Form 1099R Information Form 1099R Information

Understanding the TRS 1099-R Form

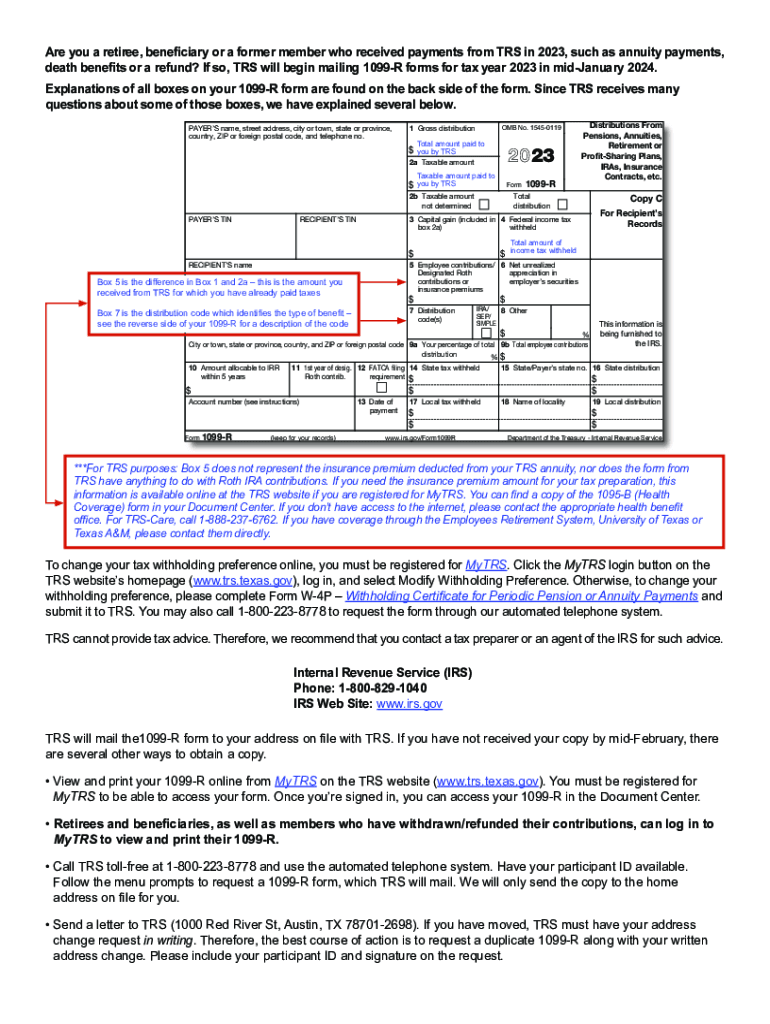

The TRS 1099-R form is a crucial document for individuals who receive distributions from retirement plans, pensions, or other similar sources. It provides essential information regarding the total amount distributed and the taxable portion of those distributions. This form is typically issued by the Teacher Retirement System of Texas (TRS) to retirees and beneficiaries, ensuring compliance with IRS reporting requirements.

Key details included on the TRS 1099-R form are the gross distribution amount, the taxable amount, and any federal income tax withheld. Understanding these elements is vital for accurate tax reporting and financial planning.

Steps to Complete the TRS 1099-R Form

Completing the TRS 1099-R form involves several straightforward steps. First, gather all necessary documentation related to your retirement benefits. This may include previous tax returns and any additional financial records that detail your retirement income.

Next, review the information provided on the form carefully. Ensure that your personal details, such as your name and Social Security number, are correct. Then, accurately report the amounts listed for gross distribution and taxable amount on your tax return. If you have any questions about specific entries, consulting a tax professional can provide clarity.

Obtaining the TRS 1099-R Form

To obtain the TRS 1099-R form, individuals can visit the official Teacher Retirement System of Texas website. The form is typically made available online for download or can be requested directly from TRS if you prefer a mailed copy. It is important to ensure that you have the most recent version of the form to comply with current tax regulations.

Additionally, if you are a retiree, you may receive your TRS 1099-R form automatically via mail at the beginning of each year. Always check your records to ensure you have received it, as this document is essential for filing your taxes.

Key Elements of the TRS 1099-R Form

The TRS 1099-R form contains several key elements that are important for tax reporting. These include:

- Gross Distribution: The total amount distributed to you from your retirement plan.

- Taxable Amount: The portion of the distribution that is subject to federal income tax.

- Federal Income Tax Withheld: Any federal taxes that have been withheld from your distribution.

- Distribution Codes: Codes that indicate the type of distribution you received, which can affect tax treatment.

Understanding these elements helps ensure accurate reporting and compliance with IRS requirements.

Filing Deadlines for the TRS 1099-R Form

Filing deadlines for the TRS 1099-R form align with standard tax filing deadlines in the United States. Typically, the IRS requires individuals to file their tax returns by April fifteenth of the following year. However, if you need additional time, you may file for an extension, which allows you to submit your return by October fifteenth.

It is essential to keep track of these dates to avoid penalties and ensure timely processing of your tax return. Additionally, if you are expecting a refund, filing on time can expedite the return process.

IRS Guidelines for the TRS 1099-R Form

The IRS provides specific guidelines for the use of the TRS 1099-R form, which must be adhered to for accurate tax reporting. These guidelines outline how to report distributions, the appropriate tax treatment based on distribution codes, and the necessary documentation required for filing.

Taxpayers should familiarize themselves with these guidelines to ensure compliance and to avoid potential issues with the IRS. Consulting the IRS website or a tax professional can provide further insights into these regulations.

Quick guide on how to complete form 1099r information form 1099r information

Effortlessly prepare Form 1099R Information Form 1099R Information on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form 1099R Information Form 1099R Information on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign Form 1099R Information Form 1099R Information with ease

- Find Form 1099R Information Form 1099R Information and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details, then click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Form 1099R Information Form 1099R Information to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099r information form 1099r information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TRS 1099 R form?

The TRS 1099 R form is a tax document used by the Teacher Retirement System (TRS) to report distributions from retirement plans. Understanding this form is crucial for managing your taxes, especially if you receive retirement benefits. The TRS 1099 R details the amounts distributed, which can help you accurately file your tax returns.

-

How can airSlate SignNow help with TRS 1099 R documentation?

airSlate SignNow provides an efficient way to electronically sign and send your TRS 1099 R forms. With our secure platform, you can ensure that your important tax documents are handled quickly and reliably. This not only saves time but also enhances the accuracy of your submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs and budgets. Whether you're an individual needing basic features for your TRS 1099 R or a large organization requiring advanced integrations, our pricing is designed to be cost-effective. Check our website for current offers and more details.

-

Are there any key features for handling TRS 1099 R forms with airSlate SignNow?

Yes, airSlate SignNow includes features like customizable templates, automatic reminders, and secure document storage specifically designed for handling TRS 1099 R forms. These features streamline the process of managing your tax documents, ensuring that every step is efficient and compliant with IRS regulations.

-

What benefits does airSlate SignNow provide for TRS 1099 R management?

Using airSlate SignNow for TRS 1099 R management offers multiple benefits, including increased efficiency, reduced paper wastage, and enhanced security for your sensitive tax documents. Our platform simplifies e-signatures and document sharing, allowing you to focus on more important tasks while ensuring compliance with tax regulations.

-

Can airSlate SignNow integrate with other software for TRS 1099 R processing?

Absolutely, airSlate SignNow can seamlessly integrate with various accounting and tax preparation software to facilitate the processing of TRS 1099 R forms. This integration helps streamline workflows by eliminating the need for manual data entry, thus reducing errors and saving time during tax season.

-

Is airSlate SignNow secure for managing sensitive documents like TRS 1099 R?

Yes, airSlate SignNow takes document security seriously. With encryption and robust security protocols, you can trust that your TRS 1099 R forms and all sensitive data are well-protected. Our commitment to security ensures that your transactions are safe and compliant with industry standards.

Get more for Form 1099R Information Form 1099R Information

Find out other Form 1099R Information Form 1099R Information

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe