Formulario 8300

What is the Formulario 8300

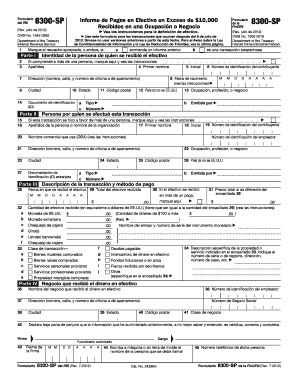

The Formulario 8300 is a crucial document required by the Internal Revenue Service (IRS) for reporting cash payments exceeding $10,000 received in a trade or business. This form is essential for ensuring compliance with federal regulations aimed at preventing money laundering and other illicit activities. Businesses that receive large cash transactions must complete the formulario to provide transparency and maintain accurate financial records.

How to use the Formulario 8300

Using the Formulario 8300 involves several key steps. First, businesses must determine if they have received cash payments that exceed the $10,000 threshold. If so, they should gather all necessary information, including the identity of the payer, the amount received, and the transaction details. Once this information is compiled, the formulario can be filled out accurately. After completing the form, it should be submitted to the IRS, typically within 15 days of receiving the cash payment.

Steps to complete the Formulario 8300

Completing the Formulario 8300 requires careful attention to detail. Follow these steps:

- Gather information about the transaction, including the date, amount, and payer's details.

- Access the Formulario 8300 from the IRS website or through authorized software.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the completed formulario to the IRS, either electronically or by mail.

Legal use of the Formulario 8300

The legal use of the Formulario 8300 is governed by IRS regulations. Businesses are required to file this form to comply with the Bank Secrecy Act, which mandates reporting large cash transactions. Failure to file the formulario can result in significant penalties, including fines and potential legal action. It is essential for businesses to understand their obligations and ensure that they file the form accurately and on time to avoid any compliance issues.

Filing Deadlines / Important Dates

Timely filing of the Formulario 8300 is critical. The IRS requires that the form be submitted within 15 days of the cash transaction. Additionally, businesses should be aware of any changes to IRS regulations that may affect filing deadlines. Keeping a calendar of important dates can help ensure compliance and avoid penalties.

Penalties for Non-Compliance

Non-compliance with the Formulario 8300 filing requirements can lead to severe penalties. Businesses that fail to file the form or provide inaccurate information may face fines ranging from $100 to $50,000, depending on the severity of the violation. In some cases, criminal charges may also be pursued for willful neglect or fraudulent activity. Understanding these penalties highlights the importance of adhering to the filing requirements.

Quick guide on how to complete formulario 8300

Complete Formulario 8300 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Formulario 8300 on any device with airSlate SignNow Android or iOS applications and streamline any document-based process today.

The easiest way to modify and electronically sign Formulario 8300 effortlessly

- Find Formulario 8300 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Formulario 8300 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 8300

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formulario 8300 and how does it relate to eSigning?

The formulario 8300 is a tax form that businesses must file with the IRS when they receive cash payments exceeding $10,000 in a transaction. Using airSlate SignNow to securely eSign this form helps streamline the documentation process, ensuring compliance and accuracy.

-

How can airSlate SignNow help me manage my formulario 8300 submissions?

With airSlate SignNow, you can easily create, edit, and eSign the formulario 8300 electronically. Our platform allows you to store and organize your forms securely, making it simple to manage your submissions without the hassle of physical paperwork.

-

What are the pricing options for using airSlate SignNow for formulario 8300?

airSlate SignNow offers various pricing plans to fit your business needs, including options specifically for managing forms like the formulario 8300. Each plan includes features tailored to streamline eSigning and document management at a cost-effective rate.

-

Are there any special features for formulario 8300 management on airSlate SignNow?

Yes, airSlate SignNow includes features such as customizable templates, real-time tracking of eSignatures, and secure storage specifically designed for documents like formulario 8300. These tools enhance efficiency and ensure compliance throughout the signing process.

-

How secure is the data when signing the formulario 8300 with airSlate SignNow?

Data security is a priority at airSlate SignNow, especially with sensitive documents like the formulario 8300. We utilize industry-standard encryption, secure authentication, and continuous data protection measures to keep your information safe throughout the eSigning process.

-

Can I integrate airSlate SignNow with other software for formulario 8300 submissions?

Absolutely! airSlate SignNow offers integrations with various platforms to enhance your experience with formulario 8300 submissions. You can seamlessly connect with tools like CRMs or accounting software to simplify workflows and ensure all your operations are in sync.

-

What benefits does airSlate SignNow provide for businesses handling formulario 8300?

By using airSlate SignNow for your formulario 8300 handling, you benefit from increased efficiency, reduced paperwork, and improved compliance. Our user-friendly platform ensures that your documents are processed swiftly and securely, saving you time and resources.

Get more for Formulario 8300

- Ulam germ free mouse facility user request form

- Fillable online certified in healthcare human resources form

- Gr 68722 medication precertification form aetna

- What to do if a workplace accident or illness occurs wichita form

- Healthscope benefits claims address form

- Uhc spine form

- Agreement insurance form

- Cpl 02 00 120 cpl 2 0120 inspection procedures for the form

Find out other Formulario 8300

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter