Hotel Tax Certificate of Registration Form

What is the Hotel Tax Certificate Of Registration

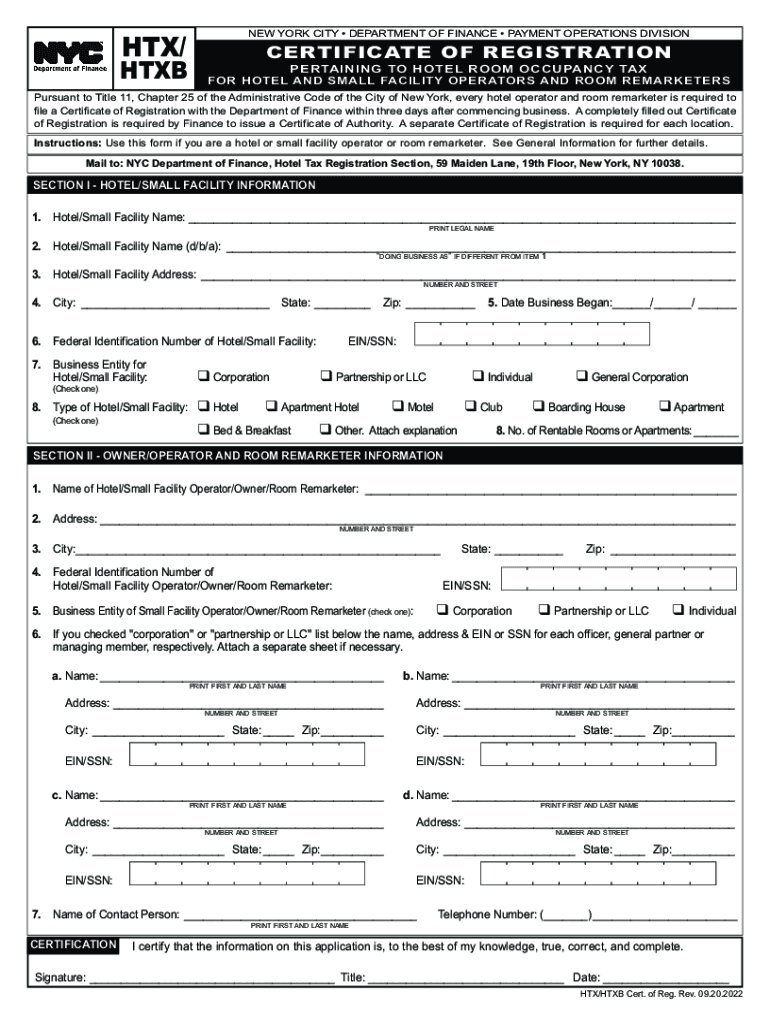

The Hotel Tax Certificate Of Registration is an official document that certifies a hotel or lodging establishment is registered to collect and remit hotel occupancy taxes. This certificate is essential for compliance with state and local tax regulations. It serves as proof that the establishment is recognized by tax authorities and is authorized to operate legally within its jurisdiction. The certificate typically includes details such as the establishment's name, address, and registration number, which are crucial for both the business and tax authorities.

How to obtain the Hotel Tax Certificate Of Registration

To obtain the Hotel Tax Certificate Of Registration, a hotel owner must typically follow a series of steps that may vary by state or locality. Generally, the process includes:

- Completing an application form provided by the local tax authority.

- Providing necessary documentation, such as proof of ownership or lease agreements.

- Paying any applicable registration fees.

- Submitting the application to the appropriate tax office, either online or in person.

Once submitted, the local tax authority will review the application and issue the certificate if all requirements are met.

Steps to complete the Hotel Tax Certificate Of Registration

Completing the Hotel Tax Certificate Of Registration involves several key steps:

- Gather required information, including business details and ownership documentation.

- Fill out the application form accurately, ensuring all sections are completed.

- Review the application for any errors or missing information.

- Submit the application along with any required fees to the local tax authority.

After submission, it is important to keep a copy of the application and any correspondence for future reference.

Legal use of the Hotel Tax Certificate Of Registration

The Hotel Tax Certificate Of Registration is legally binding and must be used in compliance with local tax laws. It allows the hotel to collect occupancy taxes from guests, which must be reported and remitted to the tax authority. Failure to use this certificate properly can result in penalties, including fines or revocation of the certificate. It is crucial for hotel operators to understand their responsibilities regarding tax collection and reporting to avoid legal issues.

Key elements of the Hotel Tax Certificate Of Registration

Key elements of the Hotel Tax Certificate Of Registration typically include:

- The name and address of the hotel or lodging establishment.

- The registration number assigned by the tax authority.

- The effective date of registration.

- Any specific conditions or limitations associated with the registration.

These elements help ensure that the certificate is valid and can be verified by tax authorities when necessary.

State-specific rules for the Hotel Tax Certificate Of Registration

Each state in the U.S. may have its own rules and regulations regarding the Hotel Tax Certificate Of Registration. This can include variations in the application process, required documentation, and fees. It is essential for hotel operators to familiarize themselves with the specific requirements in their state to ensure compliance. Some states may also have additional local regulations that must be adhered to, depending on the city or county where the hotel is located.

Quick guide on how to complete hotel tax certificate of registration

Effortlessly prepare Hotel Tax Certificate Of Registration on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly and without delays. Manage Hotel Tax Certificate Of Registration on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

The easiest way to modify and eSign Hotel Tax Certificate Of Registration without hassle

- Find Hotel Tax Certificate Of Registration and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Hotel Tax Certificate Of Registration to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hotel tax certificate of registration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Hotel Tax Certificate Of Registration?

A Hotel Tax Certificate Of Registration is a document that certifies a hotel is registered to collect and remit local taxes on guest stays. This certificate is essential for compliance with tax regulations and helps ensure that your hotel operates legally. By understanding the requirements for obtaining your Hotel Tax Certificate Of Registration, you can avoid potential fines and maintain your business's reputation.

-

How do I obtain a Hotel Tax Certificate Of Registration?

To obtain a Hotel Tax Certificate Of Registration, you must typically apply through your local tax authority or municipality. The application process may vary depending on your location, so it's essential to review the specific requirements for your area. Once you've submitted the necessary documentation and fees, you'll receive your Hotel Tax Certificate Of Registration, allowing you to proceed with tax collection.

-

What are the benefits of having a Hotel Tax Certificate Of Registration?

Having a Hotel Tax Certificate Of Registration allows your business to legally collect and remit taxes on behalf of your guests. This not only ensures compliance with local laws but also enhances your hotel's credibility. Additionally, possessing this certificate can improve your relationships with local government entities and provide peace of mind to your guests.

-

How does airSlate SignNow help with the Hotel Tax Certificate Of Registration process?

airSlate SignNow streamlines the process of obtaining your Hotel Tax Certificate Of Registration by providing an easy-to-use, electronic signature platform. You can quickly prepare, send, and eSign the necessary documents without the hassle of printing or mailing. This efficiency not only saves time but also reduces operational costs associated with obtaining your Hotel Tax Certificate Of Registration.

-

What features does airSlate SignNow offer for managing hotel documents?

airSlate SignNow offers a range of features designed to simplify document management for hotels, including customizable templates, secure eSigning, and cloud storage. These features make it easy to manage your Hotel Tax Certificate Of Registration and other important documents in one place. With airSlate SignNow, you can streamline your workflows and maintain full compliance effortlessly.

-

Is airSlate SignNow cost-effective for small hotels needing a Hotel Tax Certificate Of Registration?

Yes, airSlate SignNow is a cost-effective solution ideal for small hotels that need to manage their Hotel Tax Certificate Of Registration and other documents. With various pricing plans and no hidden fees, you can choose a solution that fits your budget while gaining access to powerful features. This makes it an excellent choice for small hotel owners focusing on compliance without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing hotel registrations?

Absolutely, airSlate SignNow offers integrations with various software tools that can assist in managing hotel registrations and communications. By integrating with your existing systems, you can streamline workflows and ensure that your Hotel Tax Certificate Of Registration process is efficient and seamless. This flexibility allows you to enhance your hotel management operations signNowly.

Get more for Hotel Tax Certificate Of Registration

- Request for divorce decree seal doc form

- Barton county superior courtside name registration form

- Mag 40 04 affidavit of disposition of amv the administrative office georgiacourts form

- Process server application state court fulton county form

- Georgia executors form

- Child abandonment warrant 404765344 form

- Defendants response to plaintiffs first and continuing form

- Www cobbcounty orgcourtsprobate courtprobate court formscobb county georgia

Find out other Hotel Tax Certificate Of Registration

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF