Minnesota Sales and Use Tax Form

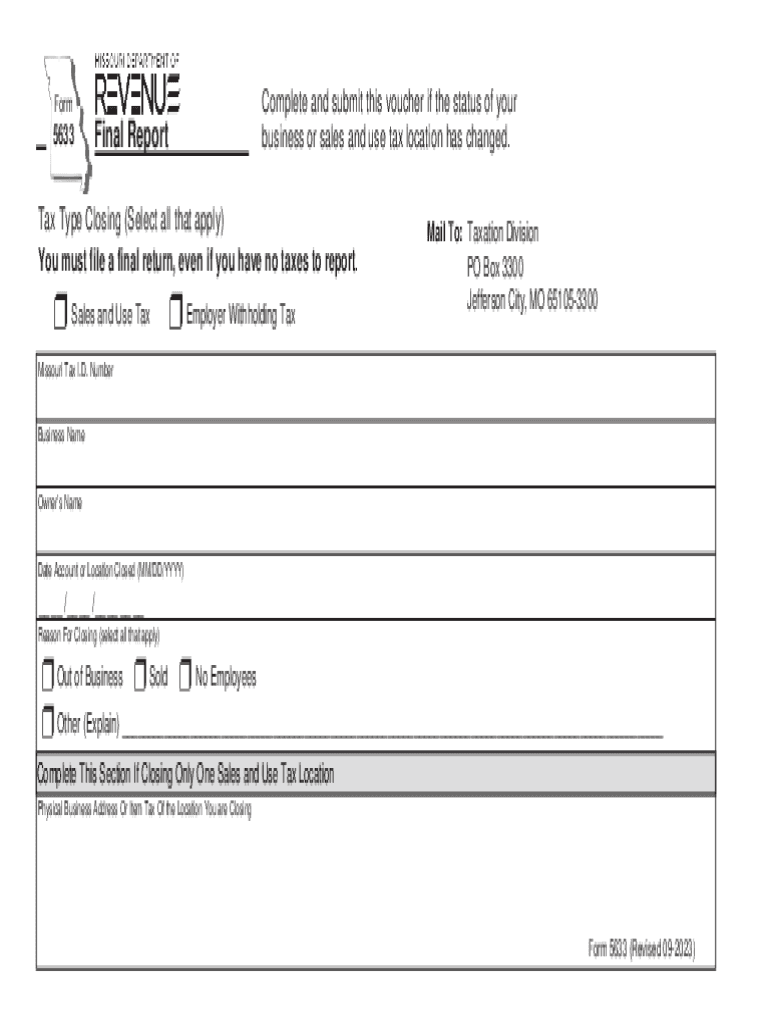

What is the 5633 form?

The 5633 form, also known as the Missouri Revenue form 5633, is a document used for reporting and remitting sales and use tax in the state of Missouri. This form is essential for businesses that engage in taxable sales or purchases within the state. It allows businesses to accurately report their sales tax liability and ensures compliance with state tax regulations.

Steps to complete the 5633 form

Completing the 5633 form involves several key steps:

- Gather necessary information, including sales figures and tax rates applicable to your business.

- Fill out the form with accurate details regarding your sales and use tax obligations.

- Calculate the total tax due based on your reported sales.

- Review the completed form for accuracy to avoid potential penalties.

- Submit the form by the designated deadline to ensure compliance.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 5633 form. Generally, businesses are required to submit this form on a monthly or quarterly basis, depending on their sales volume. Important dates include:

- Monthly filers must submit their form by the 20th of the following month.

- Quarterly filers should submit their form by the 20th of the month following the end of the quarter.

Required Documents

When preparing to complete the 5633 form, businesses should have the following documents ready:

- Sales records detailing all taxable sales made during the reporting period.

- Purchase records for any taxable items acquired for business use.

- Previous tax returns, if applicable, for reference and accuracy.

Penalties for Non-Compliance

Failure to file the 5633 form on time or inaccuracies in reporting can lead to significant penalties. Businesses may face:

- Late fees based on the amount of tax due.

- Potential audits from the state tax authority.

- Interest charges on unpaid taxes.

Who Issues the Form

The Missouri Department of Revenue is responsible for issuing and regulating the 5633 form. This department provides resources and guidance for businesses to ensure they meet their tax obligations effectively.

Quick guide on how to complete minnesota sales and use tax

Set Up Minnesota Sales And Use Tax Effortlessly on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Minnesota Sales And Use Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign Minnesota Sales And Use Tax with Ease

- Obtain Minnesota Sales And Use Tax and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, cumbersome form searching, and mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Minnesota Sales And Use Tax to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota sales and use tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5633 final report feature in airSlate SignNow?

The 5633 final report feature in airSlate SignNow allows users to generate comprehensive reports on document signings. This feature offers insights into who signed the documents, the time taken, and other essential aspects to streamline your workflow.

-

How can I access the 5633 final report?

You can access the 5633 final report by navigating to the dashboard after completing your document processes. Simply select the appropriate document, and the option to generate the report will be available for you to review and export.

-

Is there a cost associated with accessing the 5633 final report?

Accessing the 5633 final report is included in the pricing plans offered by airSlate SignNow. The cost-effective subscription allows you to utilize various features, including detailed reporting, without hidden fees.

-

What benefits does the 5633 final report provide for my business?

The 5633 final report provides invaluable insights by tracking document engagement and signatory actions. This helps businesses improve processes, enhance accountability, and maintain compliance with regulatory requirements.

-

Can I integrate the 5633 final report with other tools?

Yes, airSlate SignNow supports various integrations, allowing you to link the 5633 final report with other software solutions. This enables you to automate reporting workflows and effectively manage your document signing processes.

-

How does the 5633 final report improve document management?

The 5633 final report enhances document management by providing a clear overview of all signed documents in one accessible location. This streamlines your operations and ensures you can locate important signatures and timestamps easily.

-

Is the 5633 final report customizable?

Absolutely! The 5633 final report can be customized to suit your reporting needs. You can select which data points to include, making it easier to focus on the metrics that matter most to your business.

Get more for Minnesota Sales And Use Tax

- Or126 horseshoe creek siuslaw river section oregon gov oregon form

- Name and address of the new employer date employment commences and the reason for the change in employment health ri form

- Form it 135 sales and use tax report for purchases of

- Form it 640 start up ny telecommunication services excise tax credit tax year

- Average time to complete 10 minutesidentity theft form

- Software e development agency contract template form

- Software development outsourc contract template form

- Software implementation contract template form

Find out other Minnesota Sales And Use Tax

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer