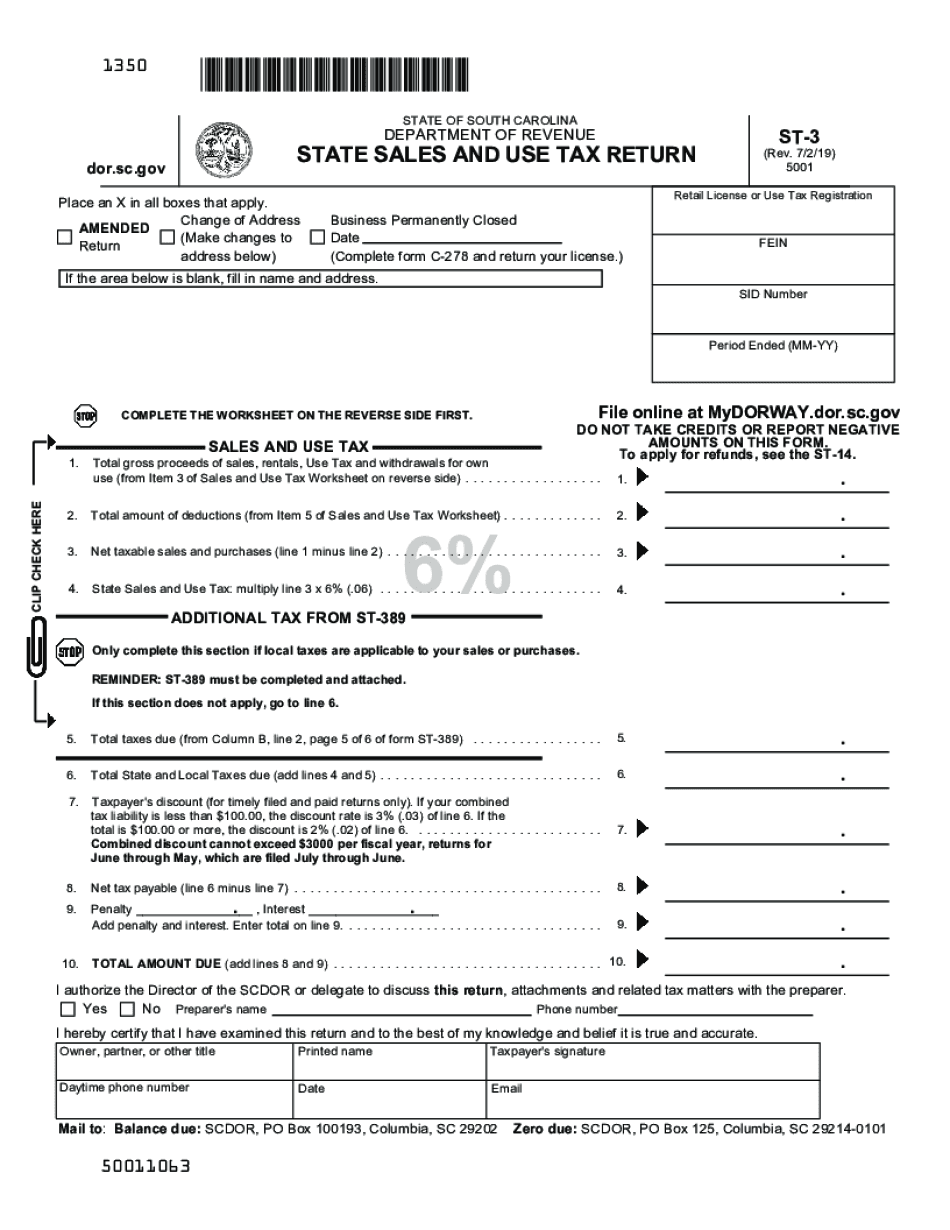

What is the ST-3 Form?

The ST-3 form is a sales and use tax exemption certificate used in South Carolina. It allows certain entities, such as non-profit organizations and government agencies, to make tax-exempt purchases. By completing this form, buyers can avoid paying sales tax on eligible items, provided they meet specific criteria set by the South Carolina Department of Revenue. Understanding the purpose of the ST-3 form is essential for organizations looking to maximize their budget and ensure compliance with state tax regulations.

Steps to Complete the ST-3 Form

Filling out the ST-3 form requires attention to detail to ensure accuracy and compliance. Here are the steps to complete the form:

- Begin by entering the name and address of the purchaser, ensuring that all details are correct.

- Specify the type of organization or entity making the purchase, such as a charity or government body.

- List the items being purchased that are eligible for tax exemption.

- Provide the seller's information, including their name and address.

- Sign and date the form to validate the exemption claim.

After completing the form, it should be presented to the seller at the time of purchase to avoid sales tax charges.

Legal Use of the ST-3 Form

The ST-3 form is legally recognized in South Carolina as a valid document for claiming sales tax exemptions. To ensure its legal standing, the form must be filled out accurately and presented to the seller during the transaction. Misuse of the ST-3 form, such as using it for ineligible purchases, can lead to penalties and fines. It is important for organizations to understand the legal implications of using this form and to maintain proper records of all exempt purchases.

Filing Deadlines / Important Dates

While the ST-3 form itself does not have a specific filing deadline, it is crucial to present it at the time of purchase to ensure tax exemption. Organizations should be aware of the sales tax filing deadlines for their regular tax returns to maintain compliance with state regulations. Keeping track of these dates can help avoid unnecessary penalties and ensure that all tax-related documents are submitted on time.

Required Documents

When using the ST-3 form, certain documents may be required to substantiate the tax-exempt status of the purchaser. These may include:

- A copy of the organization's tax-exempt status letter from the IRS.

- Proof of the organization's mission or purpose, such as bylaws or articles of incorporation.

- Any additional documentation requested by the seller to validate the exemption claim.

Having these documents ready can facilitate a smoother transaction and help ensure compliance with tax regulations.

Examples of Using the ST-3 Form

Organizations can utilize the ST-3 form in various scenarios. For instance, a non-profit organization purchasing office supplies for its operations can present the ST-3 form to avoid paying sales tax. Similarly, a government agency acquiring equipment for public use can also use this form to claim exemption. Understanding these examples can help organizations effectively utilize the ST-3 form for eligible purchases and manage their finances efficiently.

Quick guide on how to complete make changes to

Complete Make Changes To effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, alter, and electronically sign your documents quickly and without hold-ups. Manage Make Changes To on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Make Changes To with ease

- Obtain Make Changes To and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere moments and carries the same legal validity as an ink signature on paper.

- Review all information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhaustive form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Make Changes To and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct make changes to

Create this form in 5 minutes!

How to create an eSignature for the make changes to

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is an ST3 form?

The ST3 form is a crucial document used for various legal purposes, including tax purposes in certain jurisdictions. It enables businesses to report and manage specific financial information. Using airSlate SignNow, you can easily create, send, and eSign your ST3 form, streamlining your document management process.

-

How can airSlate SignNow help with the ST3 form?

airSlate SignNow offers a user-friendly platform to create and electronically sign your ST3 form, saving time and reducing paperwork. Our features allow for easy sharing and tracking of the document, ensuring you remain organized. You can also integrate the ST3 form within your existing workflows for improved efficiency.

-

Is there a cost associated with using airSlate SignNow for the ST3 form?

Yes, airSlate SignNow provides a cost-effective solution for managing documents like the ST3 form. We offer various pricing plans tailored to fit different business needs, allowing you to choose one that suits your budget. Take advantage of our free trial to explore how our platform can benefit your processes.

-

What features does airSlate SignNow offer for the ST3 form?

With airSlate SignNow, you get features like customizable templates for the ST3 form, document sharing, and comprehensive tracking capabilities. Our platform allows for seamless editing and collaboration on the document, enhancing workflow efficiency. Plus, our robust security measures ensure that your ST3 form remains protected.

-

Can I integrate the ST3 form with other software using airSlate SignNow?

Absolutely! airSlate SignNow offers integrations with various tools such as CRM and accounting software, allowing for efficient management of your ST3 form. These integrations help streamline your workflow, ensuring that document handling is smooth and consistent within your existing processes. Connect your favorite applications with ease!

-

How secure is my ST3 form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to safeguard your ST3 form and ensure that only authorized users can access sensitive information. Our platform complies with industry standards to protect your documents throughout the entire signing process.

-

Can I access my ST3 form from anywhere?

Yes, airSlate SignNow is a cloud-based solution, allowing you to access your ST3 form from any device with internet connectivity. This convenience means you can manage, send, and eSign documents on-the-go, making your business processes more flexible. Whether you're in the office or working remotely, your ST3 form is always at your fingertips.

Get more for Make Changes To

Find out other Make Changes To

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form