It 201 X Form

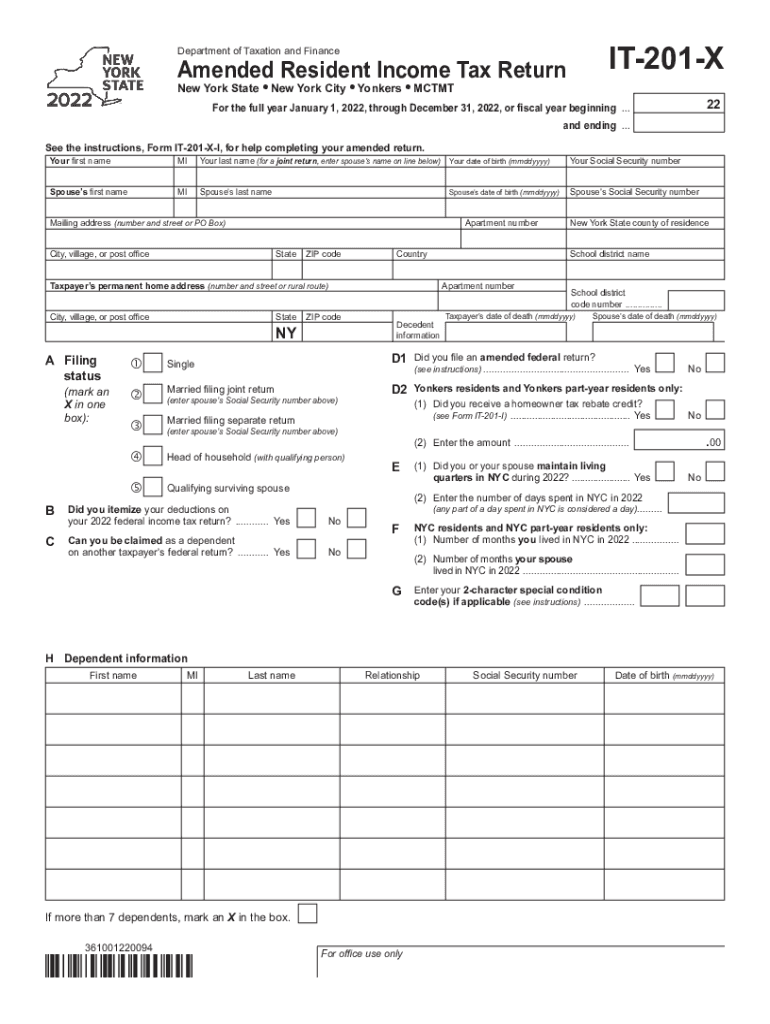

What is the IT-201-X?

The IT-201-X is a New York State tax form used for amending personal income tax returns. It allows taxpayers to correct errors or make changes to their original IT-201 forms filed for the tax year. This form is essential for ensuring that tax records are accurate and up to date, allowing for adjustments in income, deductions, or credits that may have been overlooked or misreported. By filing the IT-201-X, taxpayers can rectify their tax obligations and avoid potential penalties associated with inaccuracies.

How to Use the IT-201-X

Using the IT-201-X involves several key steps. First, taxpayers must obtain the form, which can be accessed online or through tax preparation services. After downloading the IT-201-X, individuals should carefully review their original tax return to identify specific areas that require amendments. The form provides clear sections for reporting changes, including income adjustments, deductions, and credits. Once completed, the amended form must be submitted to the New York State Department of Taxation and Finance, either electronically or by mail, depending on the taxpayer's preference and eligibility.

Steps to Complete the IT-201-X

Completing the IT-201-X requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant documents, including the original IT-201 form and any supporting documentation for the changes.

- Carefully fill out the IT-201-X, indicating the specific lines that have been amended and providing explanations for each change.

- Calculate any adjustments to your tax liability, ensuring that all figures are accurate and reflect the changes made.

- Sign and date the form, confirming that the information provided is true and complete.

- Submit the completed IT-201-X to the appropriate state tax authority, either electronically or via postal mail.

Required Documents

When filing the IT-201-X, taxpayers need to include specific documents to support their amendments. This may include:

- A copy of the original IT-201 form that is being amended.

- Any relevant schedules or forms that were part of the original submission.

- Documentation supporting the changes, such as W-2 forms, 1099s, or receipts for deductions claimed.

- Any correspondence from the New York State Department of Taxation and Finance regarding the original return.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IT-201-X is crucial for compliance. Generally, the amended return must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. It is important to keep track of these dates to avoid penalties and ensure that any refunds due are processed in a timely manner.

Penalties for Non-Compliance

Failure to file the IT-201-X when required can result in penalties imposed by the New York State Department of Taxation and Finance. These penalties may include interest on unpaid taxes, late filing fees, and potential audits. It is essential for taxpayers to address any inaccuracies in their tax filings promptly to mitigate these risks and maintain compliance with state tax laws.

Quick guide on how to complete it 201 x

Complete It 201 X effortlessly on any device

Digital document management has become a preferred choice for companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage It 201 X on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-centric operation today.

How to modify and eSign It 201 X with ease

- Find It 201 X and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign It 201 X and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 201 x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form it 201 x 2022 and how does it work?

Form it 201 x 2022 is a comprehensive eSignature solution that allows businesses to fill out and electronically sign documents seamlessly. Users can create, send, and track documents with ease, ensuring a streamlined workflow. This solution is particularly useful for those looking to enhance their document management process.

-

How can form it 201 x 2022 benefit my business?

Implementing form it 201 x 2022 can signNowly reduce time spent on paperwork, allowing for quicker transactions. The solution automates the signing process, improving efficiency and minimizing errors. Moreover, it enhances your business's professionalism with secure and legally binding eSignatures.

-

What pricing plans are available for form it 201 x 2022?

airSlate SignNow offers flexible pricing plans for form it 201 x 2022 to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, tailored to your specific needs. Additionally, a free trial is available, allowing you to explore features without any commitment.

-

What features are included in form it 201 x 2022?

Form it 201 x 2022 includes a variety of features designed to enhance user experience, such as customizable templates, multi-party signing, and real-time tracking. Integrations with popular software ensure that your signing process fits seamlessly into existing workflows. Additionally, the platform offers security features to keep your documents safe.

-

Can I integrate form it 201 x 2022 with other platforms?

Yes, form it 201 x 2022 can be integrated with numerous platforms, including CRM systems and cloud storage services. This ensures that all your tools work together efficiently, allowing for a smoother document management process. Integration capabilities help streamline workflows and reduce manual entry.

-

Is form it 201 x 2022 secure and compliant with regulations?

Absolutely, form it 201 x 2022 adheres to strict security protocols and industry regulations, ensuring that your data and documents are fully protected. The platform utilizes encryption and multi-factor authentication for added security. Compliance with laws such as eIDAS and ESIGN ensures that your eSignatures are legally binding.

-

What are the advantages of using form it 201 x 2022 compared to traditional signing methods?

Using form it 201 x 2022 offers numerous advantages over traditional signing methods, including faster turnaround times and reduced paper usage. The electronic signatures eliminate the need for in-person meetings and postal delays, enhancing overall efficiency. Furthermore, tracking and managing documents becomes easier with digital solutions.

Get more for It 201 X

Find out other It 201 X

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document