Form CT 245 IInstructions for Form CT 245 Maintenance Fee Tax Ny

What is the Form CT 245 Instructions For Form CT 245 Maintenance Fee Tax NY

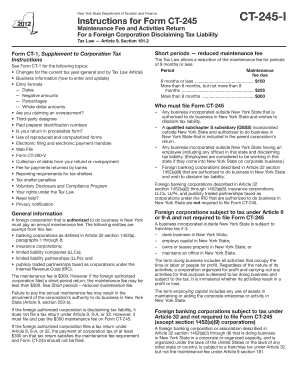

The Form CT 245 is a crucial document used in New York for the maintenance fee tax. This form is specifically designed for businesses to report and pay the maintenance fees associated with their corporate status. It ensures that corporations remain compliant with state regulations and maintain their good standing. The instructions provided with the form guide users through the necessary steps for accurate completion, ensuring that all required information is submitted correctly.

How to use the Form CT 245 Instructions For Form CT 245 Maintenance Fee Tax NY

Using the Form CT 245 involves several steps that are outlined in the accompanying instructions. First, you must gather all necessary information about your business, including its legal name, address, and identification number. Next, follow the instructions to fill out the form accurately. This includes entering the appropriate maintenance fee amount based on your business type and ensuring that all calculations are correct. Once completed, the form must be submitted to the appropriate state agency, either online, by mail, or in person, depending on your preference.

Steps to complete the Form CT 245 Instructions For Form CT 245 Maintenance Fee Tax NY

Completing the Form CT 245 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant business information, including your business entity type and identification number.

- Access the Form CT 245 and its instructions from the appropriate state website or office.

- Fill out the form by entering your business details and calculating the maintenance fee based on your entity type.

- Review the completed form for accuracy, ensuring all required fields are filled out correctly.

- Submit the form according to the specified method, ensuring you retain a copy for your records.

Key elements of the Form CT 245 Instructions For Form CT 245 Maintenance Fee Tax NY

Several key elements are essential when completing the Form CT 245. These include:

- Business Identification: Accurate identification of your business entity is crucial.

- Maintenance Fee Amount: The fee varies based on the type of business entity and must be calculated correctly.

- Signature: The form must be signed by an authorized individual to validate the submission.

- Submission Method: Understanding the available methods for submitting the form ensures compliance with deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 245 are critical to avoid penalties. Typically, the form must be submitted annually, and specific due dates may vary based on your business's fiscal year. It is essential to check the latest guidelines from the New York Department of State to ensure timely filing. Missing the deadline can result in additional fees or loss of good standing for your business.

Penalties for Non-Compliance

Failure to file the Form CT 245 on time can lead to significant penalties. These may include late fees, interest on unpaid amounts, and potential loss of good standing status for your business. It is important to adhere to all filing requirements and deadlines to maintain compliance and avoid these consequences.

Quick guide on how to complete form ct 245 iinstructions for form ct 245 maintenance fee tax ny

Complete Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny effortlessly on any device

Online document management has become popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny with ease

- Locate Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 245 iinstructions for form ct 245 maintenance fee tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny?

Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny provides guidelines for businesses regarding the maintenance fee associated with this tax in New York. It outlines the requirements for accurate filing, specifying relevant deadlines and required documentation. Correctly following these instructions is crucial to ensure compliance with state regulations.

-

How can airSlate SignNow aid in completing Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny?

With airSlate SignNow, you can efficiently manage your document workflow for Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny. Our user-friendly platform allows you to eSign and share forms securely, minimizing errors and enhancing accuracy. This saves time and keeps your tax documentation organized.

-

What features does airSlate SignNow offer for managing Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny?

airSlate SignNow provides several features that are beneficial for handling Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny, including eSignature capabilities, customizable templates, and real-time document tracking. These features ensure that you can streamline your filing process and keep all parties informed as the document progresses.

-

Is there a cost associated with using airSlate SignNow for Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny?

Yes, airSlate SignNow operates on a subscription model offering various pricing tiers to accommodate different business needs. Each plan provides access to our powerful tools for completing Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny effectively. We also provide a free trial period to test our service.

-

What are the benefits of using airSlate SignNow for Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny?

Using airSlate SignNow simplifies the process of managing Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny by making document signing faster and more secure. The platform helps minimize the risk of delays or errors, allowing you to focus on other important aspects of your business. Additionally, our system enhances compliance with state guidelines.

-

Can airSlate SignNow integrate with other software for better management of Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny?

Absolutely! airSlate SignNow offers integrations with popular software applications, enhancing your ability to manage Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny. Whether you use accounting software or customer management tools, our integrations ensure a seamless flow of information, improving operational efficiency.

-

How does airSlate SignNow ensure the security of documents related to Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure data centers to protect documents related to Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny. Compliance with regulations and industry standards ensures that your sensitive information remains secure throughout the signing process.

Get more for Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny

Find out other Form CT 245 IInstructions For Form CT 245 Maintenance Fee Tax Ny

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now