Form 6497 Rev December Information Return of Nontaxable Energy Grants or Subsidized Energy Financing Irs

What is the Form 6497 Rev December Information Return Of Nontaxable Energy Grants Or Subsidized Energy Financing IRS

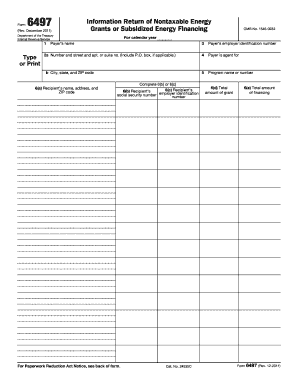

The Form 6497 Rev December is an official document used by the Internal Revenue Service (IRS) to report nontaxable energy grants or subsidized energy financing. This form is primarily utilized by organizations that provide financial assistance for energy-related projects, ensuring compliance with federal regulations. The form captures essential details about the grants or financing provided, including the amounts and recipients, facilitating transparency and accountability in the reporting process.

How to use the Form 6497 Rev December Information Return Of Nontaxable Energy Grants Or Subsidized Energy Financing IRS

Using the Form 6497 involves several steps to ensure accurate reporting. Organizations must first gather all relevant information regarding the energy grants or financing they have issued. This includes details such as the names of recipients, the total amounts granted, and the purpose of the funding. Once this information is compiled, it can be entered into the designated fields on the form. After completing the form, organizations should review it for accuracy before submission to the IRS.

Steps to complete the Form 6497 Rev December Information Return Of Nontaxable Energy Grants Or Subsidized Energy Financing IRS

Completing the Form 6497 requires careful attention to detail. Follow these steps:

- Collect all necessary information about the grants or financing.

- Fill out the form with accurate data, ensuring all fields are completed.

- Double-check the entries for any errors or omissions.

- Sign the form where required, confirming the accuracy of the information provided.

- Submit the completed form to the IRS by the specified deadline.

Key elements of the Form 6497 Rev December Information Return Of Nontaxable Energy Grants Or Subsidized Energy Financing IRS

Key elements of the Form 6497 include the identification of the organization providing the funding, the details of each grant or financing arrangement, and the total amount distributed. Additionally, the form requires information about the purpose of the funding and the recipients. Accurate completion of these elements is crucial for compliance with IRS regulations and to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 6497 are critical for compliance. Organizations must submit the form by the IRS deadline to avoid penalties. Typically, the deadline aligns with the end of the tax year, but it is advisable to check the IRS guidelines for any updates or changes to specific dates. Staying informed about these deadlines helps ensure timely submission and adherence to federal requirements.

Penalties for Non-Compliance

Failure to file the Form 6497 accurately or on time can result in penalties imposed by the IRS. These penalties may include fines based on the severity of the non-compliance, such as late filing or incorrect information. Organizations should prioritize timely and accurate submissions to mitigate the risk of financial repercussions and maintain good standing with the IRS.

Quick guide on how to complete form 6497 rev december information return of nontaxable energy grants or subsidized energy financing irs

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign [SKS] without hassle

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and electronically sign [SKS] to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6497 rev december information return of nontaxable energy grants or subsidized energy financing irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 6497 Rev December Information Return Of Nontaxable Energy Grants Or Subsidized Energy Financing IRS?

Form 6497 Rev December is an IRS information return used to report nontaxable energy grants or subsidized energy financing. This form facilitates transparency in reporting financial assistance related to energy projects, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with filing Form 6497 Rev December?

airSlate SignNow allows businesses to efficiently create, send, and eSign Form 6497 Rev December electronically. Our platform simplifies document management, making it easy to ensure your information return is accurate and submitted on time.

-

What are the pricing options for using airSlate SignNow for Form 6497 Rev December?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes. Whether you're a small business or a large enterprise, you'll find a cost-effective solution to manage Form 6497 Rev December and other essential documents.

-

What features of airSlate SignNow are beneficial for handling tax-related documents like Form 6497 Rev December?

Key features of airSlate SignNow include document templates, automated workflows, secure eSignatures, and real-time tracking. These functionalities make it easier to manage Form 6497 Rev December and ensure compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other tools for processing Form 6497 Rev December?

Yes, airSlate SignNow provides integrations with various business applications such as CRM systems, accounting software, and cloud storage. This helps streamline the process of managing Form 6497 Rev December alongside other business operations.

-

What are the benefits of using airSlate SignNow for eSigning Form 6497 Rev December?

Using airSlate SignNow for eSigning Form 6497 Rev December increases efficiency by reducing the need for physical paperwork. The platform ensures secure and legally binding signatures, speeding up the filing process and making document management seamless.

-

Is airSlate SignNow compliant with IRS and federal regulations when processing Form 6497 Rev December?

Yes, airSlate SignNow is designed to comply with IRS and federal regulations, ensuring that documents like Form 6497 Rev December are handled according to legal standards. Our security measures protect sensitive information during the filing process.

Get more for Form 6497 Rev December Information Return Of Nontaxable Energy Grants Or Subsidized Energy Financing Irs

- Shp 974 doc form

- 19c10 5 office of the director department of health and senior services sos mo form

- Award letter example form

- Bcs retiree packet cover page form

- Sources and uses template form

- Safety determination request form state of tennessee tn

- Hunter college course repeat form 19955863

- Home rental agreement template form

Find out other Form 6497 Rev December Information Return Of Nontaxable Energy Grants Or Subsidized Energy Financing Irs

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF