SC3911 PDF SC Department of Revenue SC GOV Form

Understanding the SC3911 Form

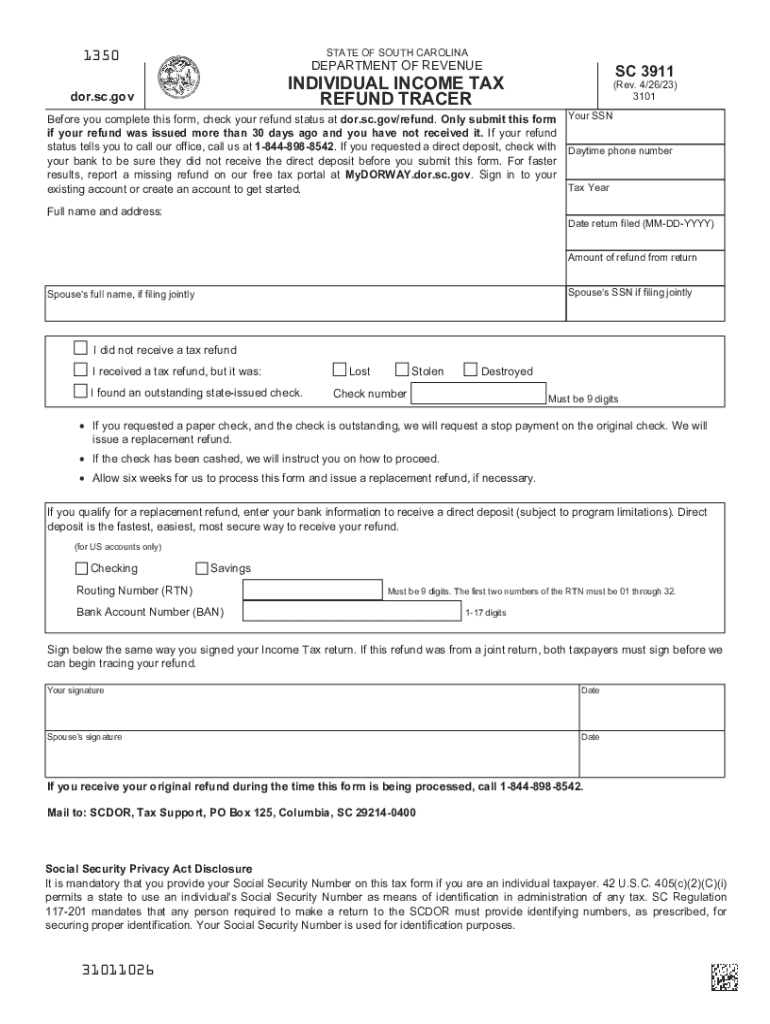

The SC3911 form, officially known as the South Carolina Income Tax Refund Request, is a crucial document for taxpayers seeking to claim a refund of their state income tax. This form is issued by the South Carolina Department of Revenue and is specifically designed for individuals who believe they are entitled to a refund due to overpayment or other qualifying circumstances. Understanding the purpose and requirements of the SC3911 is essential for ensuring a smooth refund process.

Steps to Complete the SC3911 Form

Completing the SC3911 form involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary documentation, including your original tax return and any supporting documents that demonstrate your eligibility for a refund. Next, fill out the form carefully, providing accurate personal information and details about your tax situation. It is important to double-check all entries for errors before submission. Finally, sign and date the form to validate your request.

Required Documents for the SC3911 Submission

When submitting the SC3911 form, certain documents are required to support your refund request. These typically include a copy of your completed South Carolina income tax return, any W-2 forms or 1099s that report income, and documentation of any deductions or credits claimed. If applicable, include any correspondence from the South Carolina Department of Revenue regarding your tax status. Having these documents ready can expedite the processing of your refund.

Form Submission Methods

The SC3911 form can be submitted through various methods, allowing flexibility based on your preferences. You can complete the form digitally and submit it online through the South Carolina Department of Revenue's website. Alternatively, you may print the completed form and mail it to the appropriate address listed on the form. In-person submissions are also accepted at designated Department of Revenue offices. Choose the method that best suits your needs for a timely refund process.

Eligibility Criteria for the SC3911 Form

To qualify for a refund using the SC3911 form, you must meet specific eligibility criteria set by the South Carolina Department of Revenue. Generally, you must have filed a South Carolina income tax return for the applicable tax year and demonstrate that you overpaid your taxes. Additionally, certain circumstances, such as changes in income or tax credits, may affect your eligibility. Review the guidelines carefully to ensure you meet all requirements before submitting your request.

Common Scenarios for Using the SC3911 Form

There are various scenarios in which taxpayers may need to use the SC3911 form. For instance, if you discover that you made an error on your original tax return that resulted in an overpayment, you can file this form to claim your refund. Additionally, individuals who have experienced changes in their financial situation, such as job loss or retirement, may also find themselves eligible for a refund. Understanding these scenarios can help taxpayers recognize when to utilize the SC3911 form effectively.

Quick guide on how to complete sc3911 pdf sc department of revenue sc gov

Complete SC3911 pdf SC Department Of Revenue SC GOV seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage SC3911 pdf SC Department Of Revenue SC GOV on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The optimal way to alter and eSign SC3911 pdf SC Department Of Revenue SC GOV with ease

- Locate SC3911 pdf SC Department Of Revenue SC GOV and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to finalize your changes.

- Choose how you would like to send your form, via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign SC3911 pdf SC Department Of Revenue SC GOV and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc3911 pdf sc department of revenue sc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining my South Carolina income tax refund?

To obtain your South Carolina income tax refund, you need to file your tax return accurately and promptly. Ensure all necessary documents are submitted through the South Carolina Department of Revenue. Once processed, you can check the status online to see when your refund will be issued.

-

How can airSlate SignNow help me with my South Carolina income tax refund documentation?

airSlate SignNow simplifies the process of managing and signing your tax documents necessary for claiming your South Carolina income tax refund. With our eSigning feature, you can efficiently gather signatures from clients or partners, ensuring a quick turnaround on your paperwork. This means you can submit your tax return faster and get your refund sooner.

-

Are there any fees associated with filing for a South Carolina income tax refund using airSlate SignNow?

Using airSlate SignNow to prepare and manage your tax documents incurs a subscription fee, which is competitive and offers great value for eSigning capabilities. However, there are no additional fees specifically for managing your South Carolina income tax refund documents. This makes it a cost-effective solution for businesses needing streamlined signing processes.

-

What features does airSlate SignNow offer for eSigning tax documents?

airSlate SignNow provides features like document templates, team collaboration, and secure eSigning, which are essential when working with tax documents. These tools enable you to prepare your South Carolina income tax refund claims quickly and efficiently. Additionally, our cloud storage ensures your documents are accessible anytime, from anywhere.

-

Can I track the status of my South Carolina income tax refund through airSlate SignNow?

While airSlate SignNow does not directly track your South Carolina income tax refund status, it helps you keep all your documents organized and easily accessible. You can maintain records of submitted forms and communications, ensuring that all necessary steps have been followed. For tracking your refund status, you will need to visit the South Carolina Department of Revenue website.

-

Is airSlate SignNow user-friendly for individuals managing their own South Carolina income tax refund?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it suitable for individuals handling their own South Carolina income tax refund. Our intuitive platform allows users to navigate easily through document preparation and eSigning. Whether you’re a tech-savvy individual or a beginner, you will find the process straightforward.

-

What integrations does airSlate SignNow offer for tax professionals processing South Carolina income tax refunds?

airSlate SignNow integrates seamlessly with various accounting and tax software, allowing tax professionals to manage South Carolina income tax refunds efficiently. These integrations enhance workflow automation, ensuring that all relevant documents are synchronized and easily accessible. This streamlines the entire tax preparation process for your clients.

Get more for SC3911 pdf SC Department Of Revenue SC GOV

- Pennsylvania legal last will and testament form for single person with adult and minor children

- Printable last will and testament forms

- Legal will form

- Pa minor form

- Pennsylvania widow form

- Form widower 481376633

- Pennsylvania legal last will and testament form for a widow or widower with adult and minor children

- Pa will form

Find out other SC3911 pdf SC Department Of Revenue SC GOV

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free