40ES Alabama Department of Revenue Form

What is the 40ES Alabama Department Of Revenue

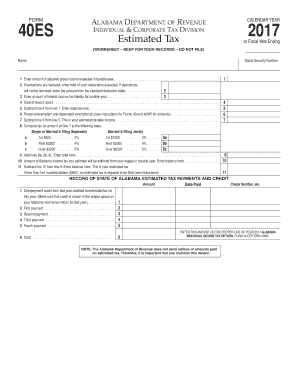

The 40ES form is a crucial document used by the Alabama Department of Revenue for the purpose of estimating and paying income taxes. This form is specifically designed for individuals and businesses that expect to owe tax of $500 or more when they file their returns. By submitting the 40ES, taxpayers can make estimated payments throughout the year, which helps to avoid penalties and interest associated with underpayment at the time of filing. Understanding the 40ES is essential for effective tax planning and compliance.

How to use the 40ES Alabama Department Of Revenue

Using the 40ES form involves several key steps. First, you need to determine your estimated tax liability for the year based on your expected income and applicable deductions. Once you have this figure, you can fill out the 40ES form with your personal information, including your name, address, and Social Security number. After completing the form, you can submit it along with your estimated payment. It is important to keep a copy for your records and to ensure that you are making payments on time to avoid any penalties.

Steps to complete the 40ES Alabama Department Of Revenue

Completing the 40ES form requires careful attention to detail. Here are the steps to follow:

- Gather your financial information, including income sources and deductions.

- Calculate your estimated tax liability for the year.

- Fill out the 40ES form with your personal details and estimated tax amount.

- Review the form for accuracy before submission.

- Submit the form along with your estimated payment by the due date.

Following these steps will help ensure that you meet your tax obligations and avoid any issues with the Alabama Department of Revenue.

Legal use of the 40ES Alabama Department Of Revenue

The 40ES form is legally recognized as a valid method for making estimated tax payments in Alabama. To be considered compliant, taxpayers must adhere to the guidelines set forth by the Alabama Department of Revenue. This includes submitting the form by the specified deadlines and ensuring that the estimated payments are accurate. Failure to comply with these regulations may result in penalties or interest charges, making it essential to understand the legal implications of using the 40ES.

Filing Deadlines / Important Dates

Timely filing of the 40ES form is critical to avoid penalties. The Alabama Department of Revenue typically sets quarterly deadlines for estimated tax payments. These deadlines usually fall on:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is important to check the Alabama Department of Revenue's official website for any updates or changes to these deadlines.

Required Documents

When preparing to complete the 40ES form, certain documents are essential for accurate reporting. These may include:

- Previous year’s tax return for reference

- Income statements such as W-2s or 1099s

- Documentation of deductions and credits

Having these documents on hand will facilitate a smoother completion process and ensure that your estimated payments are based on accurate financial data.

Quick guide on how to complete alabama department of rev

Effortlessly Prepare alabama department of rev on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and electronically sign your documents swiftly without holdups. Handle 40es on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign 40nr alabama 2018 with Ease

- Obtain alabama 40es 2018 and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign alabama 40nr instructions and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs alabama department of revenue form 40

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Related searches to alabama department of revenue forms

Create this form in 5 minutes!

How to create an eSignature for the alabama department of revenue mailing address

How to generate an eSignature for the 40es 2017 Alabama Department Of Revenue online

How to generate an eSignature for the 40es 2017 Alabama Department Of Revenue in Google Chrome

How to generate an electronic signature for putting it on the 40es 2017 Alabama Department Of Revenue in Gmail

How to create an eSignature for the 40es 2017 Alabama Department Of Revenue straight from your smart phone

How to generate an eSignature for the 40es 2017 Alabama Department Of Revenue on iOS

How to create an eSignature for the 40es 2017 Alabama Department Of Revenue on Android

People also ask alabama form 40

-

What are the key features of airSlate SignNow for 40es?

airSlate SignNow offers a range of key features for 40es, including electronic signatures, customizable templates, and real-time tracking of documents. These features streamline the signing process and enhance collaboration. Additionally, users benefit from secure cloud storage and mobile access for managing documents on the go.

-

How does pricing work for airSlate SignNow for 40es?

Pricing for airSlate SignNow for 40es is designed to be cost-effective, offering flexible plans tailored to various business needs. Users can choose from monthly or annual subscriptions, ensuring they pay only for what they need. There are also options for volume discounts to support larger teams requiring multiple licenses.

-

What benefits can businesses expect from using airSlate SignNow for 40es?

By utilizing airSlate SignNow for 40es, businesses can expect faster turnaround times on document approvals and an overall increase in productivity. The user-friendly interface allows for quick onboarding and ease of use, minimizing the learning curve. Moreover, reducing paper usage leads to signNow cost savings and environmental benefits.

-

Is airSlate SignNow for 40es compatible with other applications?

Yes, airSlate SignNow for 40es integrates seamlessly with various popular applications such as Google Drive, Salesforce, and Microsoft Office. This compatibility enhances your workflow by allowing for easy document import and export. Additionally, the integrations facilitate smooth collaboration between teams using different software.

-

How secure is airSlate SignNow for 40es?

Security is a top priority for airSlate SignNow for 40es, featuring advanced encryption and compliance with industry standards such as GDPR and HIPAA. All documents are securely stored, ensuring that sensitive information remains protected from unauthorized access. This focus on security provides peace of mind for businesses handling confidential documents.

-

Can I customize documents while using airSlate SignNow for 40es?

Absolutely! airSlate SignNow for 40es offers robust customization options for documents. Users can create templates, add branding elements, and include specific fields tailored to their business needs. This customization enhances the professional appearance of documents and ensures they meet regulatory requirements.

-

What types of documents can I eSign with airSlate SignNow for 40es?

You can eSign a wide variety of documents using airSlate SignNow for 40es, including contracts, agreements, and forms. The platform supports multiple file formats, allowing users to upload and manage different types of documents easily. This versatility makes it suitable for various industries and use cases.

Get more for alabama form 40 2017

- Wslcb form liq 871

- Personalcriminal history statement form

- Injured by a third party lni wa form

- Form af

- Cvs caremark compound prescription form template

- Washington state child abuse and neglect findings request form

- Vehicle transportdisposal addendum x bls dor wa form

- Dshs statement of shared living arrangements form

Find out other alabama form 40 instructions

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation