Sc1040es Form

What is the SC-1040ES?

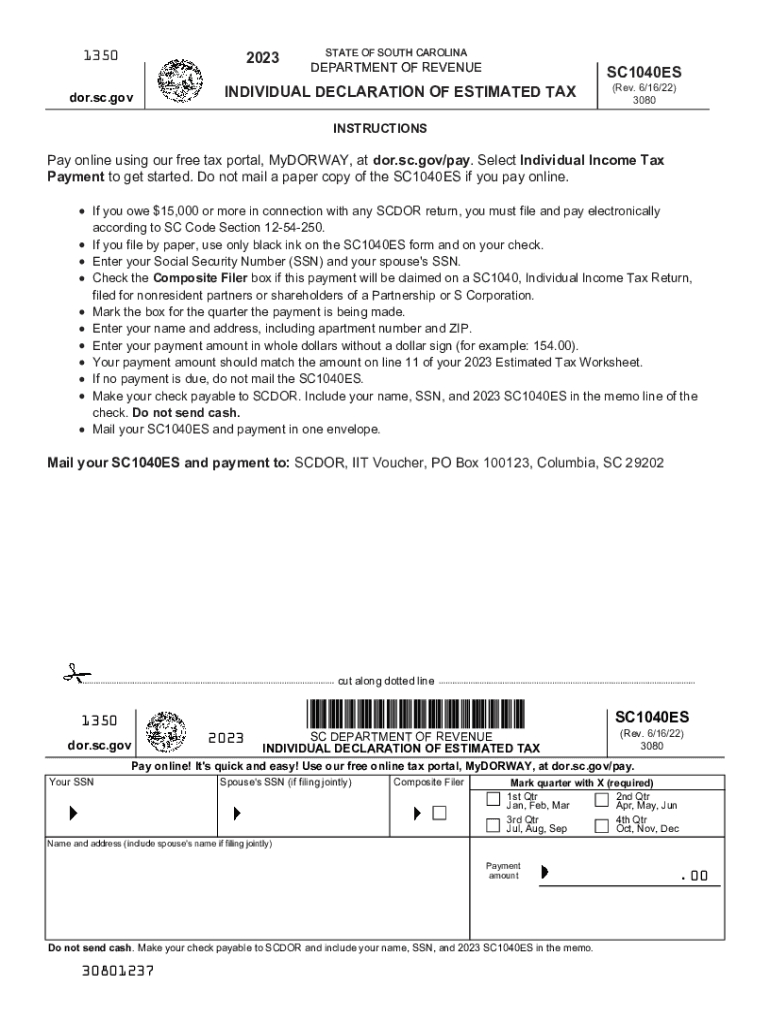

The SC-1040ES is the South Carolina estimated tax form used by individuals and businesses to report and pay estimated income taxes throughout the year. This form is essential for taxpayers who expect to owe tax of $100 or more when they file their annual tax return. It helps ensure that taxpayers meet their tax obligations and avoid penalties for underpayment. The SC-1040ES is specifically designed for those who earn income that is not subject to withholding, such as self-employment income, rental income, or interest and dividends.

How to Use the SC-1040ES

To use the SC-1040ES effectively, taxpayers need to estimate their total income for the year and calculate the expected tax liability. This involves:

- Gathering financial information from previous years to project income.

- Using the South Carolina tax tables to determine the estimated tax based on the projected income.

- Filling out the SC-1040ES form with the calculated estimated tax amounts.

- Submitting the form along with any payment due by the specified deadlines.

It is important to review the form carefully to ensure accuracy, as errors can lead to penalties or overpayment.

Steps to Complete the SC-1040ES

Completing the SC-1040ES involves several key steps:

- Estimate your total income for the year, considering all sources.

- Calculate your expected tax liability using the appropriate tax rate.

- Fill out the SC-1040ES form, providing your personal information and the estimated tax amounts.

- Review the form for accuracy and completeness.

- Submit the form and payment by the due date to avoid penalties.

Following these steps will help ensure compliance with South Carolina tax laws and prevent any issues with the Department of Revenue.

Filing Deadlines / Important Dates

For the SC-1040ES, estimated tax payments are typically due on the following dates:

- April 15 for the first quarter payment.

- June 15 for the second quarter payment.

- September 15 for the third quarter payment.

- January 15 of the following year for the fourth quarter payment.

It is crucial to adhere to these deadlines to avoid penalties for late payments. Taxpayers should also be aware of any changes to these dates that may occur due to holidays or weekends.

Required Documents

When preparing to complete the SC-1040ES, taxpayers should gather the following documents:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of any other income sources, including interest, dividends, and rental income.

- Documentation of any deductions or credits that may apply.

Having these documents on hand will facilitate accurate estimations and ensure compliance with tax regulations.

Penalties for Non-Compliance

Failing to file the SC-1040ES or underpaying estimated taxes can result in penalties. The South Carolina Department of Revenue may impose:

- A penalty for late payment, typically a percentage of the unpaid tax amount.

- Interest on any unpaid taxes, which accrues from the due date until the tax is paid.

- Potential legal action for continued non-compliance, leading to further financial consequences.

Taxpayers are encouraged to make timely payments to avoid these penalties and maintain good standing with the state tax authorities.

Quick guide on how to complete sc1040es

Effortlessly prepare Sc1040es on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle Sc1040es on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Sc1040es with ease

- Find Sc1040es and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Sc1040es and ensure effective communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1040es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SC estimated tax and how does it work?

SC estimated tax is an advance payment of your state income tax based on the amount you expect to owe for the year. This system is designed to help taxpayers manage their tax liabilities by making payments throughout the year rather than in one lump sum.

-

How can airSlate SignNow help with SC estimated tax documents?

airSlate SignNow simplifies the process of sending and signing SC estimated tax documents. With our platform, you can easily create, send, and eSign tax-related documents, ensuring that your important paperwork is managed efficiently and securely.

-

Are there any fees associated with making SC estimated tax payments through SignNow?

While airSlate SignNow itself does not charge fees for submitting SC estimated tax payments, standard state fees may apply when processing your tax payments. You can take advantage of our easy-to-use platform for enhanced document management without additional costs.

-

What features make airSlate SignNow ideal for SC estimated tax filings?

airSlate SignNow offers robust features such as customizable templates, real-time collaboration, and advanced security, making it an ideal choice for managing SC estimated tax filings. These features ensure that your documents are processed accurately and shared securely with stakeholders.

-

Can I integrate airSlate SignNow with other accounting software for SC estimated tax handling?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, allowing you to manage SC estimated tax documents alongside your financial data. This integration enhances your workflow by automating document management and reducing manual entry.

-

What benefits does airSlate SignNow offer for small businesses dealing with SC estimated tax?

For small businesses, airSlate SignNow provides an efficient and cost-effective way to manage SC estimated tax documentation. Our platform helps streamline the eSignature process, reduces paper usage, and ensures that your tax documents are securely stored and easily accessible when needed.

-

Is airSlate SignNow user-friendly for first-time SC estimated tax filers?

Absolutely! airSlate SignNow is designed for ease of use, making it simple for first-time filers to navigate and manage their SC estimated tax documents. Our intuitive interface and guided features help ensure that you complete your tax paperwork without confusion.

Get more for Sc1040es

Find out other Sc1040es

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation