1019, Notice of Assessment, Taxable Valuation, and Property Classification 2022

Understanding the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

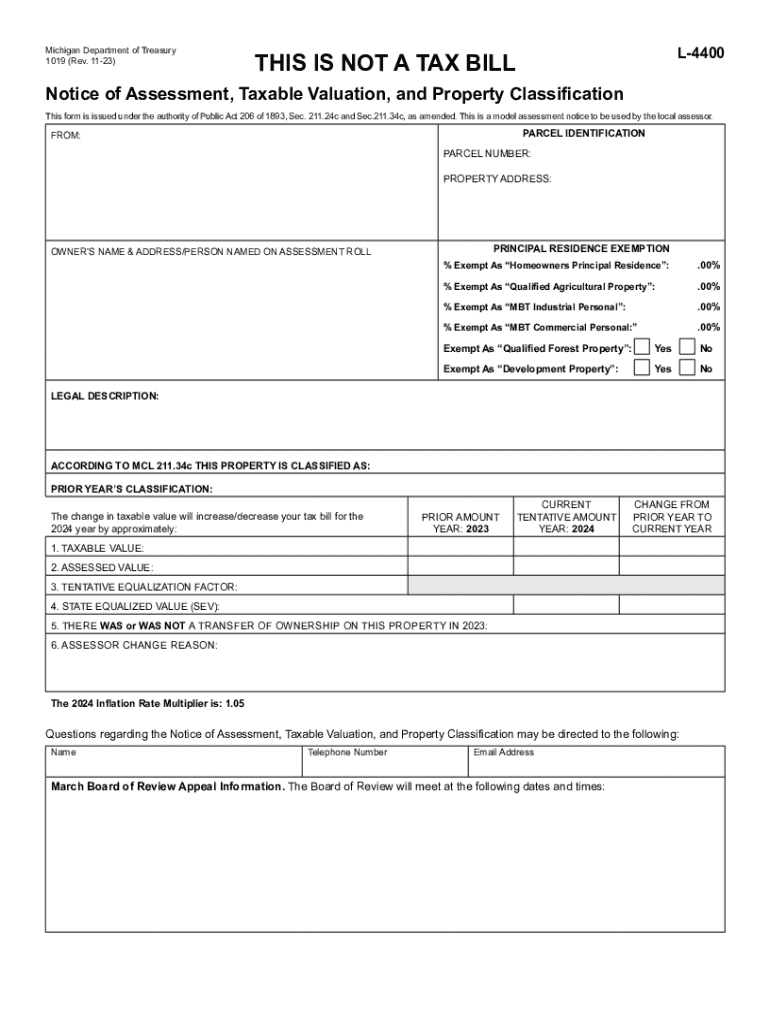

The 1019 form serves as a Notice of Assessment, detailing the taxable valuation and property classification for real estate in the United States. This document is crucial for property owners as it outlines the assessed value of their property, which directly impacts property taxes. The form includes information on the property's classification, which can affect tax rates and eligibility for certain exemptions. Understanding the contents of the 1019 is essential for property owners to ensure accurate tax assessments and to address any discrepancies that may arise.

How to Complete the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

Completing the 1019 form requires attention to detail. Property owners should gather necessary documentation, including previous assessments and property records. The form typically includes sections for identifying the property, detailing its assessed value, and classifying it according to state guidelines. Each section must be filled out accurately to reflect the property's current status. If there are any changes or disputes regarding the assessment, property owners should provide supporting documentation to substantiate their claims.

Obtaining the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

Property owners can obtain the 1019 form from their local tax assessor's office or through official state websites. Many jurisdictions provide digital access to this document, allowing for easy downloads and printing. It is advisable to check with the local tax authority for specific instructions on how to acquire the form and any associated deadlines for submission. Understanding where to access the form ensures that property owners can complete their assessments in a timely manner.

Key Elements of the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

The 1019 form contains several key elements that are vital for accurate property assessment. These include:

- Property Identification: Details such as the property address, parcel number, and owner information.

- Assessed Value: The monetary value assigned to the property, which influences tax calculations.

- Property Classification: Categorization of the property, which may include residential, commercial, or agricultural designations.

- Exemptions: Information on any applicable tax exemptions that the property may qualify for.

Legal Use of the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

The 1019 form is a legally binding document that serves as the official assessment of property value and classification. It is used by local governments to determine property taxes owed by the owner. Failure to respond to or accurately complete the form can result in penalties or disputes regarding property taxes. Property owners should be aware of their rights and responsibilities related to the assessment process, including the ability to appeal assessments they believe are incorrect.

Filing Deadlines and Important Dates for the 1019 Form

Filing deadlines for the 1019 form can vary by state and local jurisdiction. It is essential for property owners to be aware of these deadlines to avoid late fees or penalties. Typically, assessment notices are sent out annually, and property owners may have a specific period during which they can contest the assessment. Keeping track of these important dates ensures compliance with local tax regulations and helps property owners manage their tax obligations effectively.

Quick guide on how to complete 1019 notice of assessment taxable valuation and property classification

Complete 1019, Notice Of Assessment, Taxable Valuation, And Property Classification effortlessly on any device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents promptly without any holdups. Handle 1019, Notice Of Assessment, Taxable Valuation, And Property Classification on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign 1019, Notice Of Assessment, Taxable Valuation, And Property Classification with ease

- Locate 1019, Notice Of Assessment, Taxable Valuation, And Property Classification and click on Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign 1019, Notice Of Assessment, Taxable Valuation, And Property Classification and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1019 notice of assessment taxable valuation and property classification

Create this form in 5 minutes!

How to create an eSignature for the 1019 notice of assessment taxable valuation and property classification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification?

The 1019, Notice Of Assessment, Taxable Valuation, And Property Classification is a document used to inform property owners about the assessed value of their property for tax purposes. It details the taxable valuation and how the property is classified by local authorities. Understanding this document is crucial for property owners to manage their taxes effectively.

-

How can airSlate SignNow help me manage my 1019, Notice Of Assessment, Taxable Valuation, And Property Classification?

airSlate SignNow provides a streamlined process for electronically signing and managing your 1019, Notice Of Assessment, Taxable Valuation, And Property Classification. The platform allows you to send, sign, and store important documents securely, making it easier to keep track of your tax assessments and property classifications. This saves time and reduces paperwork.

-

Are there any pricing plans available for using airSlate SignNow with the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Depending on your usage, you can select a plan that allows unlimited document signing and management, including features specifically designed for handling forms like the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification. This ensures that you get the best value for your document management needs.

-

What features does airSlate SignNow offer that benefit the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification?

airSlate SignNow offers features such as customizable templates, automatic reminders, and secure cloud storage, all of which enhance the management of your 1019, Notice Of Assessment, Taxable Valuation, And Property Classification. These tools simplify the signing process, ensure timely submissions, and keep your documents securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other applications for handling my property documents?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, enhancing your ability to manage the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification and other property documents. Popular integrations include CRM tools and document management systems, allowing you to streamline your workflow and maintain organized records.

-

How secure is airSlate SignNow when handling sensitive documents like the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification?

Security is a priority at airSlate SignNow. The platform utilizes advanced encryption and follows industry-standard security protocols to protect sensitive documents such as the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification. Our commitment to security ensures that your data remains safe and confidential.

-

What benefits can I expect from using airSlate SignNow for my property classification documents?

Using airSlate SignNow for your property classification documents like the 1019, Notice Of Assessment, Taxable Valuation, And Property Classification offers numerous benefits including efficiency, improved accuracy, and ease of use. The platform helps you reduce errors and speed up processes, allowing timely filings and better management of your tax-related documentation.

Get more for 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

Find out other 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

- How Do I Sign Oklahoma Affidavit of Title

- Help Me With Sign Pennsylvania Affidavit of Title

- Can I Sign Pennsylvania Affidavit of Title

- How Do I Sign Alabama Cease and Desist Letter

- Sign Arkansas Cease and Desist Letter Free

- Sign Hawaii Cease and Desist Letter Simple

- Sign Illinois Cease and Desist Letter Fast

- Can I Sign Illinois Cease and Desist Letter

- Sign Iowa Cease and Desist Letter Online

- Sign Maryland Cease and Desist Letter Myself

- Sign Maryland Cease and Desist Letter Free

- Sign Mississippi Cease and Desist Letter Free

- Sign Nevada Cease and Desist Letter Simple

- Sign New Jersey Cease and Desist Letter Free

- How Can I Sign North Carolina Cease and Desist Letter

- Sign Oklahoma Cease and Desist Letter Safe

- Sign Indiana End User License Agreement (EULA) Myself

- Sign Colorado Hold Harmless (Indemnity) Agreement Now

- Help Me With Sign California Letter of Intent

- Can I Sign California Letter of Intent